Waiting on Silver

We keep waiting on silver to take a leadership role.

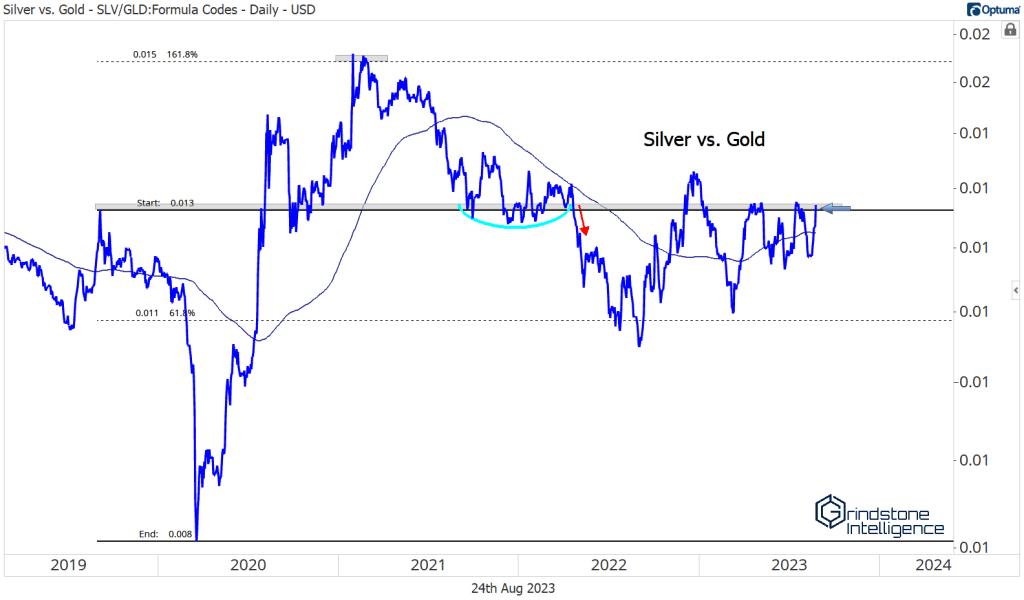

Prices for silver and gold tend to be highly correlated, but silver tends to move in greater magnitudes. As such, when precious metals are rising, we expect silver to outperform. That’s what we’ve typically seen during gold’s best runs. These days, silver refuses to lead.

Towards the end of last year, precious metals prices surged, with gold jumping from near $1600 to above $1800 by January. Similarly, silver jumped 30% from its October lows over that time. Gold prices continued to rise with the new year. Silver did not.

That divergence caused us to turn pessimistic on gold’s rally, and our concerns turned out to be well-founded. Gold and silver both dropped sharply in February. They’ve each recovered since then, but the Silver/Gold ratio is still struggling to gain ground. It’s battling the 2019 highs, which have marked a key rotational level for the past 4 years.

A relative breakout for silver would be a very positive development for both metals, in our opinion, so we’ll be watching this one closely in the coming days and weeks.

On its own, silver has strung together a handful of good days. There’s plenty of overhead supply to absorb, and the word ‘messy’ comes to mind when you see all the chop we’ve been dealing with for the past few years. Still, this isn’t a downtrend. If forced to choose, we’d err towards betting on higher prices.

Silver’s messy consolidation is mirrored by gold, which can’t seem to absorb all this overhead supply. Prices actually set incremental lows over the last few weeks – something silver didn’t do.

Buyers have stepped in over the past few days, though, and it happened at a pretty logical level. Here’s GLD (the SPDR Gold Shares ETF) finding support at the volume weighted average price from the September 26 closing lows:

We like the AVWAP because it shows the average buyer experience since that significant turning point last fall. That ‘average’ buying point has the same psychological impact of the highs and lows we usually identify as support and resistance on a chart.

Maybe this time, a rally will be enough to get past the hump of those former highs. Each time buyers push prices up toward $2070, they absorb more overhead supply. At some point, there won’t be any sellers left.

How high could the metal go on a breakout above $2070? We’re eying $3200. That’s the 1794% Fibonacci retracement from the 1990s decline. Prices have respected these retracement levels all the way up: The hiccups in 2006 and 2008 occurred near Fib levels, the ceiling from 2013-2019 was the 684.4% retracement, and right now, were stuck below the 1109% retracement. It would make a lot of sense to go up and touch the next one.

Think that target sounds too aggressive? It’s nothing compared to the rally after gold’s last major breakout.

The post Waiting on Silver first appeared on Grindstone Intelligence.