Top Charts from the Communication Services Sector

No sector was worse than Communication Services during the bear market of 2022.

From the S&P 500’s peak on January 3, 2022 to its trough in mid-October of that year, the benchmark large cap stock index fell 25%. Over that same period, Communication Services lost a whopping 40% of its value.

From that day forward, things have looked a little different. Communications has gone from worst to first, rising almost 80% and outpacing even the semiconductor-led returns of the Information Technology sector:

The strength has continued into 2024. Communication Services is the best performing sector so far this year, sporting a 16% gain compared to just 5% for the S&P 500. The relative strength picture is clear. When compared to the S&P 500, the sector is breaking out to multi-year relative highs after a 6-month cup and handle consolidation pattern.

Like the S&P 500, though, Communications stocks have come under pressure over the last week or so on an absolute basis. Yes, the sector is still outperforming, but it’s doing so by falling less, not by rising more. For Communications, the broad selloff in stocks couldn’t have come at a more logical level: the former all-time highs.

After briefly surpassing the former highs, prices are now back below them. This failed breakout is just one of a handful that we called out earlier this week, and it comes along with a big bearish momentum divergence. Failed breakouts and bearish momentum divergences often lead to mean reversions, and sometimes they can turn into full fledged trend reversals. In either case, the near-term risk to Communications stocks - and the market as a whole - is elevated.

Digging Deeper

For the past year, the dominant narrative has been that this bull market was entirely attributable to a handful of stocks. For the most part, that isn’t true. Yes, some stocks have done significantly better than others, but the vast majority of stocks have been rising.

In the case of the Communication Services sector, though, that narrative actually holds some water. Check out the sector on an equally weighted basis: prices haven’t even managed to surpass the highs they set back in the summer of 2022.

And if you take the equally weighted sector and compare it to the equally weighted S&P 500, you’ll find a group that’s knocking on the door of new 52-week relative lows. Pretty shocking when you consider that Communications is the single best performing sector of the year, and on a market-cap weighted basis, it just hit its highest level versus the rest of the market in more than 2 years.

A quick glance at moving average breadth confirms how narrow the sector’s leadership has been. 50% of Communication Services stocks are trading below a falling 200-day moving average - a mark that’s worse than every other sector save Real Estate.

Leaders

Alphabet was the top stock over the last 4 weeks, gaining more than 5% despite the overwhelming weakness across the broader market. GOOGL lays the blueprint for what we’d like to see for the rest of the market. It would be nice if prices moved in straight lines, but that’s not how the world works. Stocks trend, yes, but they oscillate within the trend.

Alphabet broke out to new highs in January, but that move quickly turned into a failed breakout. What we saw next was a textbook mean reversion: prices fell back to the 200-day moving average, but didn’t fall enough to damage the longer-term structural uptrend. RSI never even reached oversold territory. And after regrouping, the stock resumed its uptrend and broke back out above that area of stiff resistance.

We like GOOGL above $150 with a target of $190.

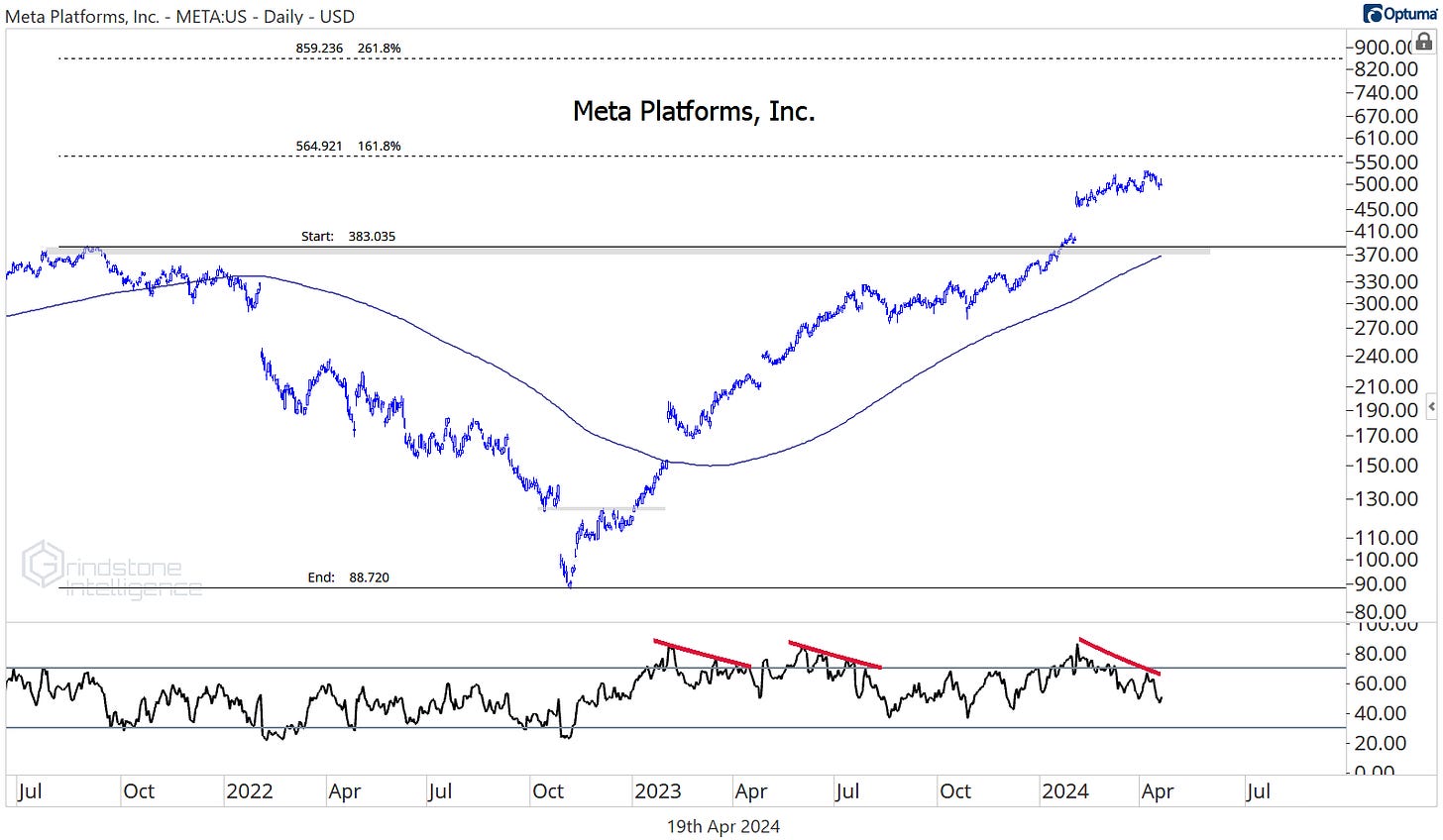

In bull markets, we don’t just want to own things that are going up in price. We also need to be thinking about the opportunity cost of what we’re owning - we want to own the things that are going up the most. So META breaking out to new all-time highs relative to the rest of the market has our attention.

Meta continues to inch towards $560, which is the 161.8% retracement from the 2021-2022 decline. This isn’t the place to be initiating new positions, not with prices so far above the risk level of $380 and momentum putting in a nasty bearish divergence. However, we should point out how little respect the stock has shown for bearish momentum action over the past year.

We’d like the setup in Meta more on a reversion back towards the 2021 highs or on a sustained move above $560. Longer-term, we could target $850 in that scenario.

The setup in Disney is a bit cleaner as it tries to establish a new uptrend following severe underperformance throughout 2023. We don’t believe DIS just goes straight up from here - bottoms are a process - but we can begin approaching this one from a more bullish long-term perspective. We like the risk/reward above $110 with a near-term target of $125.

The key chart for DIS is this one: we only want to spend time on it if it can find support here relative to the rest of the sector. If it can’t successfully reverse this relative downtrend, then the opportunity cost of owning the stock is too high.

Losers

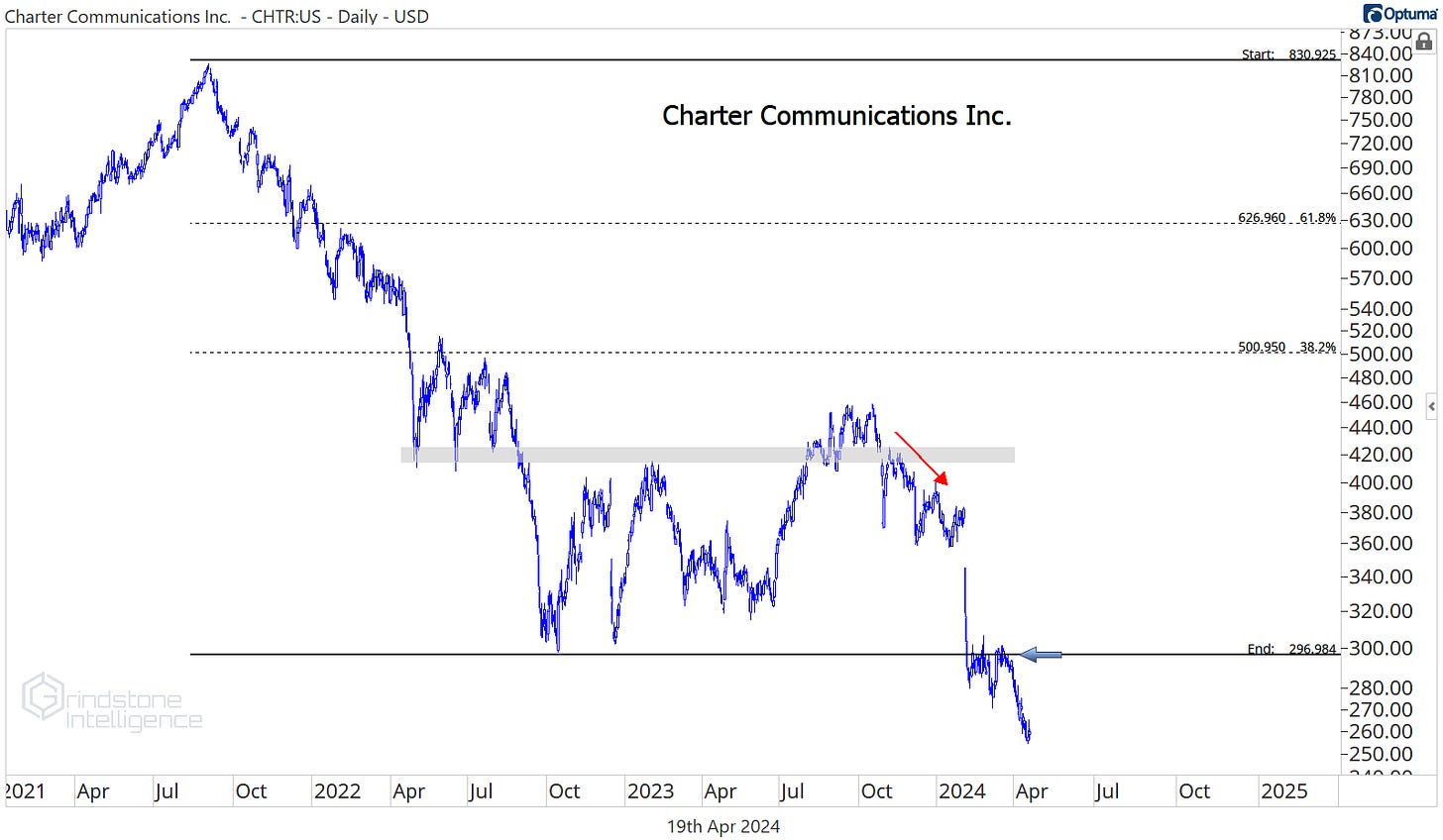

Losers tend to keep on losing. Charter Communications was an interesting setup for bottom fishers last month who were betting on a mean reversion higher, but there’s a reason we shouldn’t try to catch falling knives. CHTR just hit new lows.

One short idea

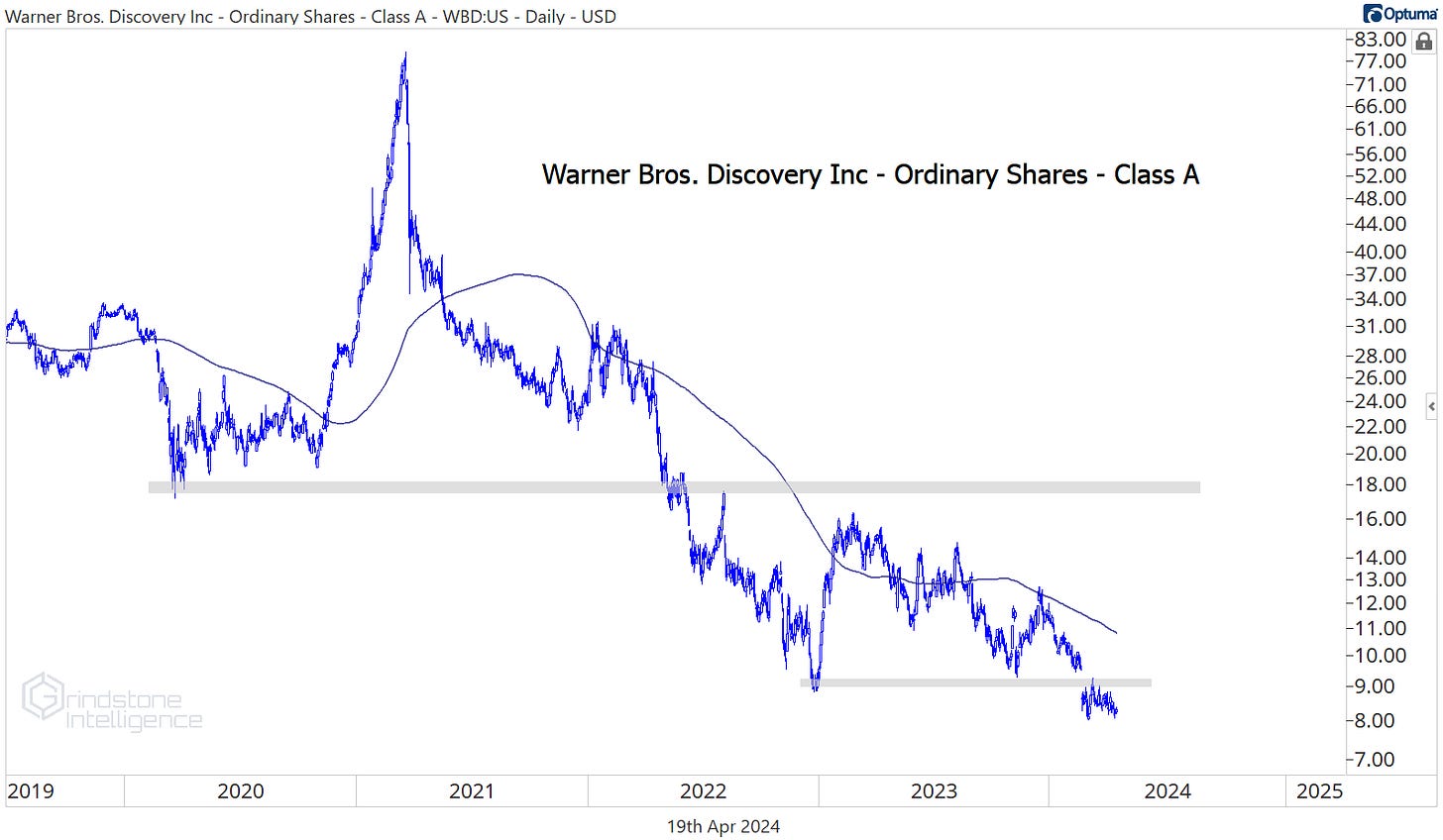

We still believe this is a bull market for stocks. Over the past week, we’ve tried to lay out that broader bullish thesis and what we’re looking at that could prove out thesis wrong. If we are wrong, then we’ll be spending more time looking for short ideas. Here’s one: Warner Bros is consolidating below resistance within a long-term downtrend. The bear thesis on WBD is wrong if the stock is above $9 - that makes our risk really easy to define.

For a downside target, why can’t it go all the way back to the 2008 lows?

That’s all for today. Until next time.