Which Gold Stocks Do We Want to Buy?

Gold has dropped 5% from the peak it set in the middle of last April, but we don’t think that’s the end of the rally.

Zoom out for a minute and look at what gold prices have done over the last 30 years. Does this look like a big top to you? Or does it look like the early stages of a new uptrend?

We’re betting on the latter.

We’re eying $3200 over the next few years, which is the 1794% Fibonacci retracement from the 1990s decline. Prices have respected these retracement levels all the way up: The hiccups in 2006 and 2008 occurred near Fib levels, the ceiling from 2013-2019 was the 684.4% retracement, and for the last few years we were stuck below the 1109% retracement. It would make a lot of sense to go up and touch that next level. Even $3200 might be too conservative of an expectation – prices rallied a lot more after the 2004 breakout.

First things first, though. Gold has to deal with near-term supply at $2440, which is the 423.6% retracement from the spring 2020 selloff. From a tactical standpoint, we can afford to wait and see a fresh breakout above that resistance level before initiating new longs, and our near-term target is just over $3000.

A coinciding breakout from silver would give us more confidence in gold’s ability to hit those upside targets. Silver came out of nowhere to erase more than two years of absolute mess, and now it’s knocking on the door of a major breakout. If silver is above $29, we think it can rally all the way to $39, which is the 423.6% retracement from the 2020 decline:

What’s so important about silver? We think of silver as a ‘risk-on’ version of gold. Prices for the two tend to be highly correlated, but silver tends to move in greater magnitudes. As such, when precious metals are rising, silver should outperform. That’s what we’ve typically seen during gold’s best runs, and that’s something that had been lacking for most of 2022 and 2023. Right now, the gold/silver ratio is rangebound.

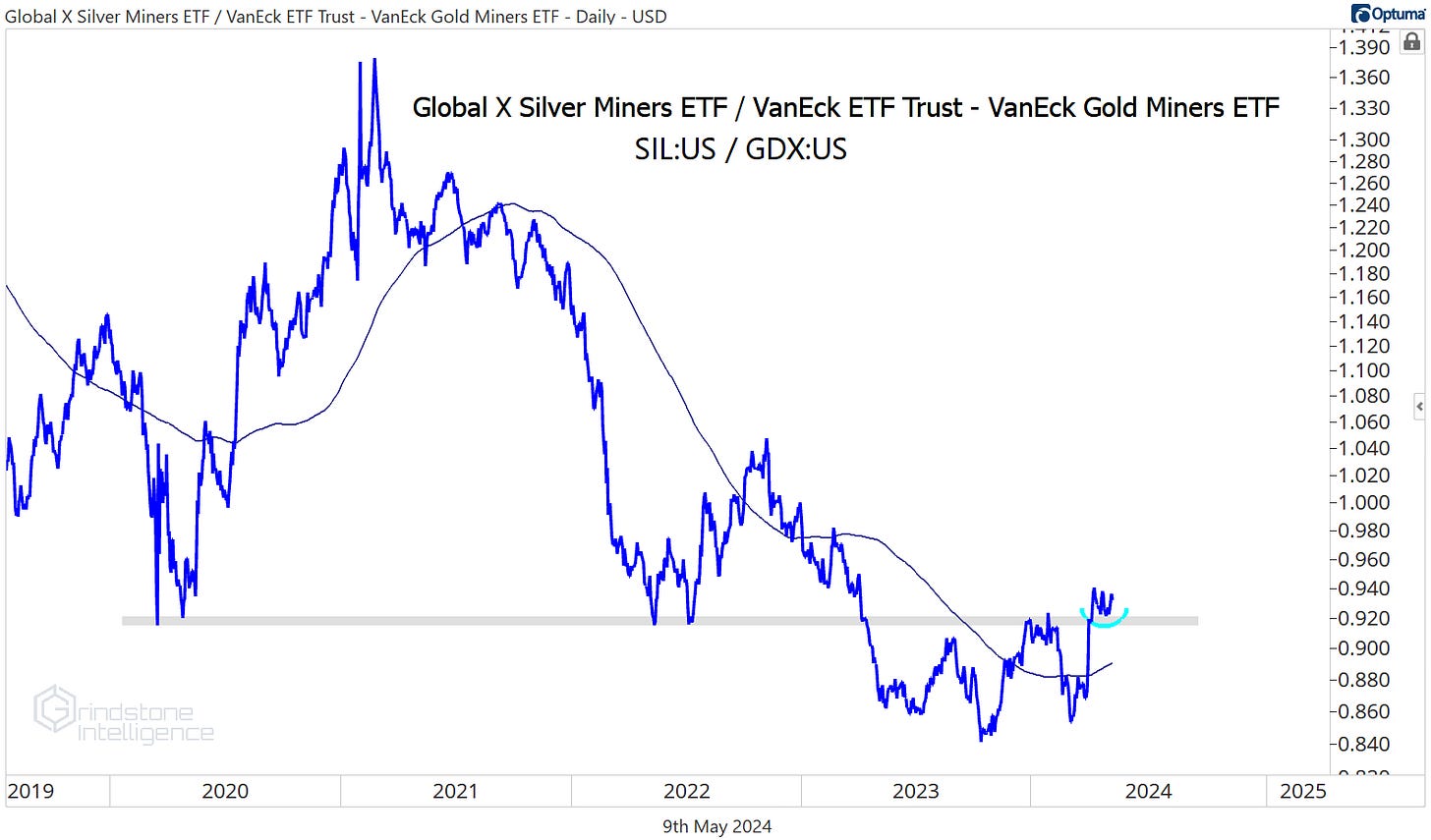

But here’s something to take note of: the silver miners are outperforming. Below we’ve got SIL, the Silver Miners ETF, divided by GDX, the Gold Miners ETF. Last month, the SIL/GDX ratio jumped back above the 2020-2022 lows, an area that acted as resistance in January. This looks to us like a clear reversal of the multi-year downtrend that had been in place since early-2021.

The silver miners are showing relative strength, but as a group they’re still stuck below the highs they set last summer. So long as SIL is stuck below $33.50, it’s hard to justify a trade here.

Fortunately, we aren’t limited to looking just at ETFs. We took a look at the individual miners and found a few that really stood out. All three are already above last year’s highs (aka showing relative strength) and all three have attractive risk setups right now.

Coeur Mining is consolidating above the 38.2% retracement from the 2020 decline, a level which was also resistance in the back half of 2022 and throughout 2023. Consolidating above support - rather than below resistance - is something we tend to see in the strongest uptrends. Our risk level in CDE is $4, with an initial target back at the pre-pandemic highs above $8.

Taseko Mines is knocking on the door of 10-year highs at $2.65. This level is the 38.2% retracement from the entire 2007-2016 decline, and it acted as support in 2011 and 2012 before turning into resistance in 2013, 2014, 2017, and 2021. In other words, there’s a lot of memory here. A breakout would serve as proof of the bulls’ control, we we’d want to be buying TGB with a target of $3.90.

And finally we’ve got Fortuna Silver Mines. FSM is breaking out TODAY above the 38.2% retracement from the 2020-2022 decline. We just spent the last few weeks consolidating below that area of former resistance, so we think this breakout is the real deal. We want to own it as long as it’s above $4.90 with a target of $6.70, which is at the next key Fibonacci retracement level.

That’s all for today. Until next time.