The Weekly Wrap: March 13, 2023

Week in Review

The stock selloff that began in February has continued into March. Each the S&P 500 Index, the NASDAQ Composite, and the Dow Jones Industrial Average declined more than 4% last week. The S&P 500 is now up less than 1% on the year. The Dow, meanwhile, has fallen nearly 4%, while the NASDAQ is still up more than 6%. Crude oil dropped 3.8%, and Bitcoin fell 7.8%. Gold managed to shake off a weak Monday and Tuesday to end the week 0.6% higher, while the Dollar was mostly unchanged. Interest rates declined.

Any attempt to summarize last week’s market action will fail to do it justice. Things got off to a hot start, when Fed Chair Jerome Powell sat before the Senate Banking Panel and testified that recent economic data would likely require a higher terminal Federal Funds Rate and could force the committee to reaccelerate the pace of interest rate hikes. Financial markets responded in no uncertain terms – stock prices cratered, the Dollar index jumped to its highest level in 4 months, and short-term interest rates moved to new 15-year highs. Powell attempted to walk back those remarks somewhat on Wednesday when he appeared before the House, saying no decisions had been made about the upcoming FOMC meeting. All of that was overshadowed by what happened after the market closed. Silicon Valley Bank, one of the country’s largest regional banks, announced plans to raise capital on Wednesday evening. By Friday morning, the bank was placed into receivership with the FDIC. It’s the largest bank failure since 2008. Expect those 48 hours to be the basis of a collection of books.

Monitoring Macroeconomics

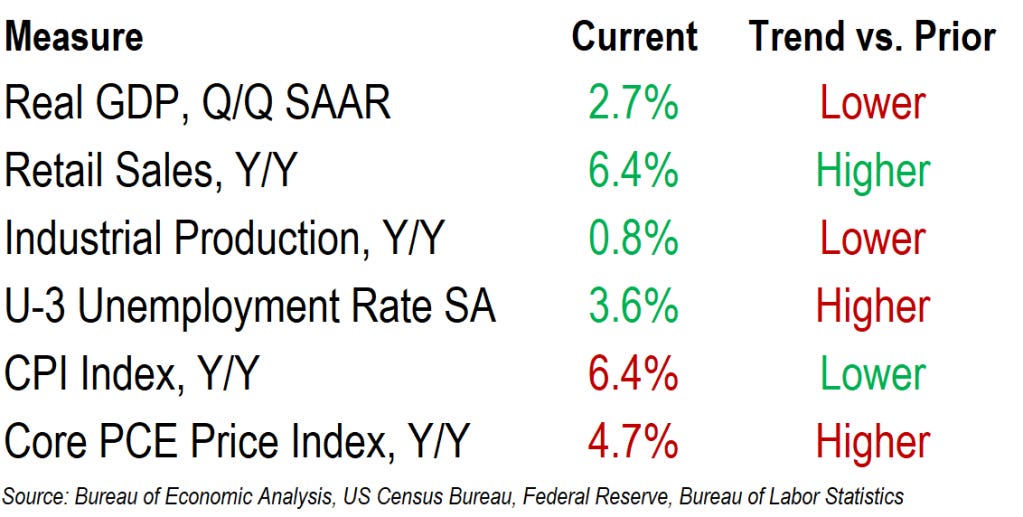

GDP grew at a healthy pace in the final quarter of 2022, helped by a surge in inventories and strong net exports. Economists widely believe that a recession will hit the United States sometime in the latter half of this year, as the Federal Reserve’s battle with inflation heats up and financial conditions tighten. The odds of a ‘soft landing’ – a scenario where the Fed successfully contains prices without creating widespread economic hardship – declined after February data showed the US economy continues to run hot.

Measures of inflation remain well above the Federal Reserve’s 2% target, but CPI has decelerated for 7 straight months, and measures of core price changes have dropped below 5%. Unemployment, meanwhile, remains near 50 year lows, and job creation to start 2023 has been well above the level needed to keep pace with population growth.

What’s Ahead

The SVB saga will continue to dominate the headlines on Monday, as investors grapple with the risk of contagion spreading across the financial system. On Tuesday, though, the narrative and focus could shift, when the BLS unveils its consumer price index for February. We’ll get additional inflation data on Wednesday with the producer price index, along with retail sales, business inventories, and the NAHB housing market index. On Thursday, look for updates on housing starts and import and export prices. The latest University of Michigan consumer sentiment survey results are scheduled for Friday, and so is industrial production. Additional business surveys are scattered throughout the week, including NFIB’s Small Business Optimism, the Philadelphia Fed’s Business Outlook, and the New York Fed’s Services activity.

The post The Weekly Wrap: March 13, 2023 first appeared on Grindstone Intelligence.