Top Charts from the Tech Sector

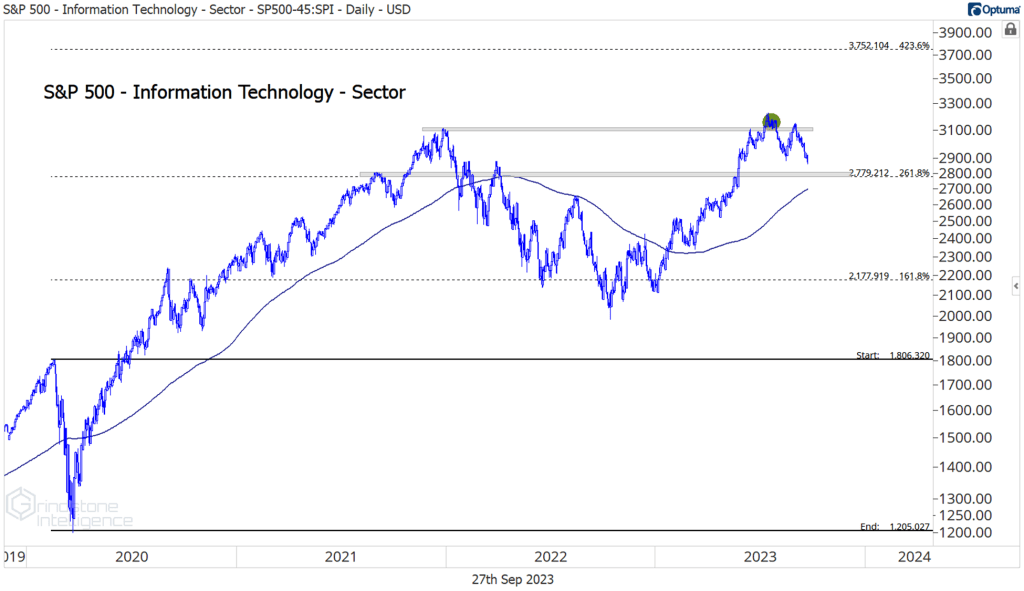

Information Technology spent most of 2023 in the pole position. Earlier this month, the S&P 500’s largest sector was up more than 45% year-to-date. Weakness in the back half of September has erased nearly a third of those gains and pushed Tech from the top of the leaderboard.

Last month, we posited that this chart might be the most important in the world. Eighteen months after the sector first stalled out, kicking off a nasty bear market in 2022, we finally made it back to all-time highs. How Tech responded to those highs would tell us a lot about the health of the market overall. Four weeks later, we seem to have our answer: the bull market is on hold until further notice.

Things are even weaker beneath the surface. The equally weighted sector never approached its own all-time high, and now it’s back below a key rotational area. Unless we’re back above this level of former support that’s now turned resistance, there’s not much reason to be excited about Tech as a whole.

The Tech sector’s relative weakness didn’t happen overnight. We can see the group moved into the Weakening quadrant of the weekly Relative Rotation Graph in the first week of August, after nearly 5 months in the Leading quadrant.

It doesn’t help that Tech is in one of its toughest seasonal periods. Seasonality isn’t gospel, and it’s always best taken with a grain of salt. Still, since 1990, September is the only month for which Tech has averaged a negative return. And when viewed on a relative basis, only December is worse.

After an unusually weak August, September has been even worse than normal this year. The question is, can we bounce back in October, which has been the second best month for Tech over the last 30 years?

Digging Deeper

The top performing sub-industry in the sector for most of the year has been Semiconductors, which had gained nearly 90% YTD in July. They’re still atop the leaderboard, but they’ve given up a big chunk over the last few weeks, and are back to levels not seen since May.

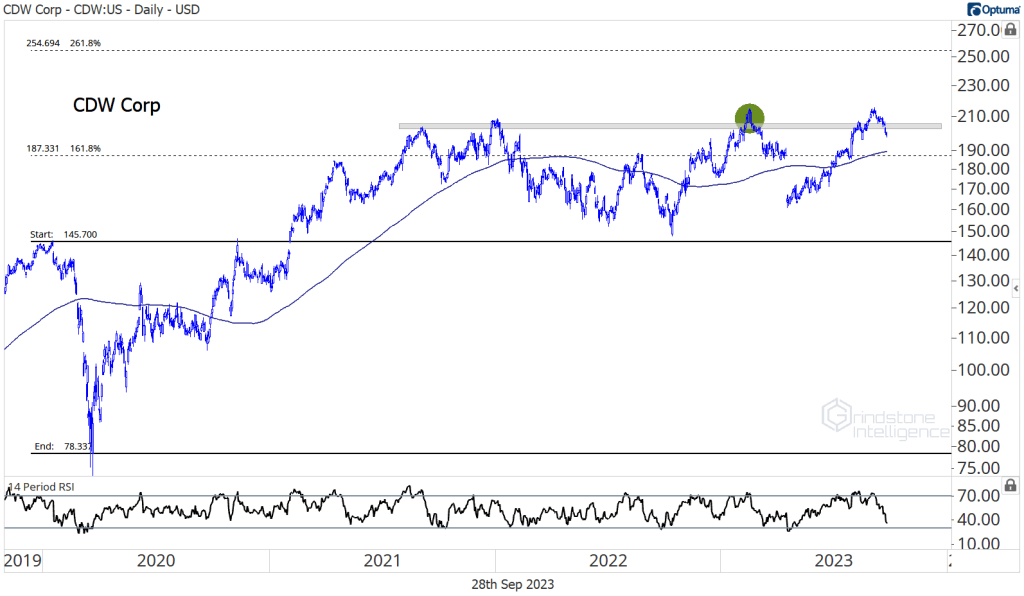

The more recent winners are Technology Distributors, IT Consulting, and Application Software, which are all in the Leading quadrant of the weekly Relative Rotation Graph when compared to the rest of the sector.

The Distributors group has just one member, CDW. CDW needs to get back above these former highs in a hurry, lest it suffers the same fate as other stocks in the sector that are now decidedly rangebound. If we’re above $205, we can target the 261.8% retracement of the COVID selloff.

Leaders

Only 5 stocks in the sector have managed to stay in the green over the last 4 weeks. Western Digital is up 41% for the year, but one could argue it’s still stuck in a long-term downtrend. The downtrend line from early 2021 is still intact, and we’ve yet to surpass the January highs. At this point, if either of those resistance levels breaks, so does the other.

Losers

SolarEdge is the sector’s worst performer over the last 4 weeks and for the year. This is a prime example of why we avoid things that are breaking down and setting new lows. Losers tend to keep on losing.

The post Top Charts from the Tech Sector first appeared on Grindstone Intelligence.