Stocks Got Punched in the Mouth

Now what?

Yesterday’s sharp selloff was a problem.

No, that doesn’t mean we’re flipping the script and betting on the start of a big, bad bear market. But this damage probably takes some time to repair.

We’ve pointed to this divergence a couple of times over the past month. The S&P 500 Index has risen steadily all year, even crossing above 5000 and setting a new all-time high last week. The list of stocks setting new 52-week highs, however, stopped going up in December.

The post-CPI decline gave us some price confirmation for that divergence. Check out Consumer Discretionary, which is the subject of today’s sector deep dive. Last week, Discretionary stocks were hitting new 52-week highs. There’s nothing bearish about breakouts… but there’s nothing bullish about failing to hold that breakout. Especially when we see such a sharp bearish momentum divergence. At the mid-December peak, the 14-day RSI reached its highest level in 2 years, something we saw as confirmation that bulls were in control. On the most recent high, RSI couldn’t even reach overbought territory.

We’ve got the exact same signature for the equally weighted Consumer Discretionary sector, which strips out the oversized influence of the mega caps: a failed breakout with a huge bearish momentum divergence.

These types of divergences can be resolved in one of two ways: through corrective price action or through time. A correction through time is the more bullish of the two, and that’s what we think is the most likely outcome here. Some sideways action after a 20% rally in a couple months would be welcome.

There’s always the chance that this could turn into something more, though. What we’re watching for is an expansion in the number of new lows. Despite yesterday’s drop, the number of stocks setting new 6-month lows was still lower than we saw in January and even last week. There’s no reason to be aggressively negative on this market as long as that’s the case.

If we do see an expansion in the number of new lows, we’ll most likely need to see weakness spread to someplace other than Utilities, Staples, and Real Estate. In risk-on areas of the market, long-term trends are still quite healthy.

Digging Deeper

There’s a sharp dichotomy within the Consumer Discretionary sector.

The two groups are led by the two most important stocks in the group: Amazon and Tesla. On the one hand, you’ve got Amazon coming out of a multi-year relative downtrend and setting new 52-week highs vs. the rest of the market.

That strength has driven the Broadline Retail industry to a 54% gain over the past 12 months, outpacing every other industry in the sector.

On the other hand there’s Tesla, which has taken the Automobiles industry from a sector-leading performance last summer to a -10% return over the last 12 months.

There’s been no reason to be involved with the stock since it hit our $300 target last summer.

Especially while the rest of the market has been rallying. Compared to the S&P 500, Tesla stopped going up in January 2021.

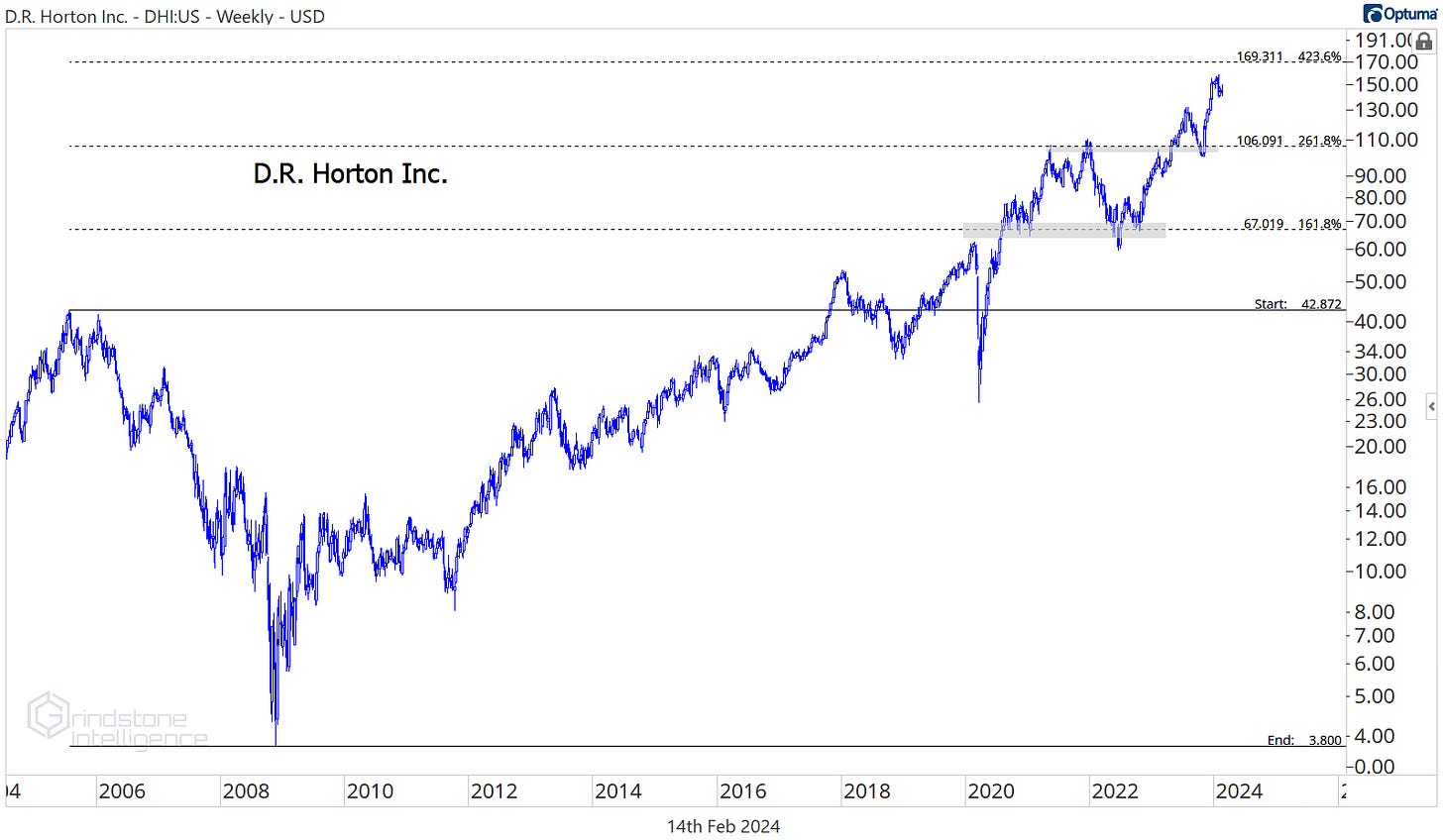

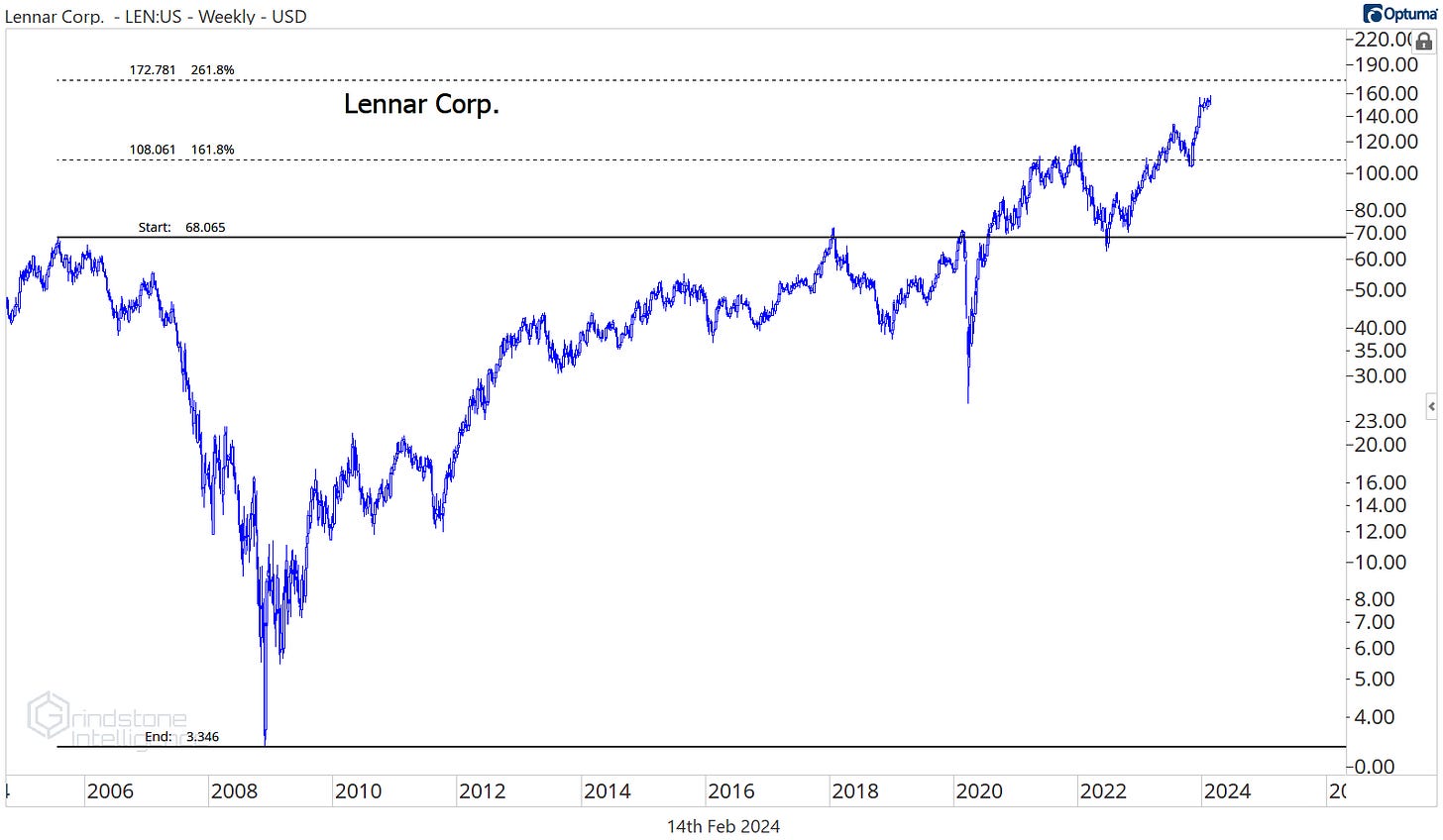

We’d much rather be in places that are showing relative strength like the homebuilders. Check out the homebuilding sub-industry, which continues to outperform the rest of the market:

Our target on DR Horton is still $170, which is the 423.6% retracement from the 2005-2009 decline.

We think Lennar goes to $170 as well.

And for PHM, we’re looking at $117.

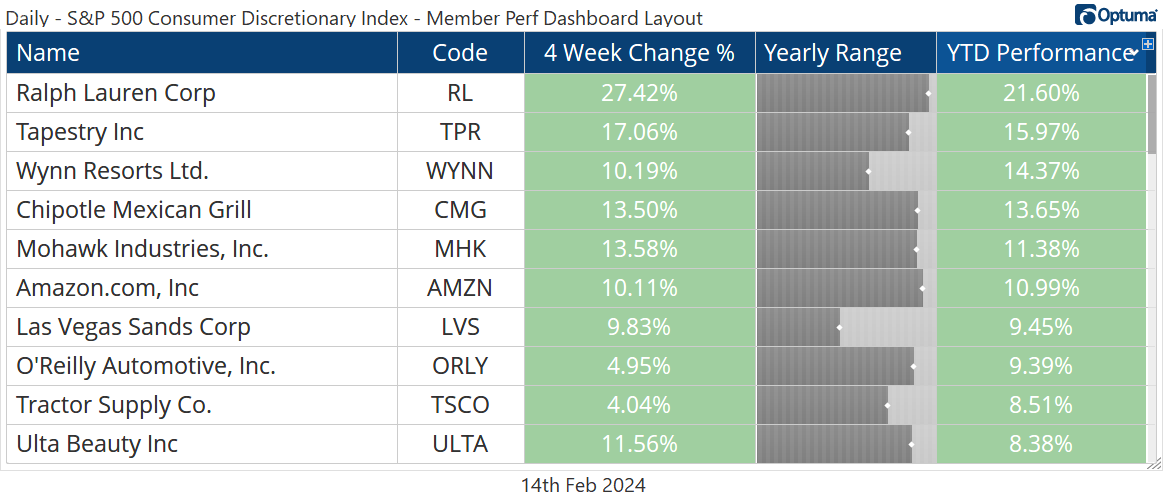

Leaders

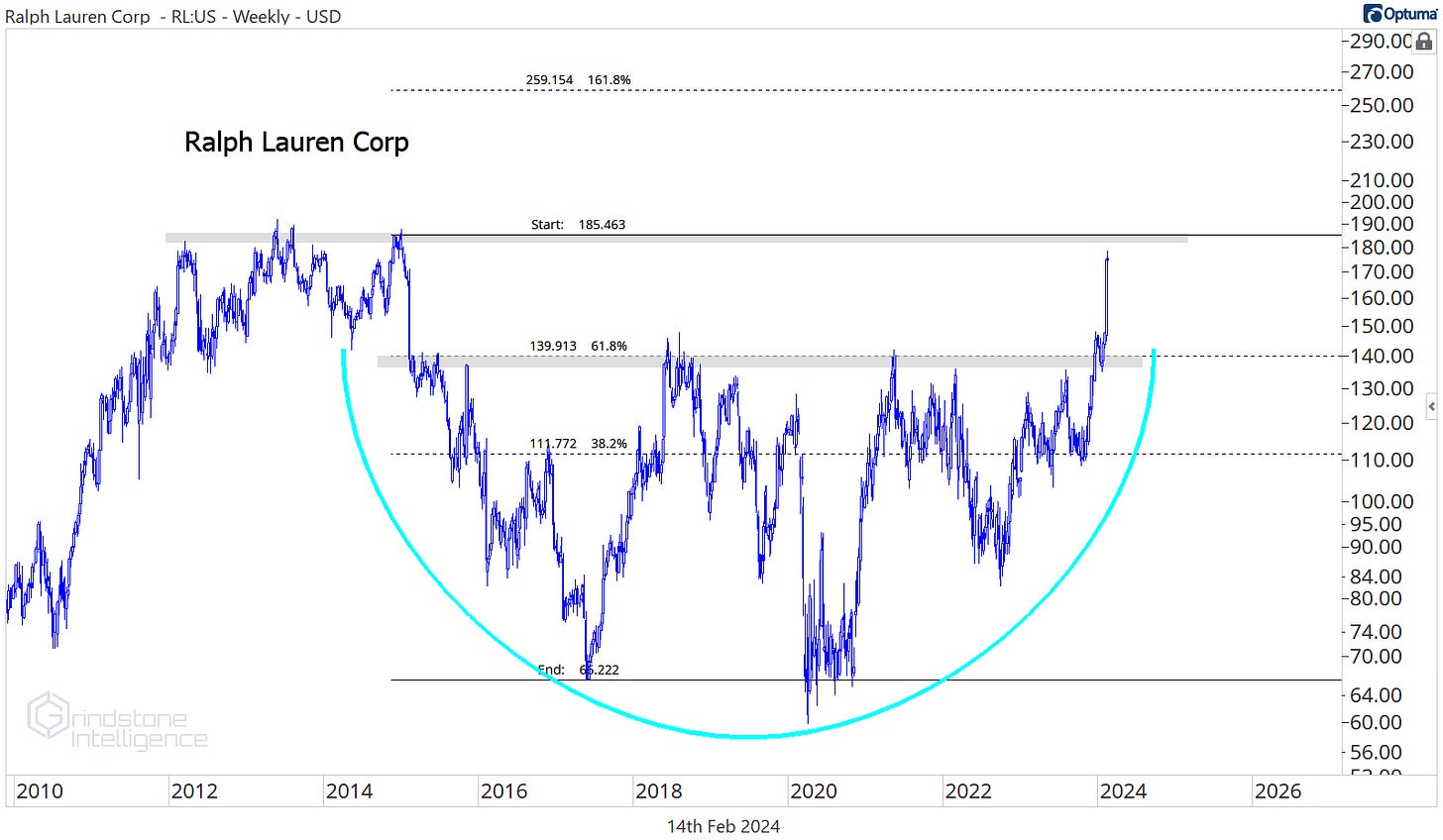

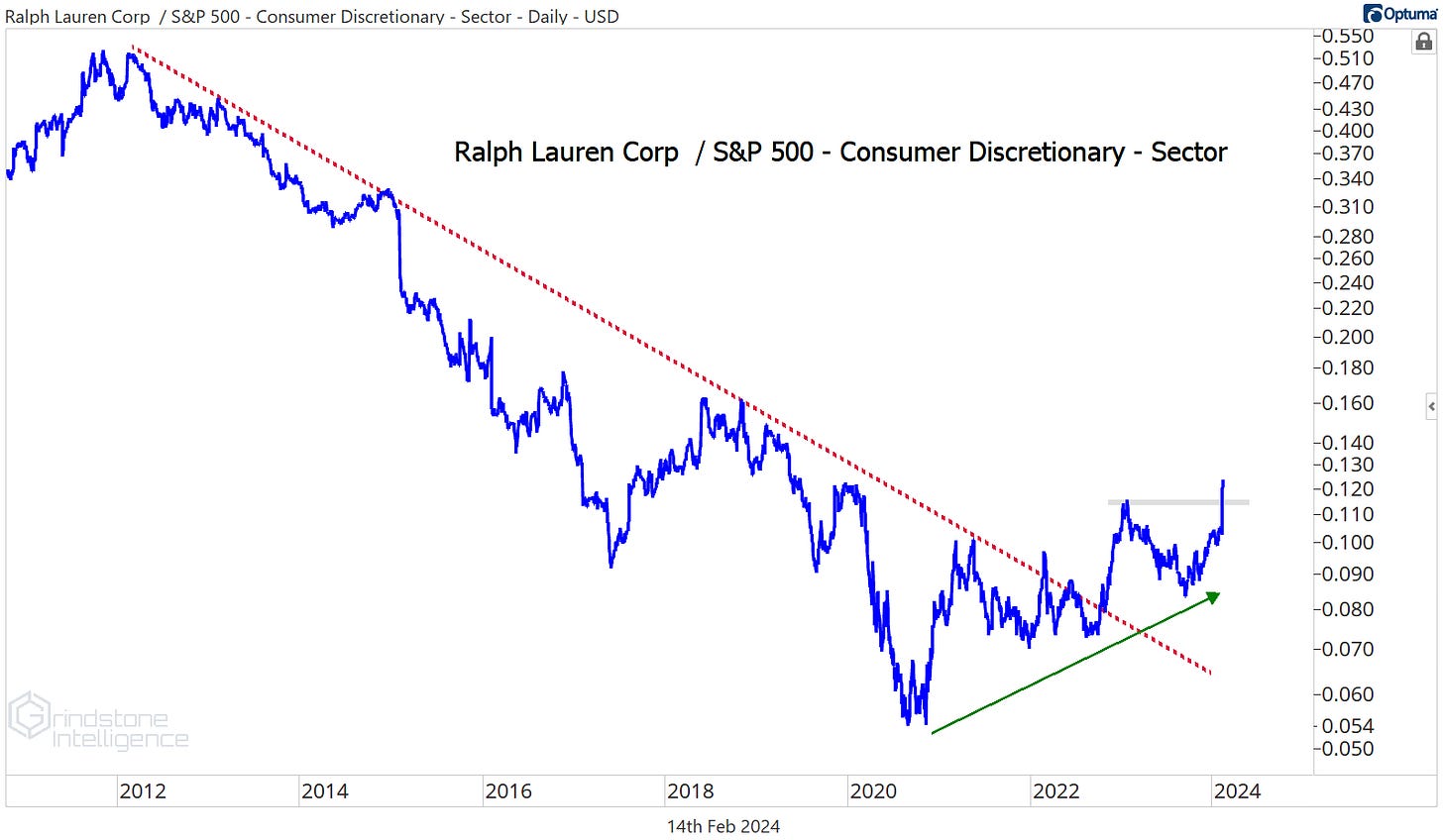

Ralph Lauren rose 27% over the last 4 weeks, topping the performance of every other stock in the sector. This is a logical spot for the stock to take a breather, up near the highs it set more than 10 years ago:

But after some consolidation, we don’t see why RL can’t keep going higher. It just reversed a decade long downtrend relative the rest of the Consumer Discretionary sector.

We want to be buying RL on a pullback to support near $140, or on a sustained breakout above $185. Our target is $260.

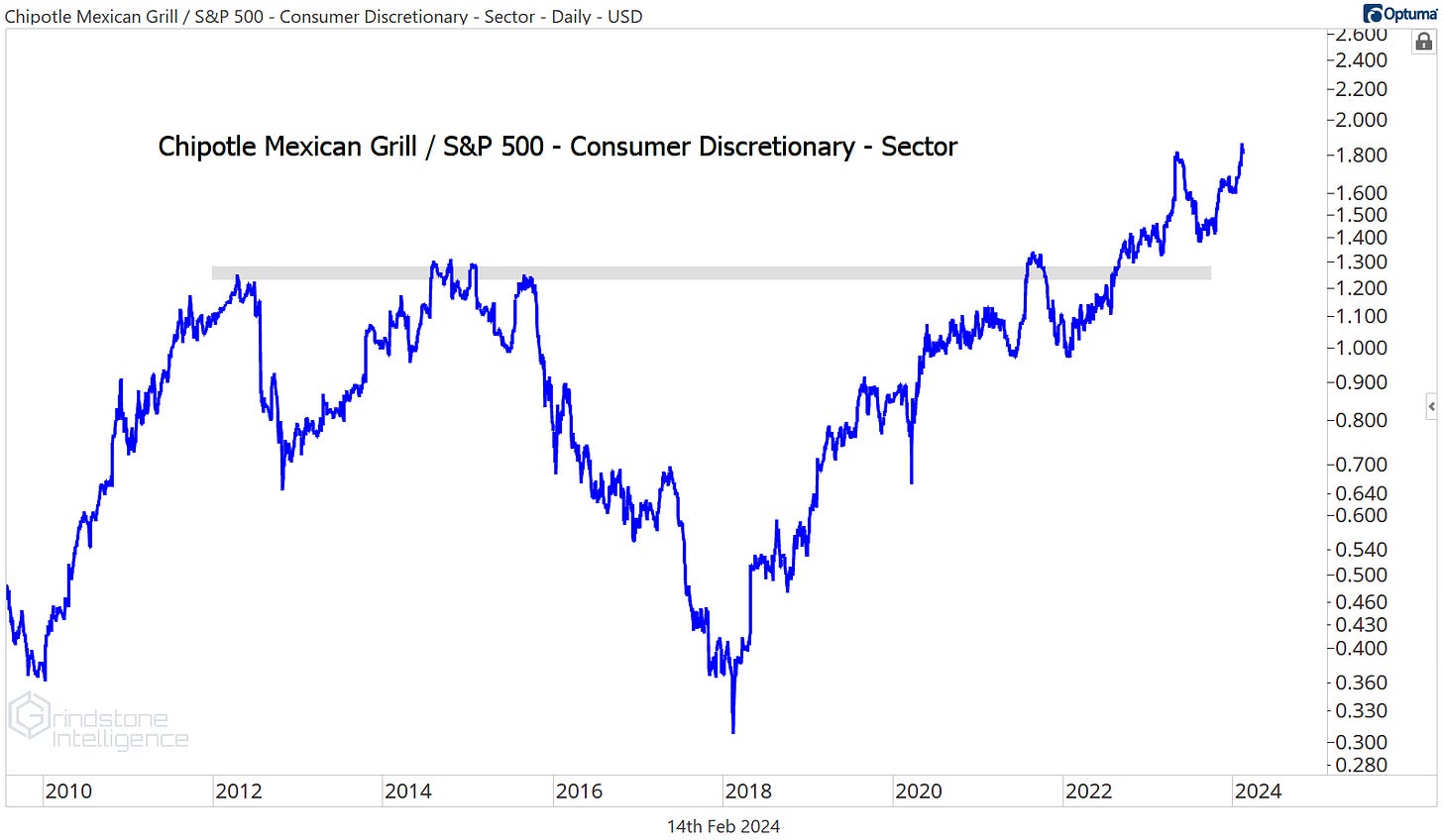

Chipotle is another one that’s showing relative strength. It just set new all-time highs vs. the sector.

Near-term, we want to see how it responds to the 423.6% retracement from the 2020 decline. We think it’ll take some time to digest this level. Longer-term, though, we want to be buying above $2600 with a target of $4000.

O’Reilly just hit our target as well.

We only want to be buying ORLY if it’s above $1060, with a target of over $1500. When that move comes, though, it could be explosive. Check out this 18-month consolidation for ORLY vs. Consumer Discretionary after a multi-year uptrend. That looks like a textbook flag pattern to us, and we expect it to resolve higher.

Tractor Supply has one of the best risk/reward setups for the right here and now. We want to be aggressively buying a breakout from this multi-year cup-and-handle pattern with a target of $360.

Losers

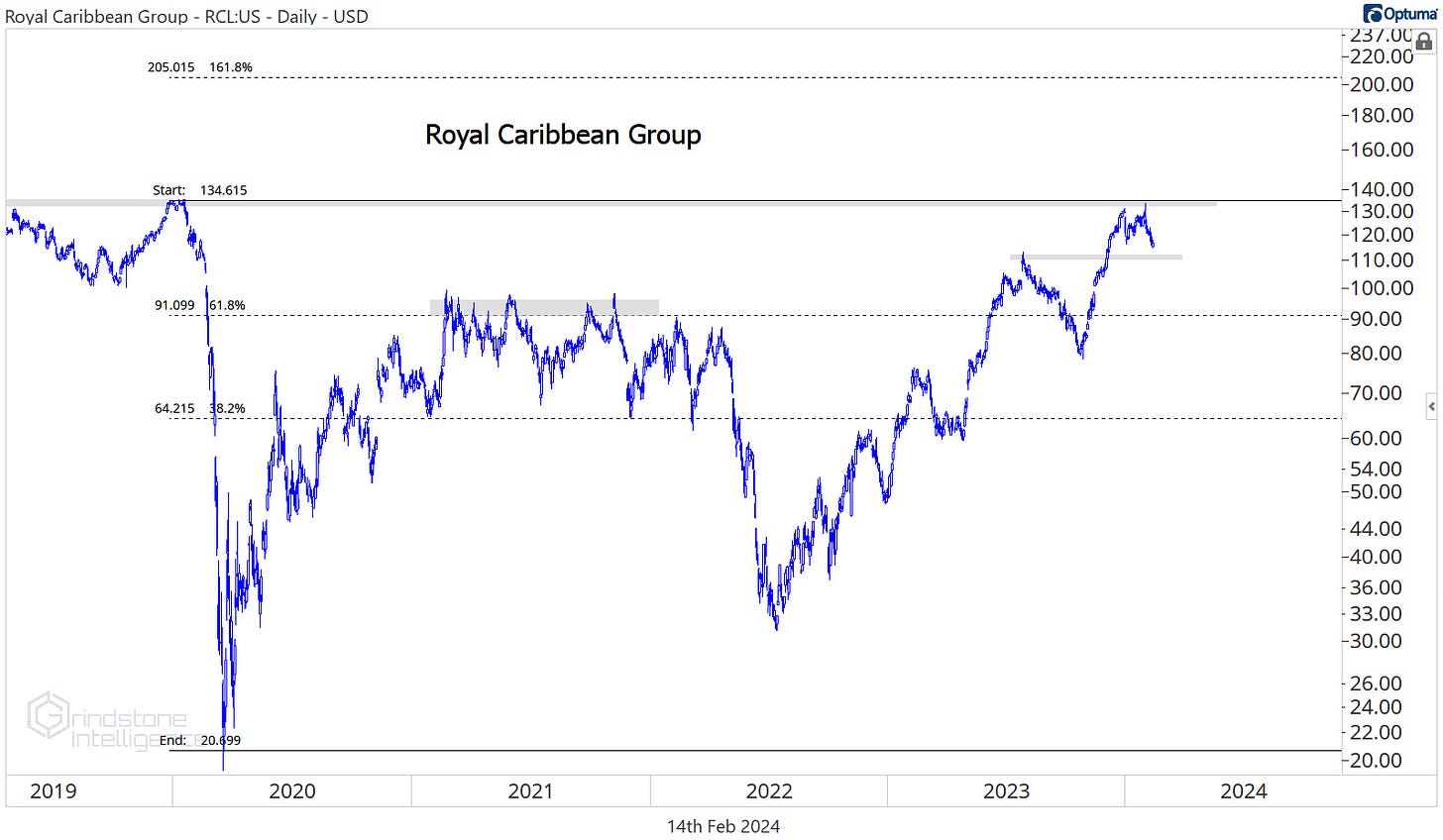

In bull markets, we want to buy pullbacks within existing uptrends. We already mentioned DR Horton, which has fallen 7% over the last 4 weeks. Royal Caribbean is another one we like. The 5% drop over the past month has RCL backtesting a multi-year breakout relative to the rest of the market.

The stock ran into resistance at the pre-COVID highs, and there’s a lot of memory at this level for prices to digest. But we think the relative strength profile makes RCL worth buying on pullbacks to $110. If the breakout ever comes, we think it can run all the way to $200.

We do not want to be buying losers that are showing relative weakness. Like BorgWarner. After a 2-year consolidation, BWA resumed its long-term downtrend vs. the rest of the sector.

More charts to watch

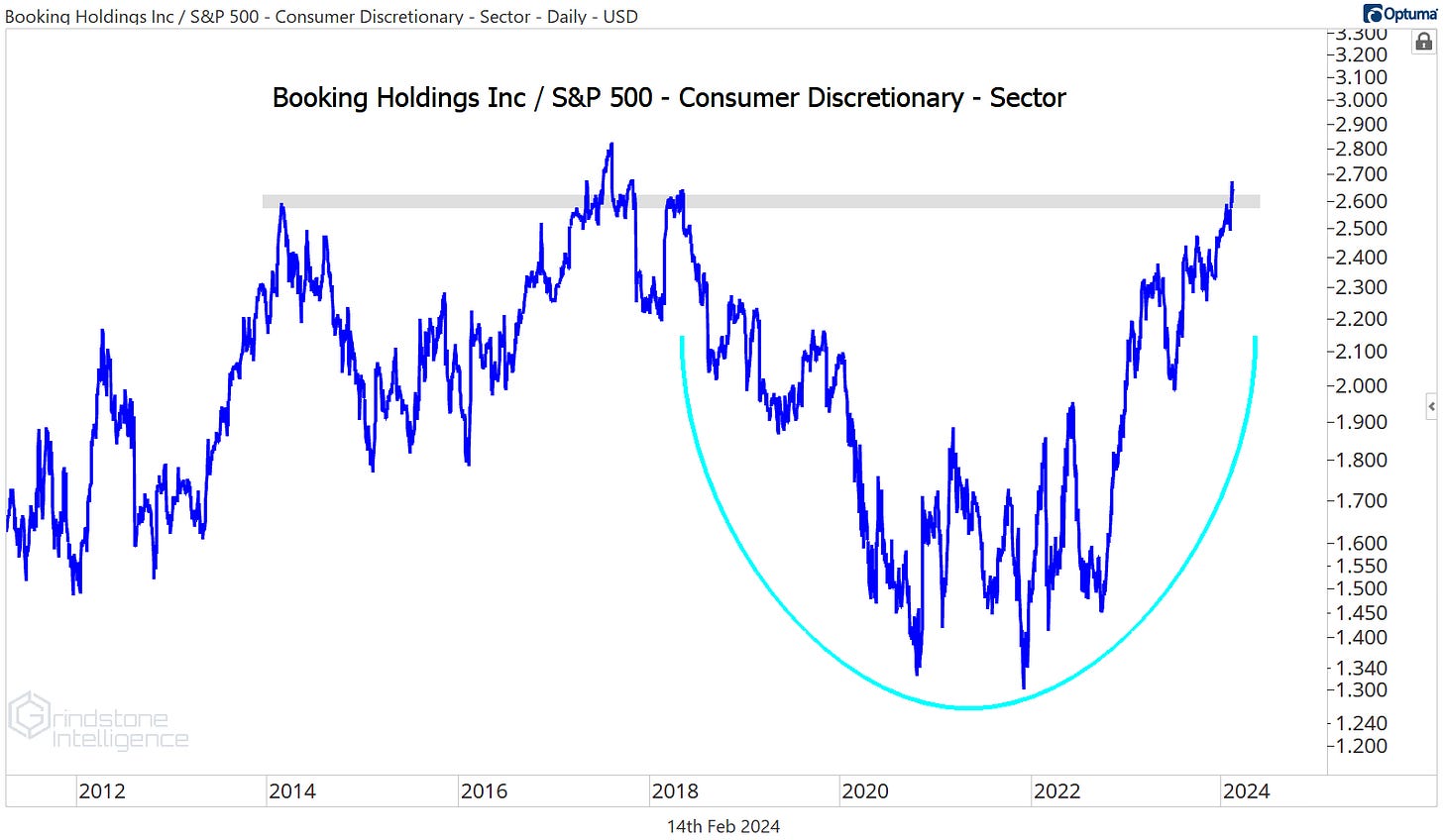

Booking, on the other hand, is setting multi-year relative highs.

It hit our target of $3650 last month and just kept going. We don’t want to give anything back, so we don’t want to own BKNG if it’s below that $3650. But with the relative strength profile and the stock consolidating above our key level, we think it makes sense to buy BKNG here with a target of $5200.

While you’re booking a trip with Booking, make sure you stay at a nice hotel. Both Hilton and Marriott are coming off all-time highs vs. the rest of the sector.

For Hilton, we continue to think it goes to $230.

And we’re still targeting $307 for Marriott, which is the 261.8% retracement from the 2020 decline.

Like we said earlier, though, there’s a dichotomy within the sector. For every stock breaking out to new highs, we can find one that’s struggling and touching new relative lows.

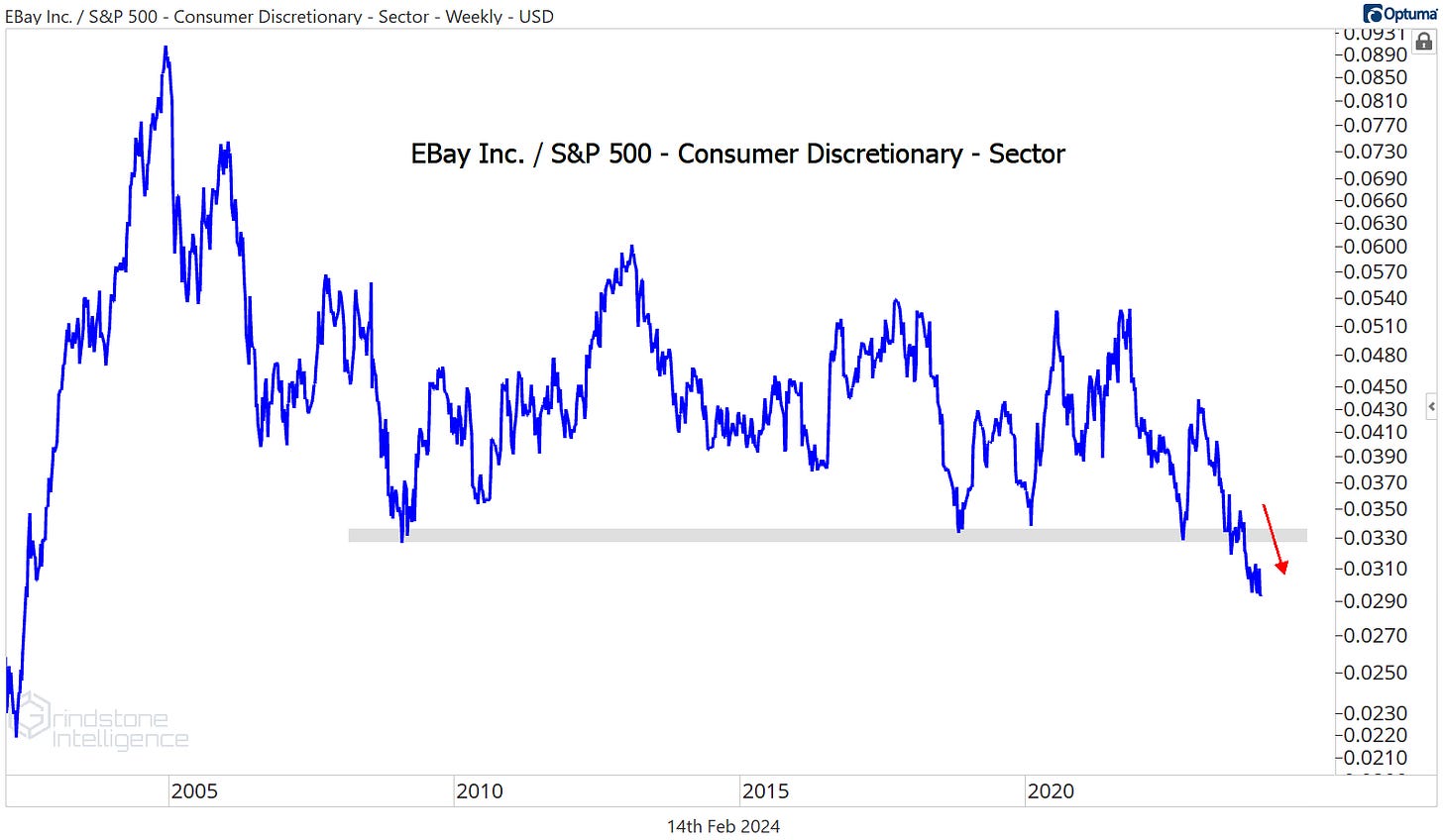

EBAY just hit its lowest level vs. the rest of the sector in 20 years.

Hasbro broke the relative lows it set at the height of the dotcom crash.

And Aptiv is in the same boat. New relative lows.

There’s no reason to be involved with these things. Own relative strength instead.

Until next time.