Underperforming Utilities

Sector outlook and trade ideas

Over the last 12 months, the S&P 500 has risen 26%, and despite the popular narrative, that rally has been pretty broad. Five large cap sectors - Communication Services, Information Technology, Consumer Discretionary, Financials, and Industrials - have all outperformed the benchmark over that period. Only one sector has failed to move higher.

That ‘one’ is the Utilities.

The Utilities set their peak relative to the rest of the market back in September 2023, just a few weeks before the bear market reached its nadir. Ever since, it’s been all lower highs and lower lows for the Utilities/SPX ratio.

That’s not a bad thing for stock market bulls, because the Utes are a risk-off sector. Nobody is buying them with the expectation of phenomenal growth over the coming years, nor is it likely that the revenues of a bunch of electricity suppliers are headed to zero any time soon. With the Utilities, you pretty much know what you’re going to get.

So when investors are trying to increase the risk/return profiles of their portfolios, they probably aren’t doing it with Utilities stocks. The Utilities should underperform in healthy bull markets.

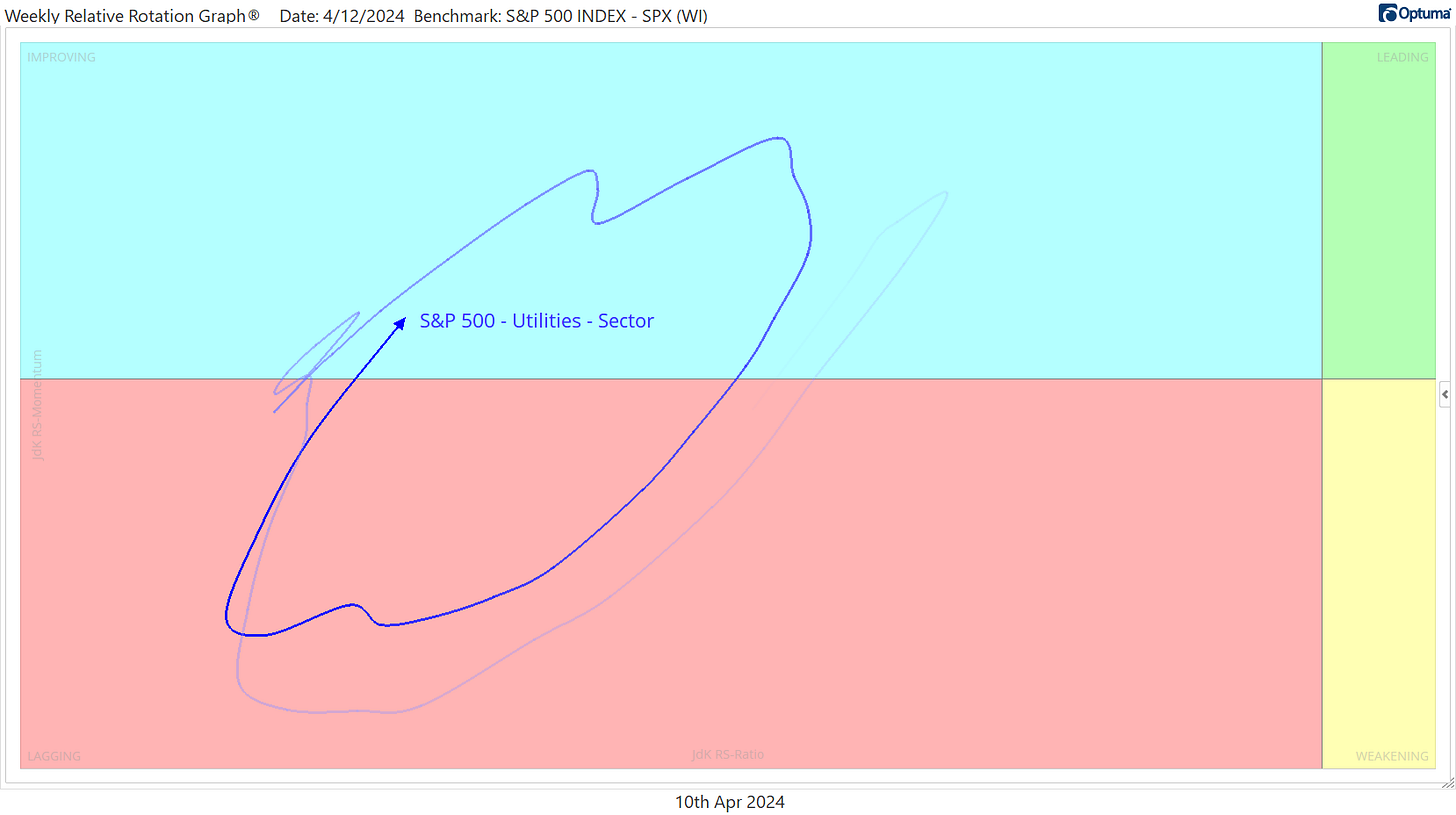

The weekly Relative Rotation Graph paints the picture of how healthy risk appetite in this market has been. Compared to the S&P 500 index, the Utilities sector has been stuck on the left side of the graph, moving between the ‘Lagging’ and ‘Improving’ quadrants, but never approaching the ‘Leading’ one.

We frequently talk about wanting to own relative strength, and that’s not the Utilities.

Now, that doesn’t necessarily mean we want to be shorting them. This is a bull market after all, and even the areas showing relative weakness tend to go up on an absolute basis during bull markets. That’s exactly what we’ve got here. The Utes on their own have broken the 2023 downtrend line and just hit a new 6-month high.

So the problem isn’t that the sector is falling, but that it isn’t rising as fast as other areas of the market. There’s opportunity cost in owning these guys.

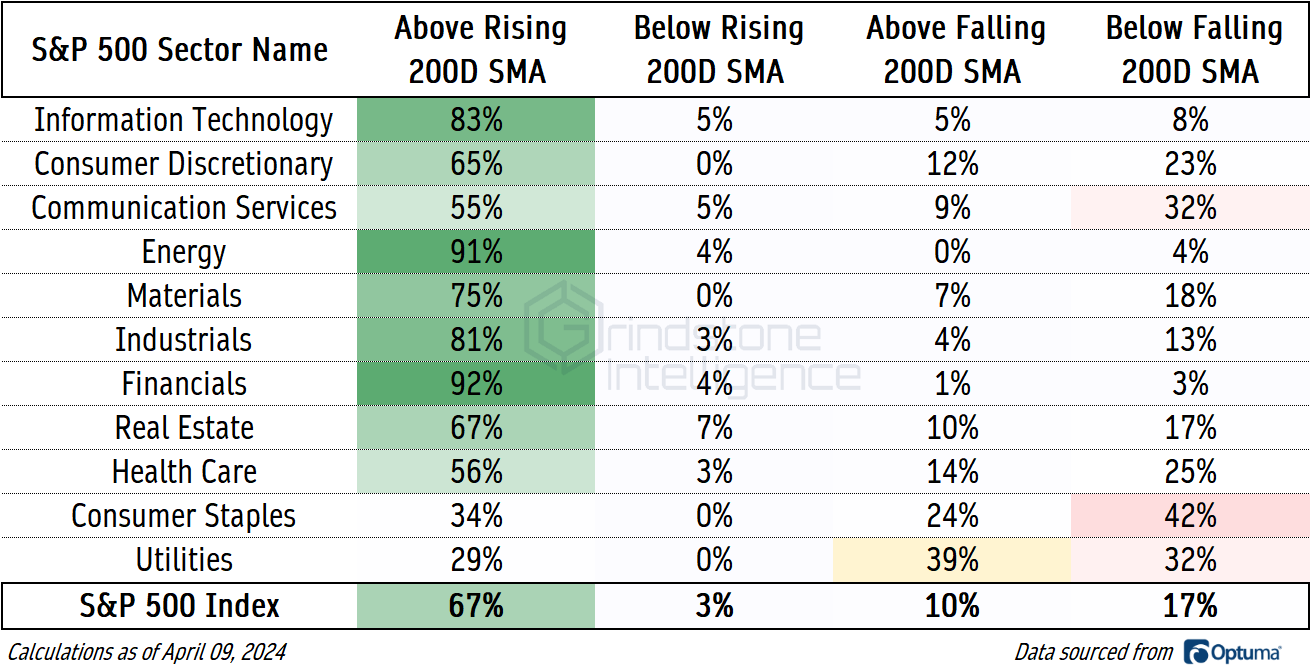

Breadth is telling the same story. Today, about two-thirds of S&P 500 stocks are above a rising long-term moving average. In other words, the majority of stocks are in clear technical uptrends. The Utilities sector, though, has the worst mark of any in the index, with just 29% of its members in an uptrend. Meanwhile, you’ve got the leaders like Financials and Energy with more than 90% uptrend participation. Those are the types of areas we want to focus on - not the less impressive Utes and Staples.

Of course, no trend lasts forever. If our thesis of continued relative weakness from the Utes is wrong, this is the chart that will tell us first. The equally weighted Utilities sector is trying to find a bottom relative to the equally S&P 500 at the same place it did back in the fall of 2021.

It’s perfectly normal for this ratio to respect that former low, but after some consolidation, we should expect this thing to resolve in the direction of the underlying trend and break to new lows. If it doesn’t, then we’ll need to start paying real attention.

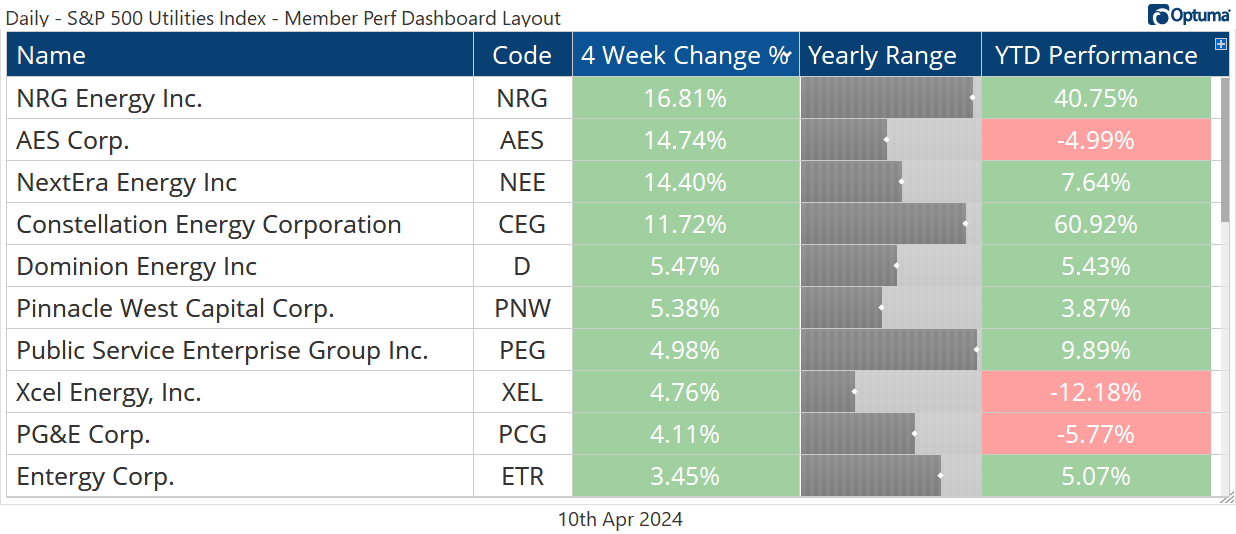

Leaders

NRG Energy was the top performing Utilities stock over the past 4 weeks, gaining 16.8% and bringing its year-to-date rally to more than 40%. That surge helped NRG break out of a huge, 15-year base and hit new all-time highs.

We expect to see NRG digest some gains here near the 423.6% retracement from the 2000-2003 decline, especially as it runs into its former all-time highs on a relative basis versus the rest of the Utilities sector. But longer-term, we have to respect the relative strength we’ve seen so far in 2024. If it can hold above this $67 level, then we we can buy NRG with a target up at $107.

Constellation Energy continues to be a big winner, and it’s the only large cap Utilities stock that’s consistently shown relative strength against the overall market for the past few years. Here it is versus the S&P 500:

We continue to like this one long above $165, which is the 685.4% retracement from the summer 2022 trading range, with a target up at the next key Fibonacci level of $230.

NextEra is worth keeping an eye on as it works on a major reversal relative to the rest of the Utilities. Remember, the Utilities as a whole are showing weakness compared to the rest of the market, so we aren’t trying to load the boat on setups like this. But if the Utilities as a whole begin to outperform in the future, then we want to know in advance which stocks within the sector to focus on.

The near-term level is $65 here for NEE, with the first area of resistance coming in at the pre-COVID highs near $70. If the whole space starts moving higher, we think it can go back to those former peaks near $88.

Losers

There are a lot of names to avoid in the Utilities sector, so we won’t waste our time (or yours) detailing each of them. The types of stocks we’re trying to stay away from all have the same signature, though. They look something like WEC Energy Group, which is setting multi-year lows relative to the rest of the Utilities space.

Relative weakness begets more relative weakness.

One more to watch

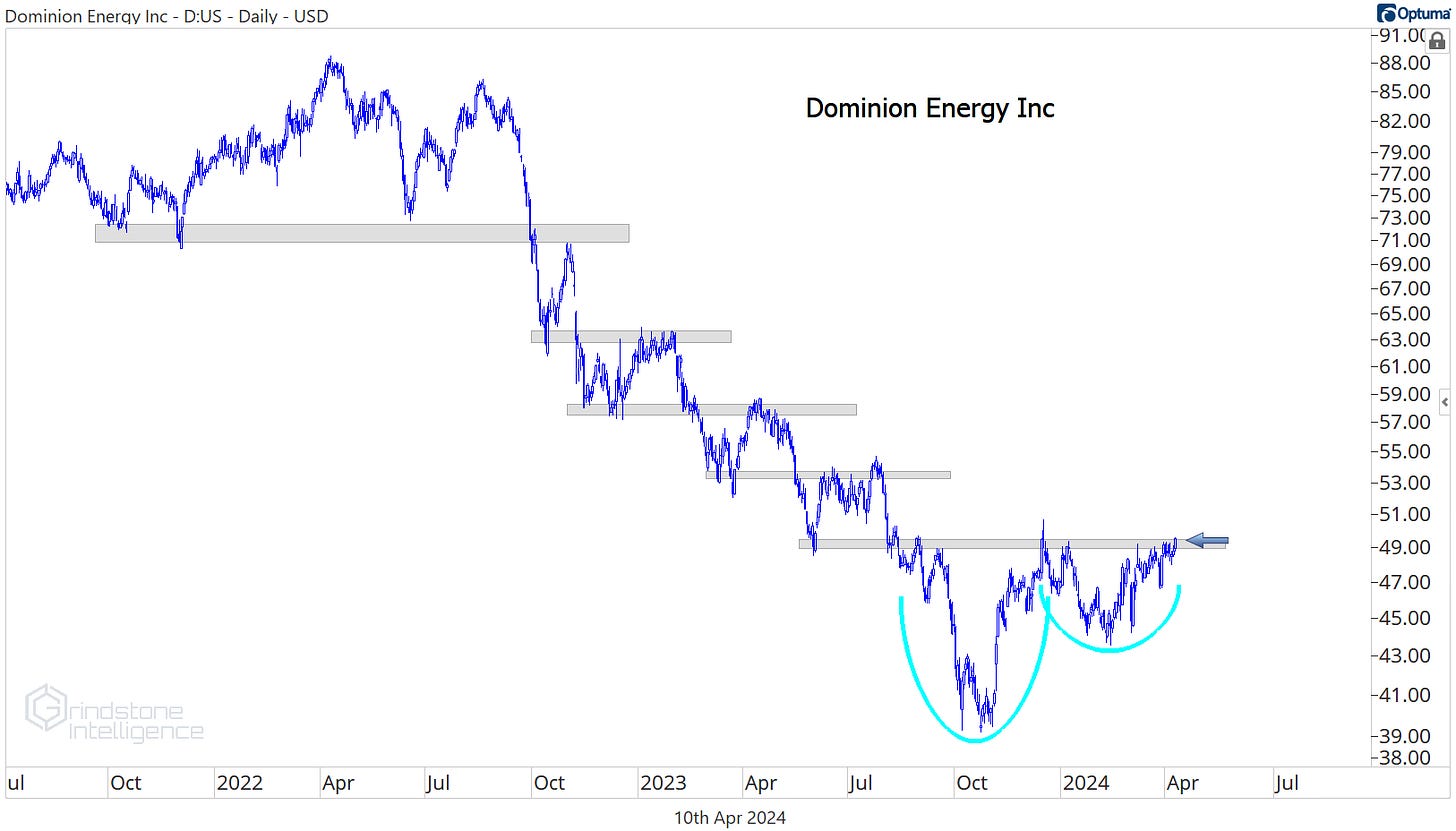

Trends are more likely to continue that reverse. Dominion Energy has been a textbook example of that over the past two years, with breakdowns followed by consolidations, followed by more breakdowns.

Over the past 6 months, Dominion has been working on a cup and handle reversal pattern, and it’s testing the brim of that cup right now.

A bullish breakout would tell us more about the type of environment we’re in than anything else: In bull markets, even the worst stocks can go up.

Until next time.