Weekly Market Wrap: May 8, 2023

Week in Review

Stock market returns were mixed last week. The NASDAQ Composite, which has been the leader all year, was the only major index to finish in the green. The S&P 500 index declined 0.8%, and the value-tilted Dow Jones Industrial Average erased half of its year-to-date gains when it dropped 1.2%. Crude oil cratered as much as 17% during the week, before rallying in the final two days to close only 7% lower. Gold, meanwhile, briefly touched an all-time high and had its best weekly close in nearly 3 years.

One Thing to Consider

The Federal Reserve raised rates for a tenth consecutive meeting last week. That wasn’t a surprise. Neither was it surprising when Chair Jerome Powell laid the groundwork for a pause in hikes, removing language from the prior meeting’s press release that indicated additional policy firming would be necessary, and replacing it with more flexible language that highlights the Fed’s data dependence going forward. After raising rates by 5% in just over a year, Powell believes policy is near a sufficiently restrictive level. Ever the pragmatic pivoter, he now wants to assess the extent to which their cumulative tightening actions, ongoing QT, and recent bank failures will affect credit creation and stymie demand. Friday’s jobs report, which exceeded expectations for the thirteenth consecutive month, showed how resilient this economy continues to be in spite of policy pressures.

Monitoring Macroeconomics

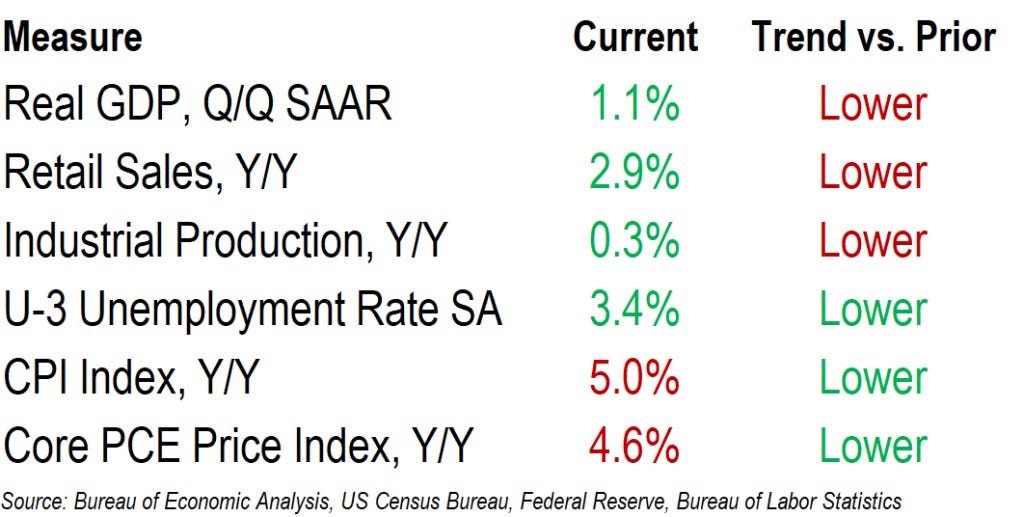

GDP continued to grow in the first quarter of 2023, though it was less than consensus expectations thanks to a large drawdown in inventories. Economists still widely believe that a recession will hit the United States sometime in the latter half of this year. The odds of a ‘soft landing’ – a scenario where the Fed successfully contains prices without creating widespread economic hardship – has declined, given price pressure that remain stubbornly elevated and the banking stresses that have emerged since March.

Measures of inflation remain well above the Federal Reserve’s 2% target, but CPI has decelerated for 9 straight months and measures of core price changes have dropped below 5%. Unemployment, meanwhile, is near 70-year lows, and job creation to start 2023 has been well above the level needed to keep pace with population growth.

What’s Ahead

Here are the key data releases to keep on eye on in the coming days.

The post Weekly Market Wrap: May 8, 2023 first appeared on Grindstone Intelligence.