Who's Number One?

Communication Services sits at the top of the leaderboard

Ever since the end of 2022, growth stocks have dominated the investment landscape. And no group has been stronger than the Communication Services sector. It’s jumped 71%, more than doubling the return of the S&P 500 and outpacing even the ever-dominant Information Technology sector.

Communications still has some catching up to do. It was the single worst performing sector in the bear market that endured for 2022, meaning for the complete cycle, the group is still lagging the return of the S&P 500. In fact, since the sector set its all-time high in September 2021, only Real Estate and Utilities have been worse.

Structurally, though, the group is clearly now in a relative uptrend versus the rest of the index, and only a break of the 2018 lows would change that. We saw the ratio successfully backtest its breakout above that key rotational level in December.

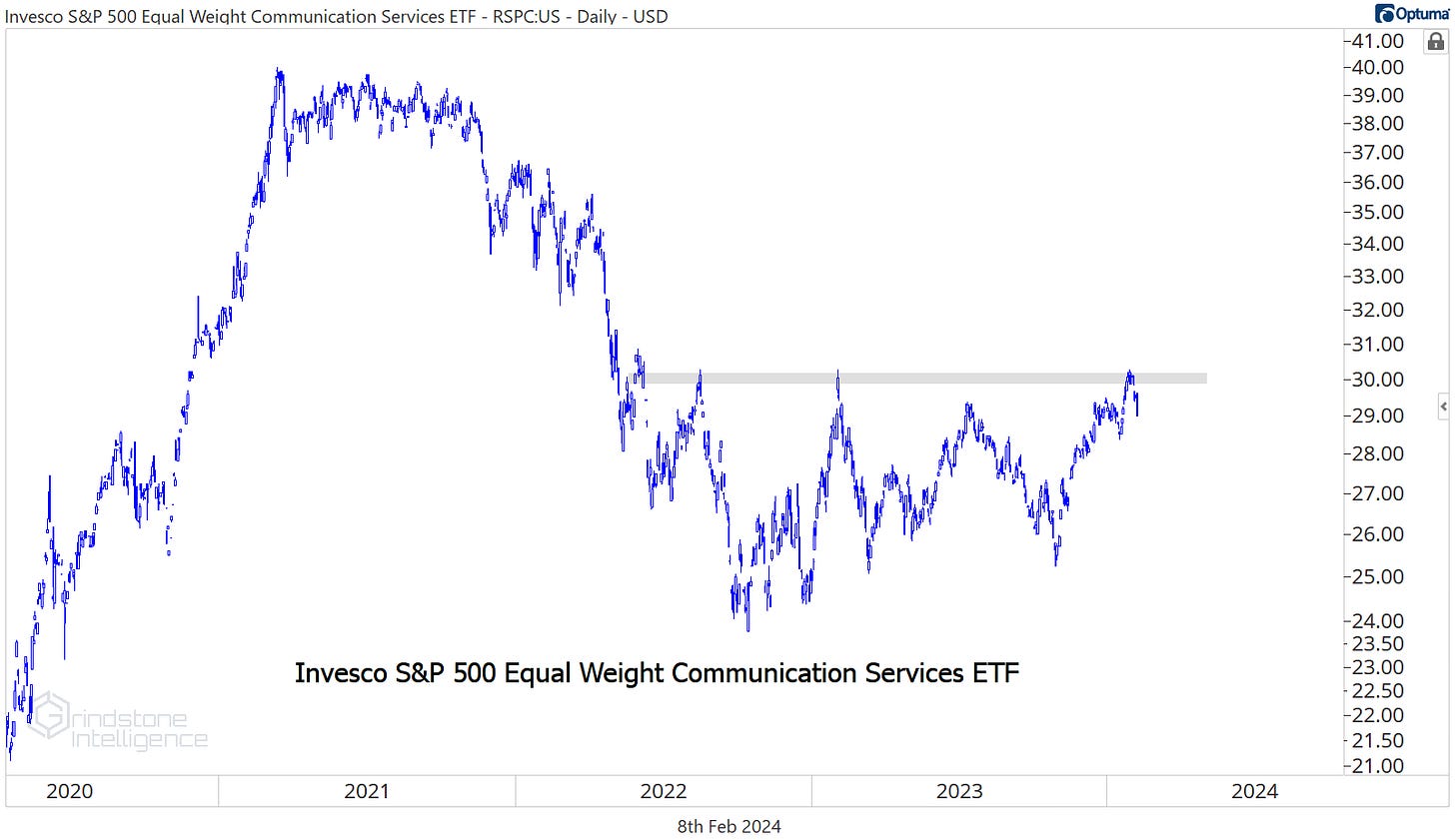

By no means is this a broad move in Communications. Unlike the Information Technology sector, where you see Tech outperforming on both a market cap weighted basis and an equally weighted basis - and even in the small cap space - the majority of Communication Services stocks aren’t doing that well. The equally weighted sector hasn’t even managed to surpass the peak it set at the beginning of last year.

And it just hit 10-month lows relative to the equally weighted S&P 500.

And just half of the sector’s constituents are above a rising 200-day moving average. That’s not the worst mark in the index, but not something you’d expect to see from a group that has risen 70% over the last 13 months and just set a new 52-week high.

How can Communications be so strong when there’s such weakness beneath the surface? Thank the mega caps. Together, Alphabet and Meta comprise more than two-thirds of the weighting of the entire sector. And those two have been nearly unstoppable.

Digging Deeper

Both Meta and Alphabet are housed in the Interactive Media & Services sub-industry. You can clearly see the extent of their outperformance here:

Sure, the 45% gain over the last 13 months by the Movies & Entertainment space is nothing to sneeze at, but it pales in comparison to the 112% rally from Interactive Media.

Meta stands apart. It just broke out to new all-time highs:

This one is a great reminder that the strongest trends don’t care about momentum divergences. The latest surge on earnings results also took META to new highs relative to the rest of the market.

If Meta comes back and fills last month’s gap higher, we want to be buying near $400 with a target up at $565.

GOOGL didn’t have nearly as much fun after its own earnings announcement. Back in December we pointed out the failed breakout in the ratio of GOOGL vs the S&P 500 index, and noted that even in a bullish outcome it would take time to repair the damage.

The failed relative breakout foreshadowed a more recent similar move for the stock on an absolute basis. As long as GOOGL is below the 2021 highs, there’s just no reason to be involved. We’d rather see it fully digest this area of resistance first.

Leaders

I don’t see anybody talking about News Corp, but they should be. NWSA just surged to new highs:

And check out this bottoming action for the stock relative to the rest of the market:

We want to be buying NSWA above the 2021 highs at $26 with a target near $33.

Speaking of bottoming action, how about Disney? This was one of the worst stocks out there from 2021-2023, but yesterday DIS broke a 3-year downtrend line relative to the SPX:

We don’t believe DIS just goes straight up from here - bottoms are a process - but we can begin approaching this one from a more bullish long-term perspective.

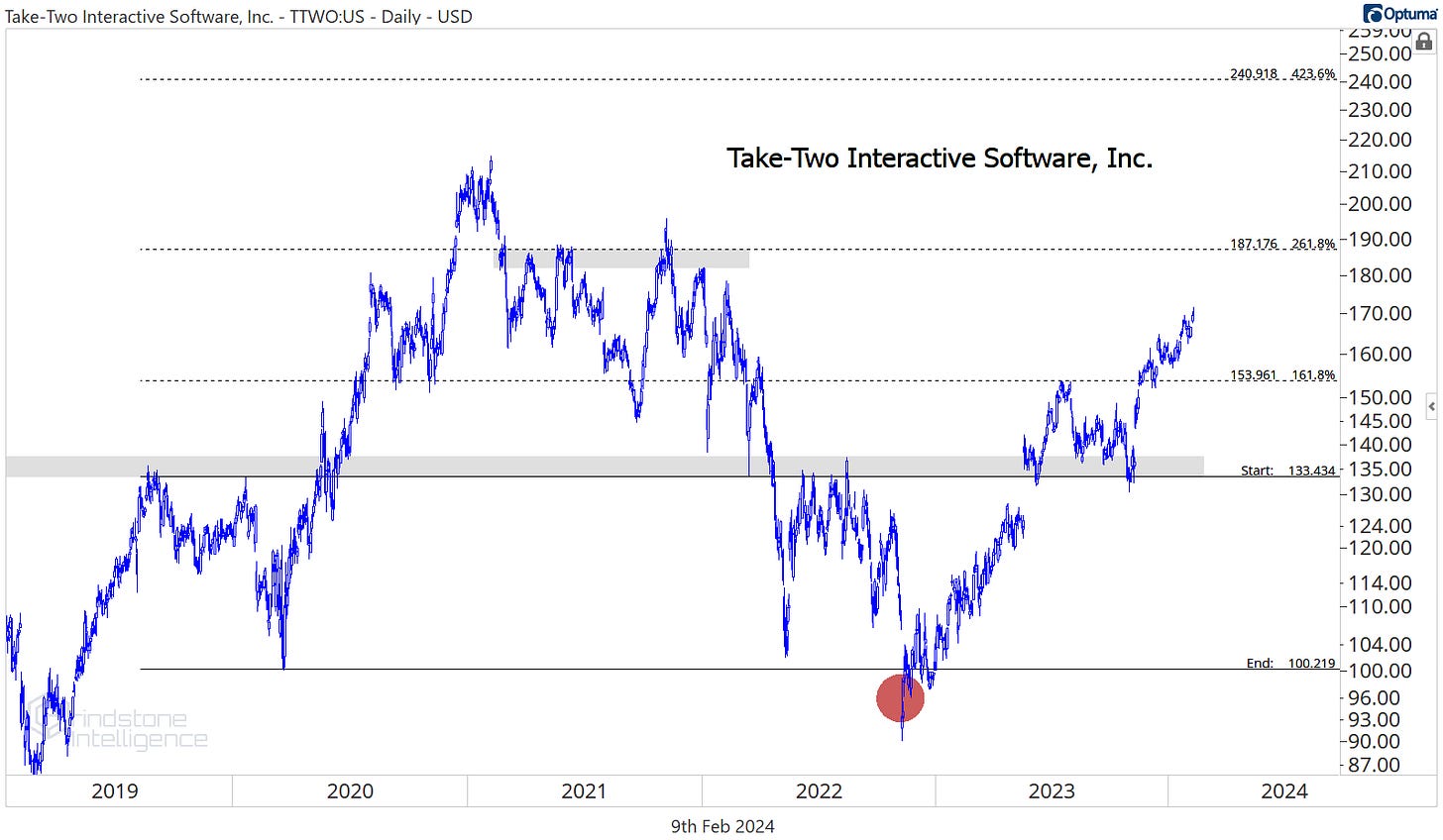

We’ve wanted to be long TTWO above $150 with a target of $185 since early December, and it continues to progress towards our target.

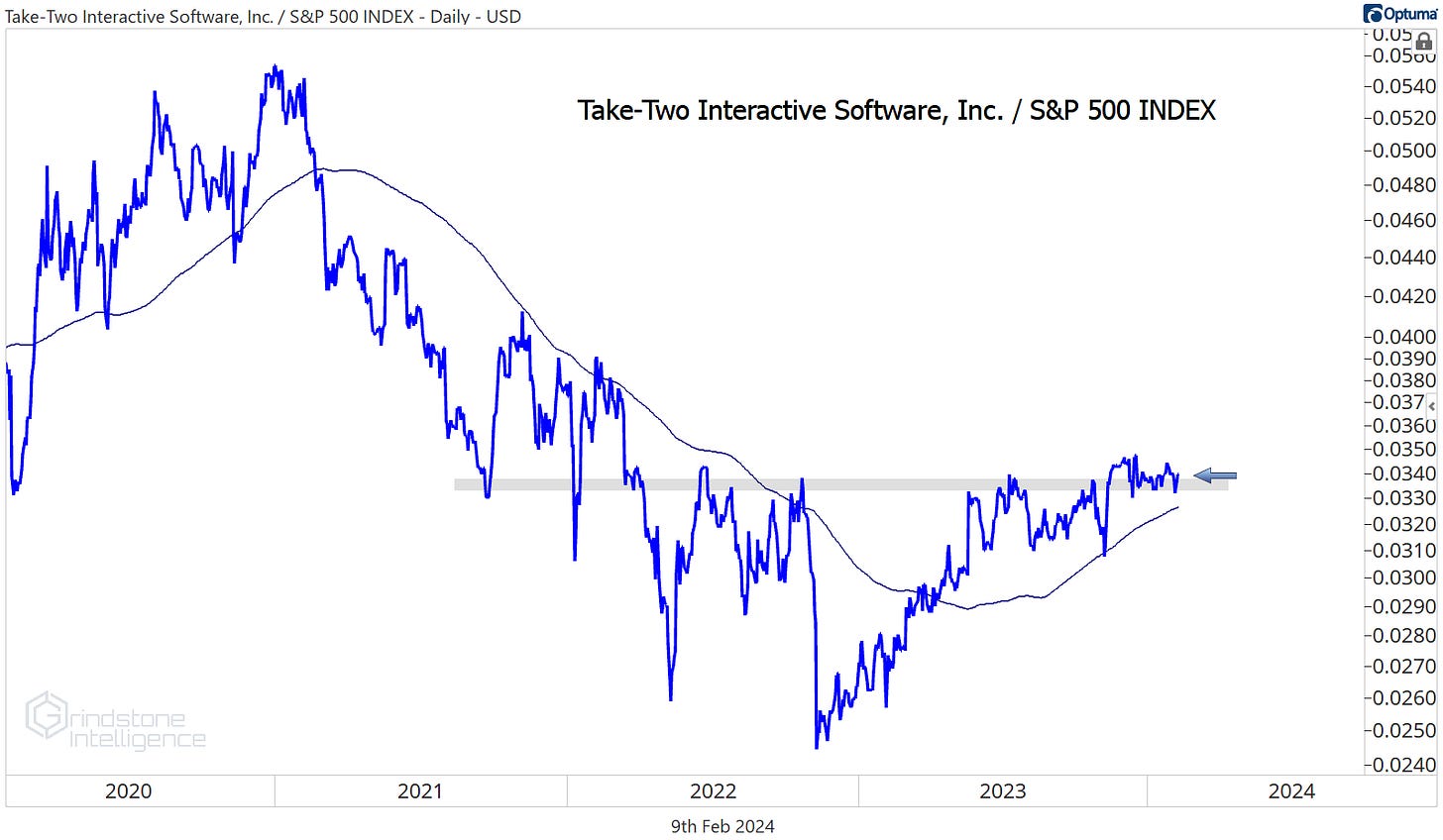

It hasn’t shown as much relative strength as we’d hoped, though. It’s still trying to absorb the 2022 highs vs. the S&P 500.

A bullish resolution from here would have us setting more aggressive targets on the stock.

Losers

Losers tend to keep on losing. Charter wasn’t able to escape its relative downtrend over the fall, and now it’s setting new lows vs. the rest of the market.

It’s setting new absolute lows, too. There’s no reason to waste time on garbage like this when we’re in the midst of a bull market.

The same goes for Interpublic Group. It broke to new relative lows this week.

And so did Warner Bros.

If you’re looking for things to buy, look somewhere else.

Until next time.