Weekly Market Wrap: May 15, 2023

Week in Review

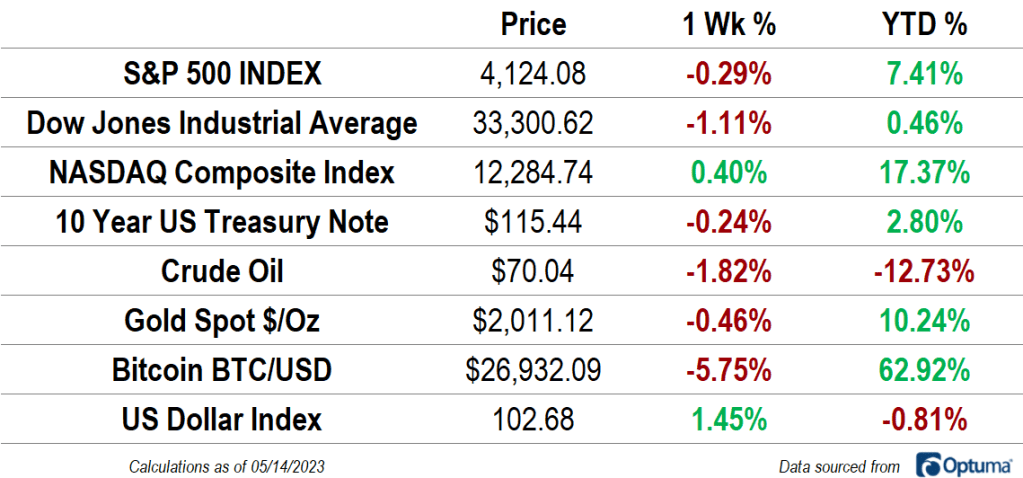

The S&P 500 was mostly unchanged last week, but the broad index masked a wide dispersion in performance beneath the surface. The Dow Jones Industrial Average dropped more than 1%, while the NASDAQ rallied. Commodity prices were under pressure, as the US Dollar posted its biggest weekly gain since last September. Crude oil fell 1.8%, gold declined 0.5%, and Bitcoin prices dropped 5.8%. Interest rates rose modestly.

Consumer prices continue to trend in the right direction. In April, CPI fell below a 5% annual rate for the first time in 2 years. The producer price index showed even more progress, falling to a 2.3% annual rate. Core inflation, which excludes volatile food and energy components, remains persistently elevated, thanks to sticky services and durable goods. Shelter costs, though, which are the biggest driver of core inflation, decelerated for the first time since April 2021.

Relatively Speaking

There’s been a wide dispersion in sector performance over the last month, which has been partially masked by an S&P 500 index that rose a healthy 0.8%. Most of the gain was attributable to large cap growth stocks, which dominate sectors like Communication Services (+5.3%), Information Technology (+3.7%), and Consumer Discretionary (+3.7%). Cyclical and value-oriented sectors fell over that same period, led by Energy (-9.2%).

Leadership over the past month mirrors that of the year-to-date period. Communication Services (+26.9%), Information Technology (22.3%), and Consumer Discretionary (+14.9%) again sit atop the standings. Investing in any other area would have yielded a return well below that of the S&P 500’s 7.4% YTD gain. Energy (-10.2%) and Financials (-7.1%) are the worst performers.

What’s Ahead

Here are the key data releases to keep on eye on in the coming days.

The post Weekly Market Wrap: May 15, 2023 first appeared on Grindstone Intelligence.