Bonds Are Back

Bonds were in fashion again last week. With equity markets around the globe under pressure, fixed income rallied, sending 30-year U.S. Treasury yields to their lowest level since January. Thirty year yields set a post-COVID high near 2.5% in the spring, but then dropped through support near 2.25% – the place yields set major bottoms in 2014 and 2016. Now-broken support at the summer lows near 1.75% should act as near-term resistance on any rally

Moving down the curve, 10-year bonds rallied last week too, though yields are still above their summer lows. The highs near 1.75% have been tough resistance since the spring.

Zooming out, 10s are stuck at a place with plenty of memory over the last decade. The area near 1.5% was the bottom in 2012, 2016, and again in 2019.

Medium and short-term rates have a different signature altogether. Five-year yields have risen steadily since late summer and set their most recent swing high only a month ago:

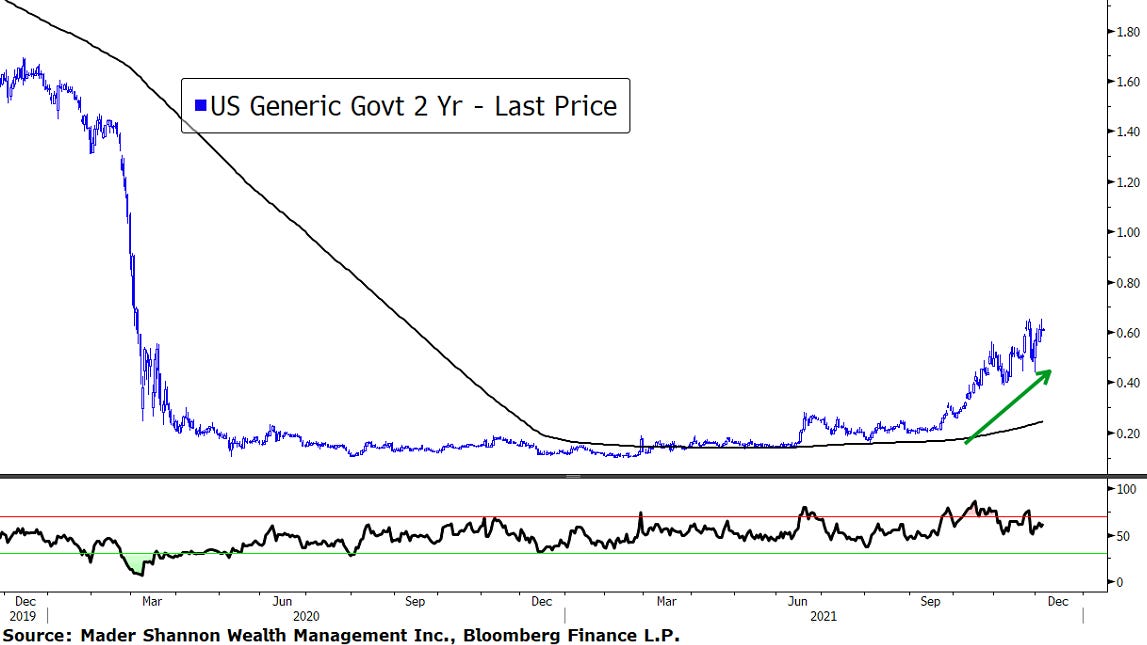

Similarly, 2-year yields have accelerated since September, around the time Fed officials started putting a timetable on tapering their accommodative monetary policy.

The impact of falling long-term and rising short-term rates on term spreads has been pronounced. The difference between 30 and 5-year interest rates has collapsed from 1.75% to about 0.50%. The 10s-2s spread has suffered a similar fate:

If we’ve already seen the economic-cycle peak for term spreads, it will be a disappointment for financial institutions that borrow deposits at short-term rates and lend them at longer-term ones, pocketing the difference. Banks enjoyed peak spreads closer to 3% following the last recession, double what was reached post-COVID.

Along with most of the equity market, the S&P 500 Banks Industry was under pressure last week. It peaked in October at the 138.2% extension from the COVID selloff, and has now fallen back below the May highs.

Not everyone hates lower long-term rates, though. Mortgage rates set their 2021 peak in the spring.

The cost of a mortgage is well above the record lows set in February, but at just 3.2% for an average 30-year term, is still less than at any time prior to the pandemic. The drop in 30-year Treasury yields may help explain why Homebuilders were able to buck the trend during last week’s market selloff. The group jumped to its best level since May, challenging the all-time high.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Bonds Are Back first appeared on Grindstone Intelligence.