(Premium) Real Estate Sector Deep Dive – September

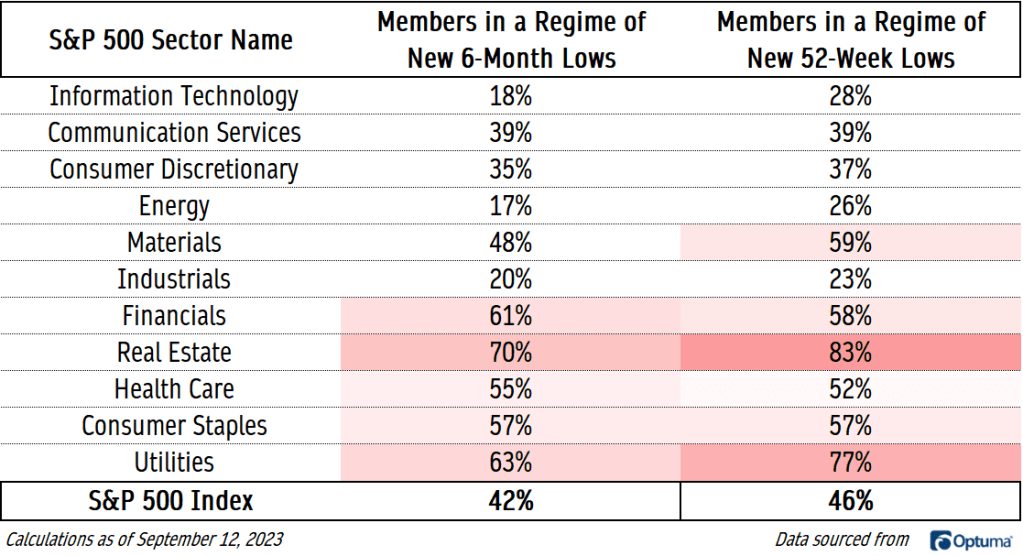

After being one of the weakest sectors in 2022, there are fewer stocks setting new highs in the Real Estate sector than anywhere else. Just 30% of sector constituents have set a new 6-month high more recently than setting a 6-month low. Less than 20% have broken out of a regime of new lows on a 52-week basis.

Real Estate started the year with a bang, tracking with growth stocks as it gained more than 10% by early February. Since then, it’s been the worst-performing sector in the index.

Seasonal trends indicate things are only set to get worse for the group. Since 2002, Real Estate underperformed the S&P 500 in September, October, and November, with the average performance getting worse with each month.

There’s nothing on the chart to indicate we’ll buck those seasonal headwinds in 2023. Real Estate is at +20-year lows vs. the S&P 500 index.

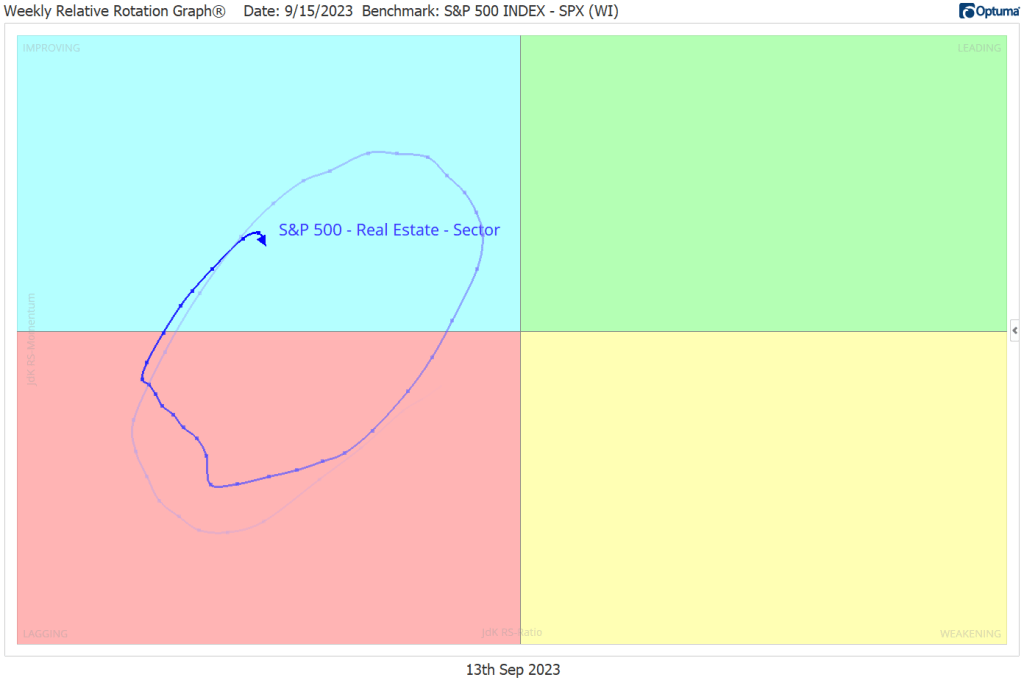

And the sector is stuck on the left side of the weekly S&P 500 sector Relative Rotation Graph, alternating between the ‘Lagging’ quadrant and the ‘Improving’ one. Over the last week, the RRG trend has shifted downward once again.

Weakness beneath the surface is clear. After being one of the weakest sectors in 2022, there are fewer stocks setting new highs in the Real Estate sector than anywhere else. Just 30% of sector constituents have set a new 6-month high more recently than setting a 6-month low. Less than 20% have broken out of a regime of new lows on a 52-week basis.

Digging Deeper

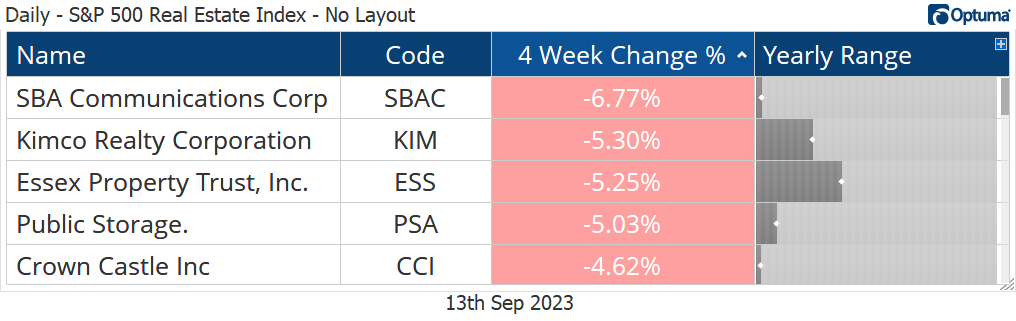

Headline sector weakness has masked a handful of stocks seeing healthy calendar year gains after a difficult 2022. Data Center REITs are up 17% for the year, and Single Family Residential REITs have jumped 12%. On the downside, Telecom Tower and Self-Storage REITs are down 16% and 13%, respectively.

Leaders

Digital Realty Trust, one of two members in the sector-leading Data Center REIT sub-industry, is the top performer stock over the last 4 weeks and for the year. DLR’s rally didn’t start until May, when a failed breakdown below last October’s low sparked a big reversal rally. This new uptrend is intact as long as the stock is above the 38.2% retracement from the entire bear market decline, but prices are dealing with some overhead supply at the mid-point of the range.

Losers

SBA Communications, a member of the Telecom Towers sub-industry, tried to mirror DLR’s failed breakdown in May. But its rally proved short lived, and this week, it dropped to the lowest levels since 2019.

One more to watch

Iron Mountain is at all time highs after breaking out above tough overhead supply at $55. That level is also the 261.8% retracement from the 2020 decline. We can’t ignore the potential bearish momentum divergence that could pose problems over the near-term, but we’re using the next key Fib retracement as a target. That’s up at $76.

The relative strength against the rest of the sector is what impresses us most. IRM is at its highest levels vs. the Utilities in more than a decade.

The post (Premium) Real Estate Sector Deep Dive – September first appeared on Grindstone Intelligence.