A Good Time to Pick Stocks

It was a great year to be a stock picker.

If you picked a handful of random stocks each year on January 1st, weighted them equally in a portfolio, and then remained invested in those stocks until the end of the year, you’d find yourself underperforming index returns most of the time. It’s one of the best-known secrets of investing: a small group of stocks have generated most of the returns for US investors over the last century or more. That’s part of what’s made index investing so popular. Buying all the stocks ensures you’ll own the few on the fat tail of the distribution curve, and history has shown those great returns are enough to offset the detriment of also owning the laggards.

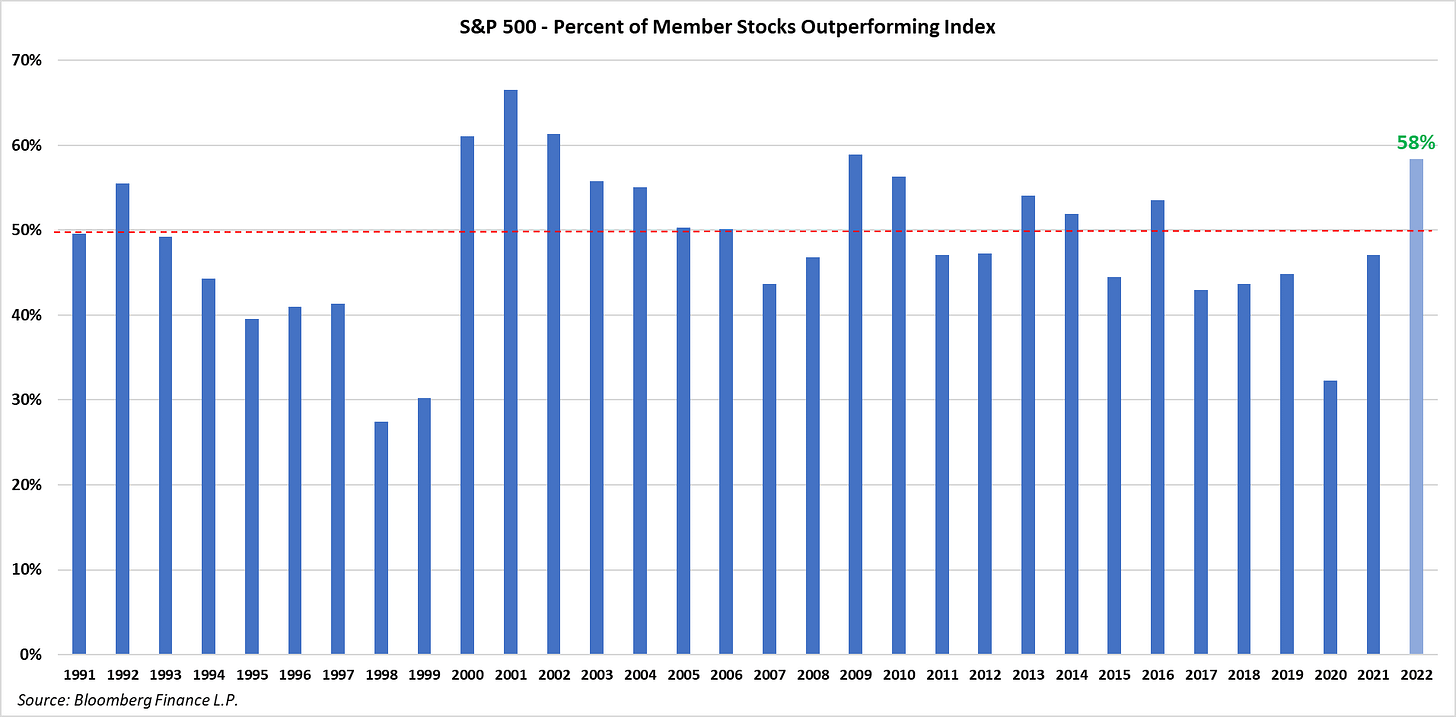

2022 has been an exception to the rule. More individual stocks are outperforming the index than in any year since 2009.

It’s a sharp divergence from the last few years – most notably 2020 – where calendar year returns were especially dominated by a handful of names. You’ve probably heard of some of those big winners from 2017 -2021. Apple. Amazon. Microsoft. Alphabet. The biggest stocks (which of course are the largest components in market cap-weighted indexes like the S&P 500) dragged indexes higher, while many non-growth stocks languished. In 2022 it’s been the opposite. Value and safety sectors like Energy, Industrials, Health Care and Consumer Staples have led the way. Mega cap tech, on the other hand, has been punished. That’s helped 58% of S&P 500 stocks to post better returns year-to-date than the index’s 19% decline.

Looking back at the last 30 years above, it’s hard not to compare today’s environment to that of the late-1990s and early 2000s. The late 1990s too was an era dominated by excessive valuations of high-flying growth stocks, which caused the average stock to underperform for several years on end. What followed in the early 2000s was 5 great years for stock pickers.

So is history set to repeat itself? Is 2022 the blueprint for the years to come? For the sake of all who endeavor to outperform the index, let’s hope so.

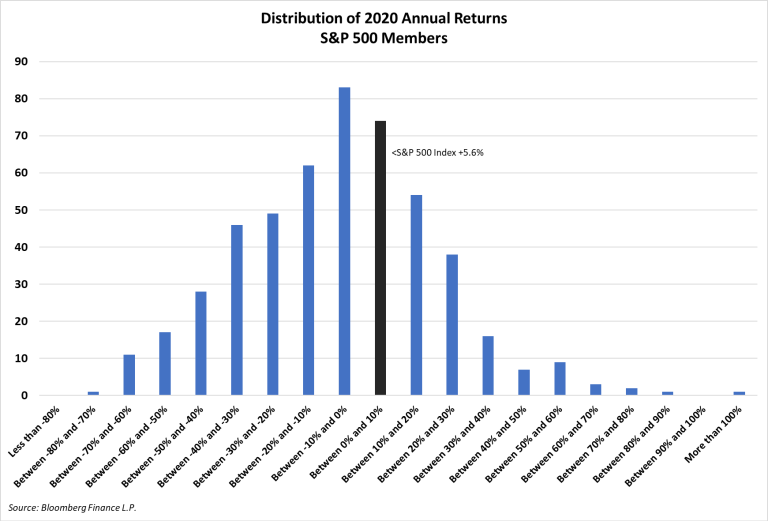

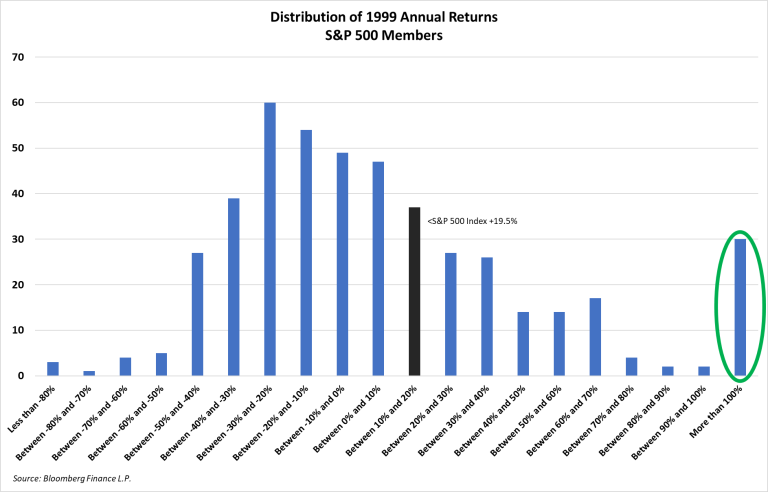

There is one sharp distinction between the internet bubble and the buy-the-dip boom of the late 2010s that can’t be seen in the chart above, though. Consider the distribution of returns for two of the most comparable years: 1999 and 2020. Two-thirds of stocks lagged in each of those years, and the leadership of tech stocks was to blame. But in 2020, excess return was generated by huge stocks that put in above average performance. The distribution of returns is almost normal. In 1999, though, excess return was generated by above average stocks that put in huge performances. Check out the fat tail in 1999!

We’ll see whether this difference leads us down a different path than the one following the dotcom collapse. In any case, it’s been a great year to pick stocks.

Thanks to all of you for following along in 2022. If you haven’t heard, Means to a Trend is now part of Grindstone Intelligence, where last week I launched premium subscription service.

See you in 2023!

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post A Good Time to Pick Stocks first appeared on Grindstone Intelligence.