Two Market Themes from February

February is nearing its end, and it’s been a month marked by two themes: failed moves followed by quick reversals and the return of a familiar foe: the US Dollar.

By the middle of January, the US Dollar Index was down than 10% from its September peak. The move pushed the index below its 2016 and 2020 peaks for the first time in nearly a year – a heartening development for equity market bulls, who watched Dollar strength wreak havoc on returns in 2022. The downtrend continued as we moved into the second month of the year, and the first trading day of February brought with it new lows for the index. All seemed well.

Then a month of declines were erased in the next 72 hours.

From failed moves come fast moves in the opposite direction, and the US Dollar Index was no exception. It’s climbed 3% in February, on pace for its best month since September.

That’s not the only place we saw a reversal. Treasury yields peaked in October, but after a handful of failures to break below support at last June’s highs, rates are back on the rise.

Those two turnarounds reminded us all about the relationship between stocks, bonds, and currencies. This isn’t a new theme (it was the only thing that mattered in 2022), but day-to-day correlations began fading in December.

Now they’re back with a vengeance, and that’s a problem for stocks.

The NYSE Composite – a cap weighted index of all the issues listed on the New York Stock Exchange – experienced a failed breakout of its own. In short, the bulls had a chance to take control, and they fumbled the opportunity.

So does that mean a resumption of the bear market is imminent and we should be watching for new lows?

That’s certainly possible. But it doesn’t have to be the case. It could just be a false start.

Consider a foot race, with all the runners lined up at the starting line. One racer jumps the gun, trying to get out to an early lead, and the race is stopped. The contestants don’t all get sent home. Instead, everyone takes some time to regroup, goes back to the starting line, and waits for the real race to begin. It might just be that this market needs a minute or two to gather its forces before moving higher.

Of course, after a few false starts, some racers may get disqualified. The race could even get canceled. That’s where we need to be careful. It’s safest to wait and see which runners successfully get off the line before placing bets – even if the best odds are afforded to those willing to place bets early.

With that in mind, take a look at some other February failures within S&P 500 sub industries. There were plenty of them out there.

In the Energy sector, Oil & Gas Equipment & Services briefly broke out to new 4-year highs.

Within Industrials, the trucking industry failed to hold new all-time highs.

And human resources reversed its breakout from a 6-month base.

In the Materials sector, gold miners were forcefully rejected by a former support level.

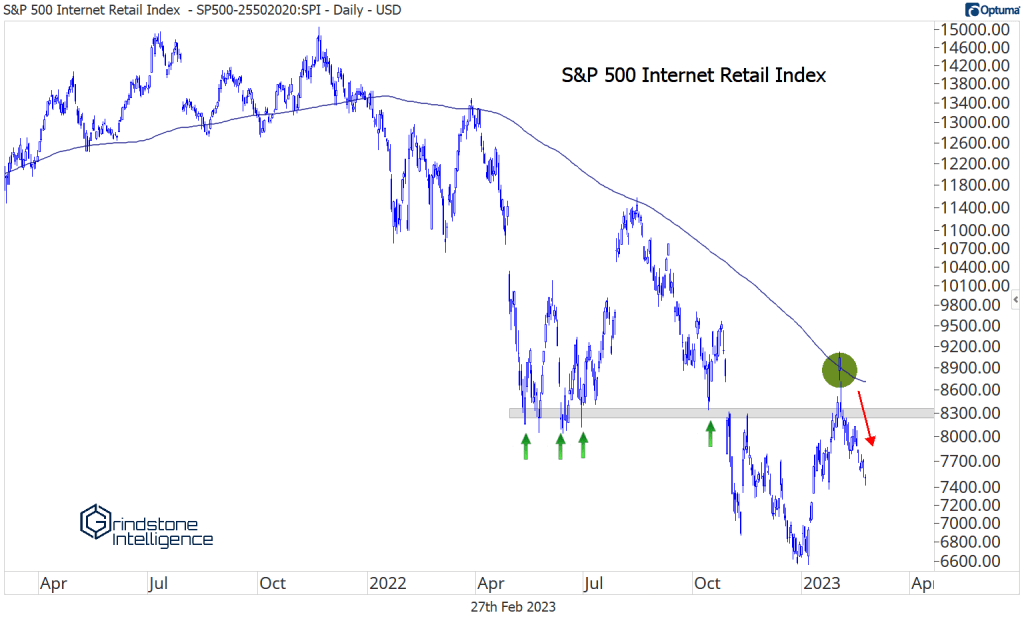

Here are 3 nearly identical charts in the Consumer Discretionary sector. Home furnishings, apparel accessories, and internet retail have all dropped more than 15% since failing to hold their breaks above former lows.

Auto manufacturers are also struggling to get back above the low end of their 2021-2022 range.

Within Communication Services, the interactive media sub industry dropped a quick 16% after getting rejected at resistance.

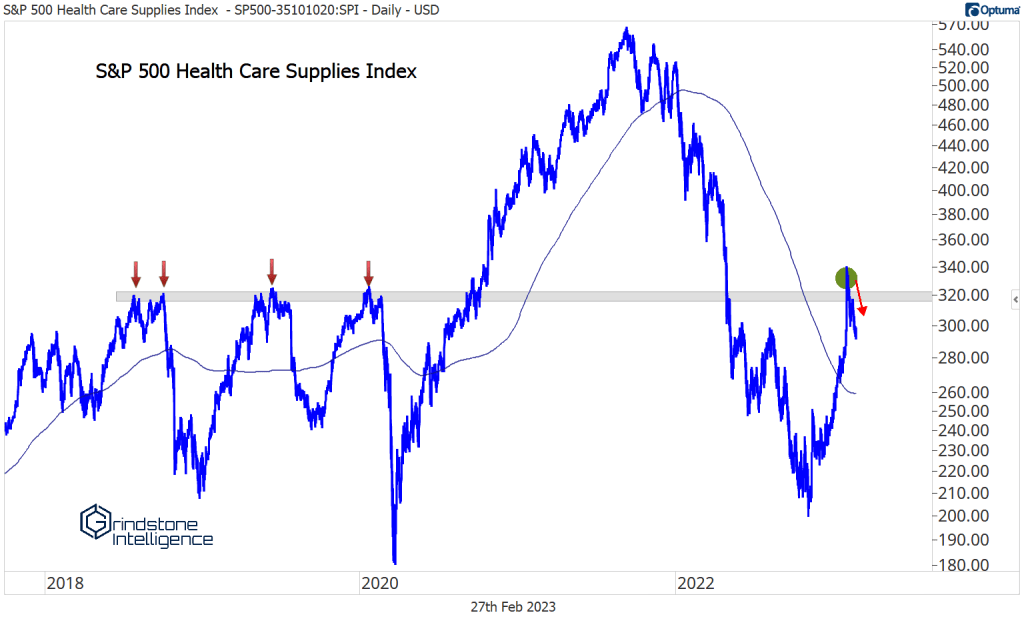

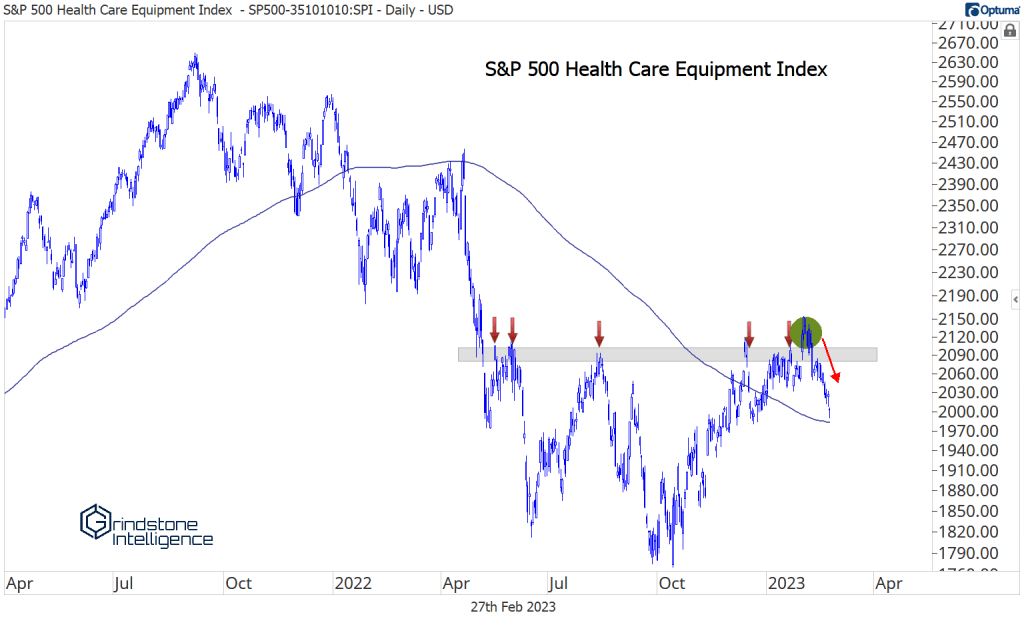

And in Health Care, the health care supplies and equipment groups are back below overhead supply.

The bulls dropped the ball. Now its time to see what the bears can do with it.

The post Two Market Themes from February first appeared on Grindstone Intelligence.