Which Sector Will Lead in the Second Half?

The question was posed on Twitter over the weekend, “Which sector will be the best performer in the second half of 2023?”

It got me thinking. The first half of the year was great for growth investors, but rather lackluster for those invested in value or risk-off areas of the market. So should we be betting that growth’s dominance will continue? Or should we be betting on mean reversion?

I dug into the data to look for clues.

I looked at sector returns going back to 1990 and ranked them for each 6-month period (Period 1). Then I compared those rankings to how each sector performed over the following 6 months (Period 2). Trend followers will be happy to hear the results: the sector that led over Period 1 was the most likely to top the list in Period 2, too. That was true 16% of the time (vs. an expected 9% if sector returns were random).

But the sector that was next most likely to lead in Period 2? The one that finished dead last over the initial measurement period. The laggard became the leader 13% of the time.

Together, the winning and losing sectors from Period 1 won 29% of the time in Period 2.

The environment we’re in today has some unique characteristics, though. The S&P 500 rose more than 15% in the first half of 2023, and the dispersion of sector returns was wider than usual. After controlling for all comparable periods since 1990, the top and bottom sectors won more than 40% of the time over the next 6 months. That’s 2x the odds we would expect if outcomes were randomized. But returns aren’t random.

So with some understanding of what’s happened in the past, which two sectors should we be focusing on in the future? Which sector topped returns in the first half, and which one brought up the rear?

Information Technology and Energy.

And wouldn’t you know it, those two already have a track record of being winners: Tech has been the top sector in 22% of 6-month periods over the last 30+ years. Energy has ranked first 17% of the time. Meanwhile, no other sector reaches the 10% threshold.

So which will it be? Tech or Energy?

The Tech sector is breaking out to new all time highs, one of only 2 sectors to do so since the bear market began last January.

And don’t forget, Tech just broke out of a 20-year base relative to the S&P 500 index.

With such a strong structural backdrop, it’s hard to be betting against the incumbent leader in the back half. Recent actions suggests there’s some near-term trouble at hand for the sector, though. Momentum failed to reach overbought territory on last week’s relative breakout, and now the ratio has dipped back below former resistance. From failed moves tend to come fast moves in the opposite direction.

What about Energy? It’s been trending lower versus the market since last November, after banner performances in 2021 and 2022. Now, though, the sector is finding support at the site of the breakdown in March 2020. This was also a key rotational level in early 2022. What better place for Energy to stage a rally?

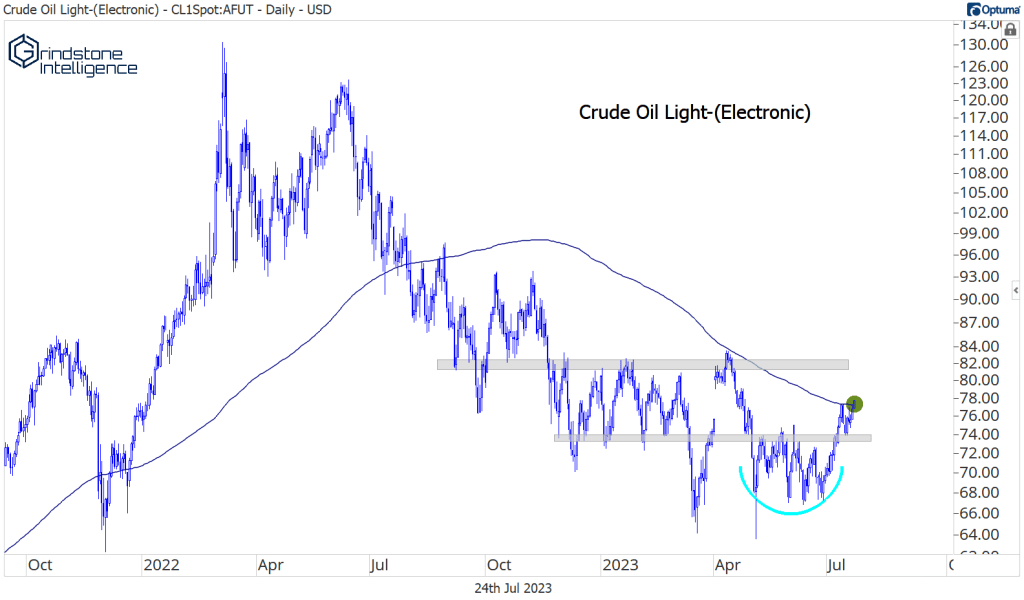

And what better tailwind for the sector than rising oil prices? Crude had every opportunity to crater lower over the spring and early summer. Instead of taking advantage of the weakness, though, the bears fumbled the opportunity. Now, oil is set to close above its 200-day moving average for the first time in almost a year.

So which sector do you think will lead us higher? The structural leader facing near-term headwinds? The beaten-down former rockstar intent on rekindling former glory? One of the other sectors?

The only thing we can know for sure is that none of us knows for sure.

As far as high probability bets go, though, I’m pretty sure I know which sector won’t rank 1st in the second half of the year. Thanks to their close correlation with the S&P 500 Index, the Industrials have topped the winners list on only a handful of occasions over the last 30 years – just 1.5% of the time.

The post Which Sector Will Lead in the Second Half? first appeared on Grindstone Intelligence.