10 Charts That Made 2023 and a Few to Watch in 2024

Closing the book on another year

The next note will be on Tuesday, January 2. Wishing you a Happy New Year!

What a year it’s been.

Last December, nearly everyone agreed: recession was coming. With the Federal Reserve embarking on its fastest hiking cycle in decades, inflation cutting into spending power, excess savings drying up, geopolitical turmoil in eastern Europe, a property crisis in China, US housing affordability at its lowest level in decades, an inverted yield curve, and the stock market in the midst of the worst bear market since 2009, all the evidence seemed to point in one direction. And not a happy direction at that.

If you were to tell everyone a year ago about the things what would happen in 2023, their confidence in a coming recession would only grow. A banking crisis in March, including the second-largest bank failure in history. A debt ceiling-crisis in May that nearly caused the US to default on its debt, followed by threats of a government shutdown in the fall - events which caused Fitch to downgrade US long-term credit rating to AA+ from AAA and Moody’s to lower their outlook on the US credit rating to ‘Negative’. Long-term interest rates rising to their highest level since 2007. The resumption of student loan payments, despite the administration’s attempts to erase the bulk of borrowings. A surge in labor strikes, causing work stoppages at the big 3 automakers and delays at UPS. Twenty straight months of declines in the Leading Economic Index. And in October, a terrorist attack in Israel that took geopolitical uncertainty to new heights. With all that, how could we not have a recession? And how could stocks possibly go up in that environment?

That’s the problem with making predictions about the economy. Even the best economists aren’t very good at it. Recession never came, and the stock market surged.

Below, we’ve compiled a handful of charts that helped define the year that was. 2023 was surely one to remember.

Fed in focus

Rarely has the Federal Reserve been so popular.. or perhaps unpopular. Interest rates were on the rise for most of the year, and that meant tougher financing conditions for businesses and consumers alike. The number of ‘Fed’ mentions on company earnings calls surged in 2023.

It wasn’t just a US phenomenon. By mid-2023, 95% of global central banks were in interest rate hiking cycles according to the BIS. But we’ve started to see the turn. A handful of banks have started loosening monetary policy, and it looks like they’ll be joined next year by the Fed, ECB, BOE, and BOJ.

What inflation?

How can the Federal Reserve be thinking about cutting rates next year when headline inflation is still well above their 2% annual target? Probably because underlying inflation has been under control for awhile now. The year-over-year change in CPI ex-shelter dropped below 2% over the summer. On a 3-month annualized basis, this measure has been near 2% since last October.

A banking crisis that turned out to be not-so-critical

A surge in interest rates caused the worst year in decades for bond investors. And banks were no exception. Unrealized losses on investment securities at lending institutions rose to levels that seemed unfathomable just a few years ago.

Though unrealized losses were (and perhaps still are) a systemic issue, no bank was more poorly positioned than Silicon Valley Bank. If SVB’s tier 1 capital ratio had been adjusted for unrealized losses on securities, their ratio would have been near zero.

Following the failure of SVB, Signature Bank, and Silvergate, the Fed created the Bank Term Funding Program to help lenders shore up balance sheets. That helped to successfully ringfence the crisis.

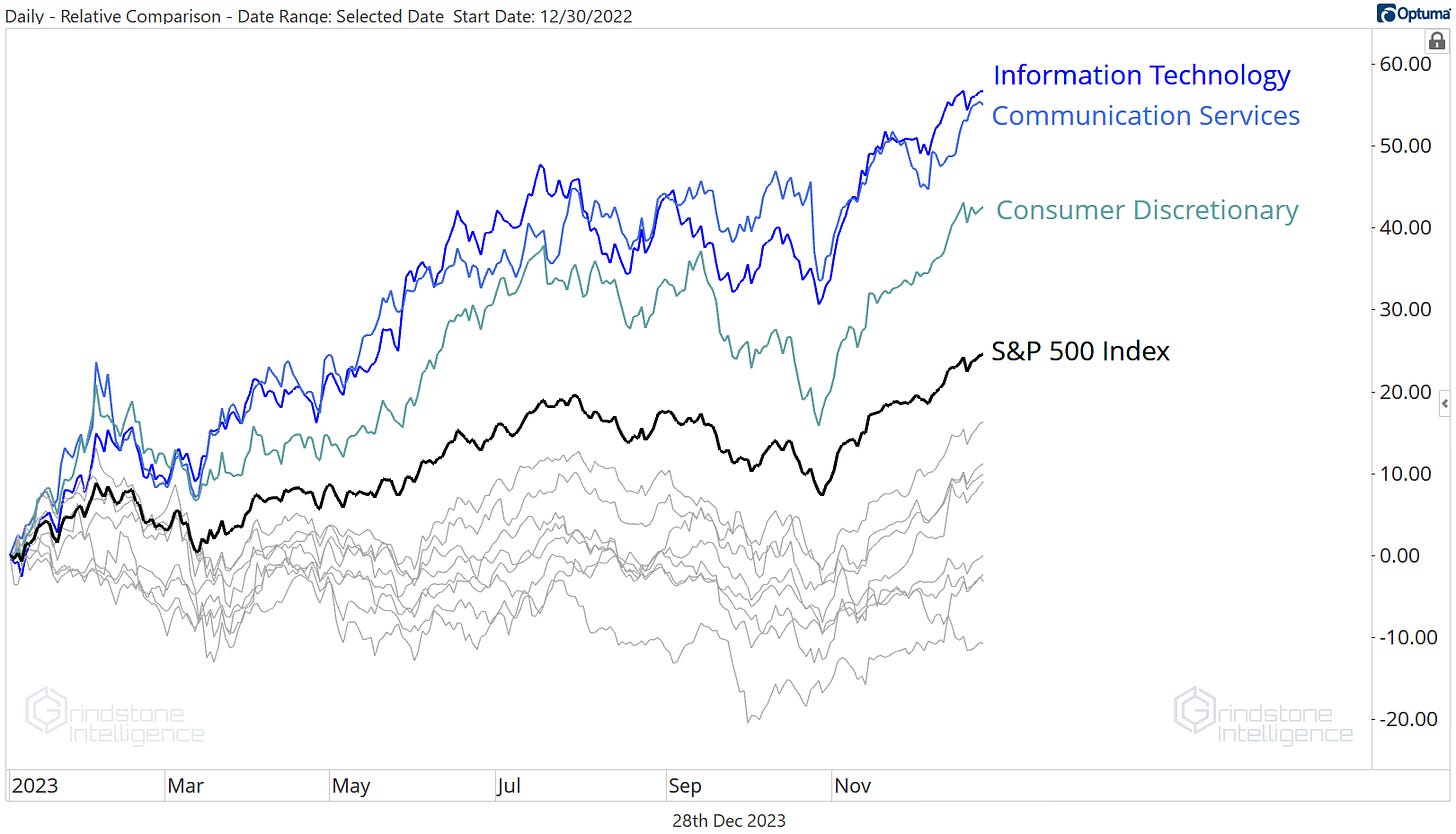

Growth stocks dominate

Growth-oriented sectors were all the rage in 2023. Information Technology, Communication Services, and Consumer Discretionary all rose more than 40%. None of the other 8 sectors were able to even keep pace with the benchmark S&P 500 index.

Tech’s outperformance finally pushed the sector past the dotcom bubble highs. It took 20 years for the Tech/SPX ratio to get back to the former peak, then it took another 3 years of digesting that peak before Tech found fresh air.

Thanks to the dominance of mega-cap growth, just 29% percent of stocks outperformed the S&P 500 this year, the lowest number since 1998. And the median stock lagged the index by 16%.

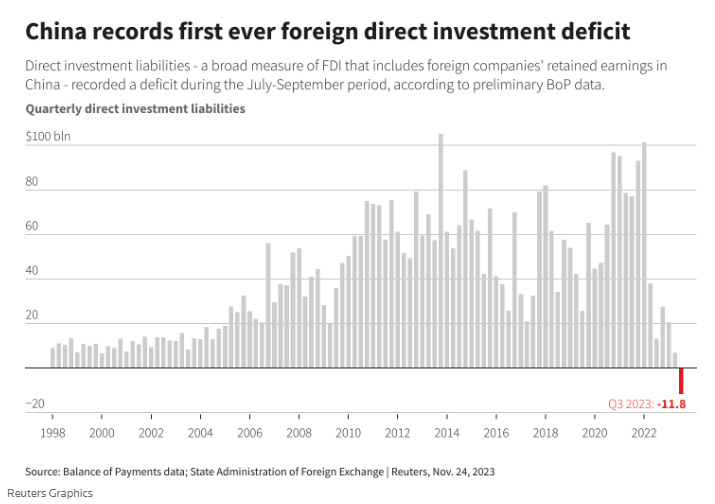

Avoiding China

Blame it on the property crisis, an unfriendly regulatory environment, weakening trade relations, or just a broad slowdown in global economic activity. Whatever the reason, China has fallen out of favor. For the first time in more than 20 years, foreign direct investment in China dropped into negative territory. The stock market is no better. While equities in the US, Europe, Japan, and India are all at or near new highs, the Shanghai Composite is set to end 2023 near multi-year lows.

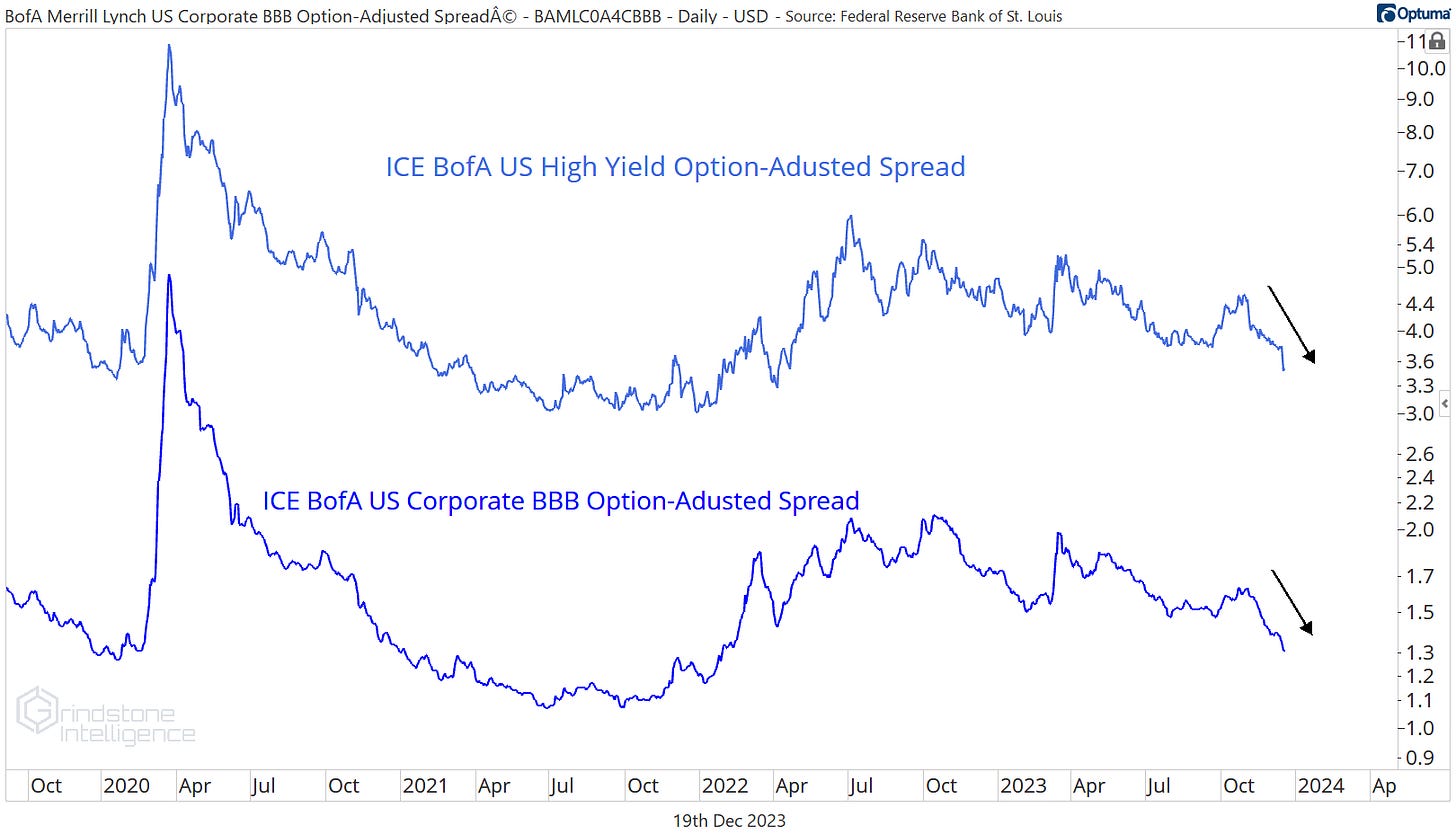

No fear in the credit market

If investors feared the US was on the verge of recession, we’d expect to see the riskiest borrowers paying higher and higher rates. We’re seeing the opposite. Credit spreads are dropping.

Looking ahead to 2024

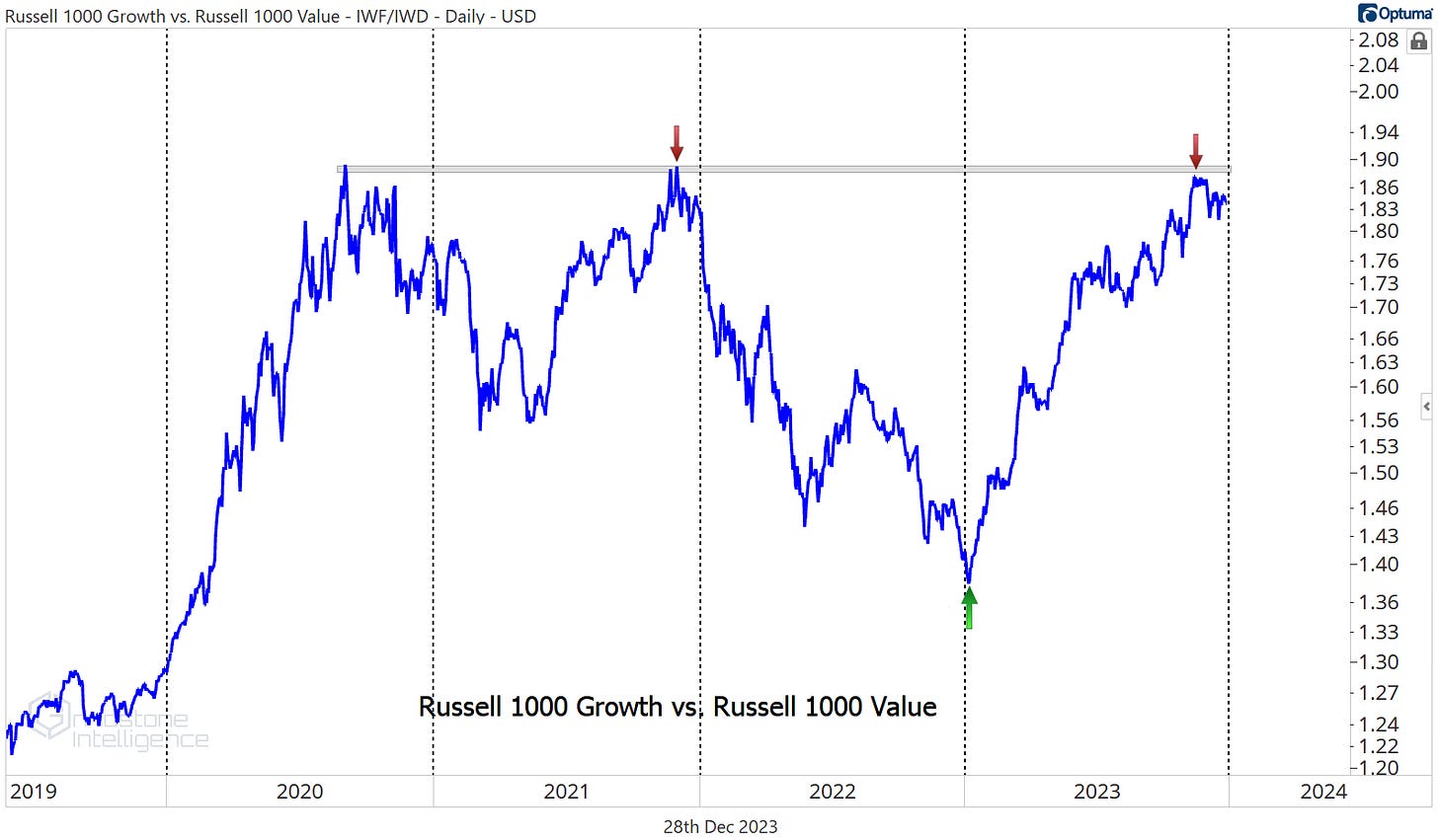

Will growth continue to lead?

It’s remarkable how market leadership has reversed course with the turning of the calendar over the past few years. Value took charge at the end of 2021, then handed the reins back to growth at the end of 2022. Now, the Growth/Value ratio is right back where it was 2 years ago. Will value fall back in favor in 2024?

How much does resistance matter?

Stocks have had a great year, but the S&P 500 hasn’t broken out. At least not yet. Can we expect stocks to blow right past this level as if it doesn’t exist? Or does resistance matter? A rejection here - just when investor sentiment has shifted to bullish extremes - could set the stage for a difficult first half.

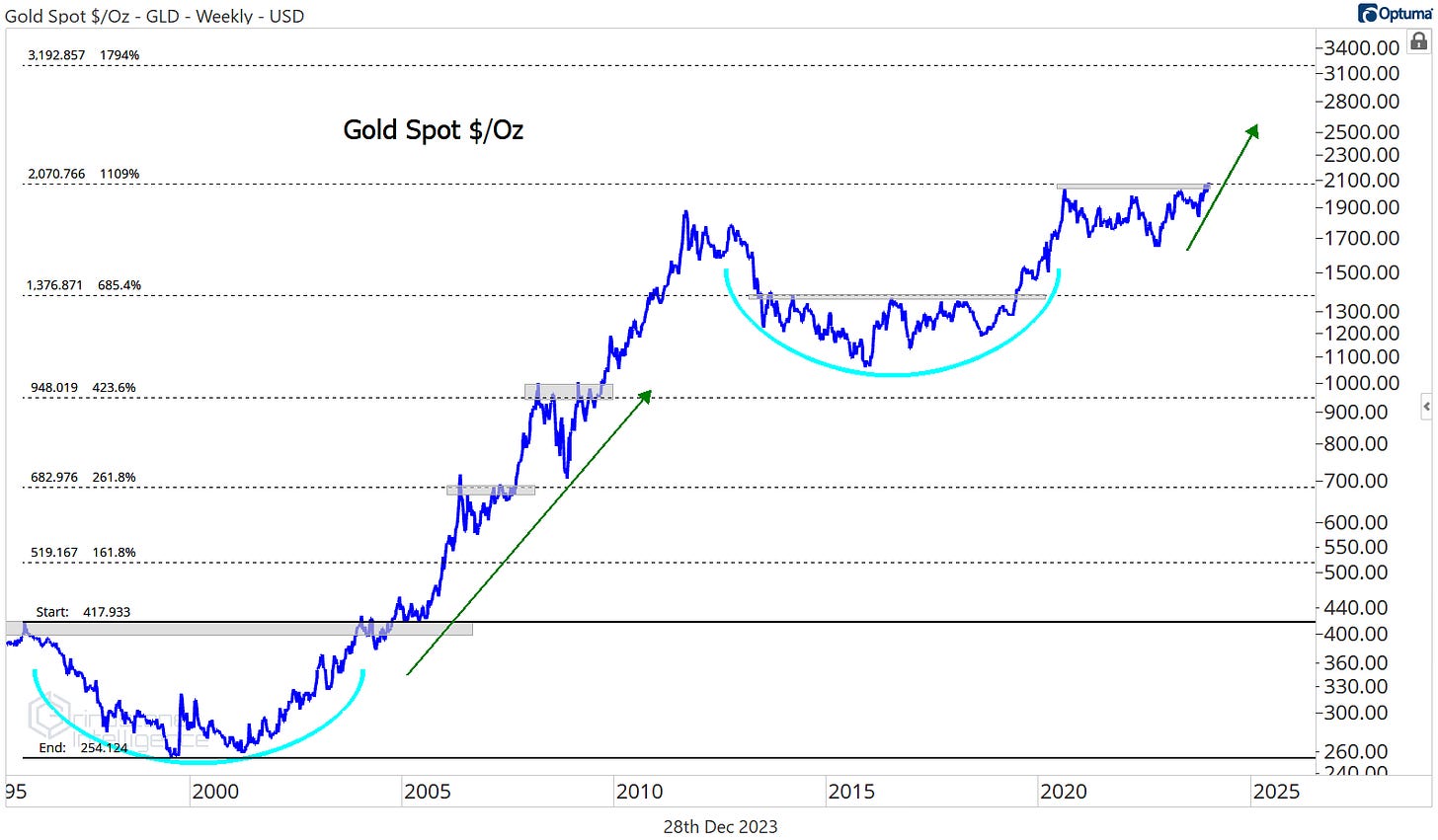

Will gold ever break out?

We’ve been watching $2100 for what seems like forever. Will gold ever break out to new highs? Maybe 2024 is finally the year that gold finds itself back in the limelight.

Does $3100 sound crazy? Maybe it is. But gold’s gone roughly nowhere since the 2011 peak. Last time we saw a decade-long consolidation resolve higher, the yellow metal jumped than 300% over 5 years. Maybe a 50% rally to $3100 isn’t so crazy after all.

That’s all from us for 2023. Thanks for reading.

Until next time.