Consumer Staples Sector Deep Dive

We’re sticking with the consumer today as we dig into the Staples sector. If you missed yesterday’s report on the Consumer Discretionary sector, check it out here.

The S&P 500 Index has gained more than 12% this year, but you’d never know it by looking at the Consumer Staples sector. It’s among the worst-performing groups in 2023, sporting a decline of 6.8%.

Not even the month of October was able to give the sector much of a boost. Historically, the month of October has been the best month to own Staples. They’ve gained an average of 2.3% during that period since 1990, and outperformed the S&P 500 index by 0.9%.

Could the next few months change the narrative? November and December are also bullish months for the sector, with average gains of 1.9% and 1.3%, respectively. A rally to end the year would be starting from a logical level of support, too. In October, the buyers stepped in when the Staples retested their lows from the prior year. That level was also where prices peaked out in the latter half of 2020.

Compared to the benchmark S&P 500, though, the rally may have already run its course. After finding support at the December 2021 lows, the Consumer Staples/S&P 500 ratio rallied 8% - but it failed to surpass the swing high from September. In other words, we’re still in a regime of lower highs and lower lows. We can’t get too excited about the Staples until that changes.

Especially since the weakness is even more pronounced beneath the surface. The equally weighted Consumer Staples broke down to multi-year lows over the summer.

A rally back to the breakdown level near $30.50 isn’t out of the question here, but the higher likelihood outcome is that any rally gets rejected by overhead supply.

An assessment of the sector’s constituents compared to their moving averages supports the uninspiring outlook. Just 13% of large cap Consumer Staples stocks are above their 200-day moving average, and only 11% are above their 100-day. Both readings are the worst of any sector within the S&P 500.

Digging Deeper

Losers tend to keep on losing.

There aren’t many bright spots within the Staples, but the sector is home to some of the worst-performing sub-industries out there. Drug Retail has lost more than 40% in 2023, while Personal Care Products has dropped more than 50%. Remember that the benchmark S&P 500 index is on pace for an above average gain of more than 12% over that same period.

Check out Walgreens in the Drug Retail space, though. We started watching this one a couple months ago, we still think it’s worth keeping an eye on. Here it is trying to find support all the way back at the financial crisis lows from 15 years ago.

Momentum has put in a big bullish divergence over the last couple months, and didn’t even approach oversold territories on the most recent stock price low. This is a prime candidate for mean reversion, and we think it could go back to almost $30.

However, we’re wary of trying to catch falling knives. We only want to be long WBA if it’s above $21, lest it suffer the same fate as Estee Lauder.

Last month, we identified a similar setup in EL as it approached potential support from the 2020 lows. But we were only interested if the stock was above those lows. Instead of finding support, the lone component of the Personal Care Products sub-industry broke those lows and dropped another 25%.

Leaders

Monster snuck in on the biggest winners list for the last month, and it’s the only stock among the top-10 that’s posted a positive return YTD. For Monster, we like the clean risk-reward setup here and the catalyst of last month’s failed breakdown below the 2021-2022 highs. We can own the stock above $50 with an initial target of $58, back near the highs. Longer-term, we think MNST can go to $70, which is the 261.8% retracement of the 2021-2022 trading range.

We really like the relative strength we’re seeing in the stock. Compared to the sector overall, MNST broke out above the 2021 highs earlier this year and just successfully backtested the breakout. That keeps the long-term structural uptrend intact.

Losers

We’re seeing some pullbacks in former leaders that are worthy of our attention.

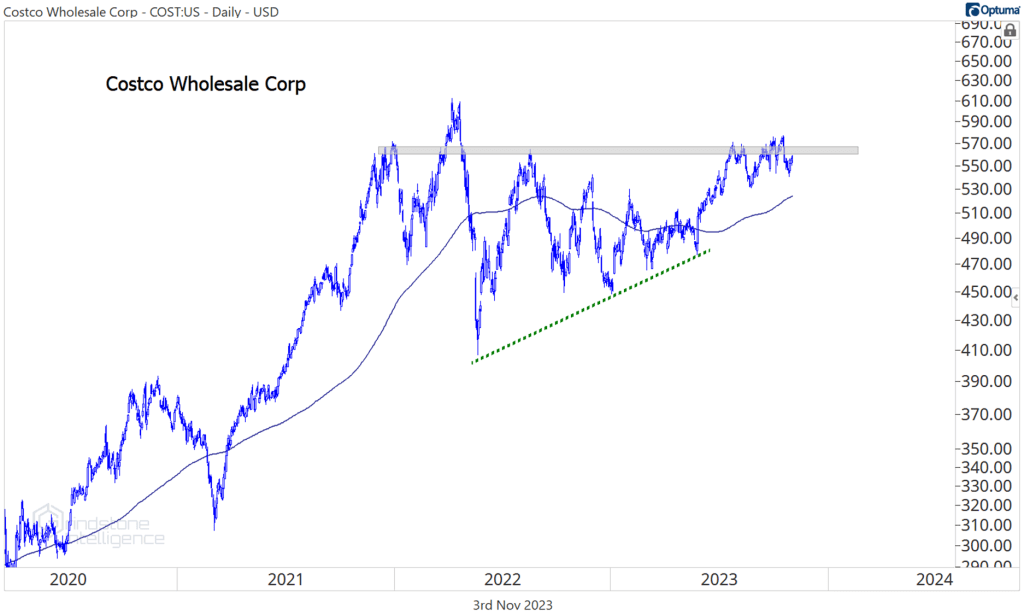

Costco fell 2.4% over the last 4 weeks, but the stock is still up 22% for the year. Despite the modest pullback, COST sits on the cusp of a huge breakout. This resistance area near $575 is the level. We can’t be anything but positive on Costco above that.

And just like Monster above, the long-term structural uptrend relative to the rest of Consumer Staples remains very much intact.

The same goes for Hershey, which was a big winner in 2022 after breaking out from a huge cup and handle base. It’s reversed sharply over the last 6 months, but as it approaches the initial breakout level, we’re watching for signs that a new leg higher is beginning.

This would be a logical spot for the stock to stop going lower, too, as it approaches the Fibonacci 138.2% retracement from the 2020 decline. That’s also where prices stalled out in mid-2021.

With momentum putting in a bullish momentum divergence, we want be long HSY above $180 with a target back up at $240, which is the 261.8% retracement from the COVID selloff.

Growth Outlook

Consumer Staples revenue growth over 2024 and 2025 is expected to outpace just 3 other S&P 500 sectors: Utilities, Energy, and Materials. Barring an unexpected margin boost, that means the Staples will likely grow their bottom line at a below-benchmark rate over that period, too.

The sales slowdown comes after 3 banner years to start the 2020s, where revenue growth averaged 9.5%. That nearly tripled the average of the prior decade.