Top Charts from the Health Care Sector - 1/5/2024

Sector outlook and trade ideas

Will Health Care be the top sector in 2024?

It’s certainly off to the right start. Over the last month, no sector has been better, thanks to a sharp selloff in growth stocks over the last week and impressive resilience in risk-off groups.

Health Care’s relative strength started from a logical level: the same place it bottomed in 2021 before outperforming the rest of the market by roughly 30% over the following 12 months. This time around, the lows were confirmed by a sharp bullish momentum divergence.

A bottom in the Health Care/S&P 500 ratio sets the stage for the sector to break out of this 2-year consolidation range. And there’s nothing bearish about breakouts.

Improving sector breadth should act as a tailwind to fuel that breakout. More than a quarter of the sector’s constituents are still in long-term technical downtrends, defined as trading below a falling 200-day moving average. But broad strength is developing beneath the surface, with 90% of Health Care stocks now in short-term technical uptrends.

It’s not all good news. Seasonality could present a problem in the first quarter, since Health Care has lagged by 0.67% on average in the month of February since 1990, and by 0.55% in March.

But remember that seasonality is a general guideline, not a prescription. Even in those two months, where the sector has underperformed the S&P 500 most consistently, Health Care has still won out 35% of the time.

We think Health Care can buck the seasonal headwinds at hand and outperform over the next few months - and maybe even for the rest of the year. We raised the group to Overweight yesterday.

Digging Deeper

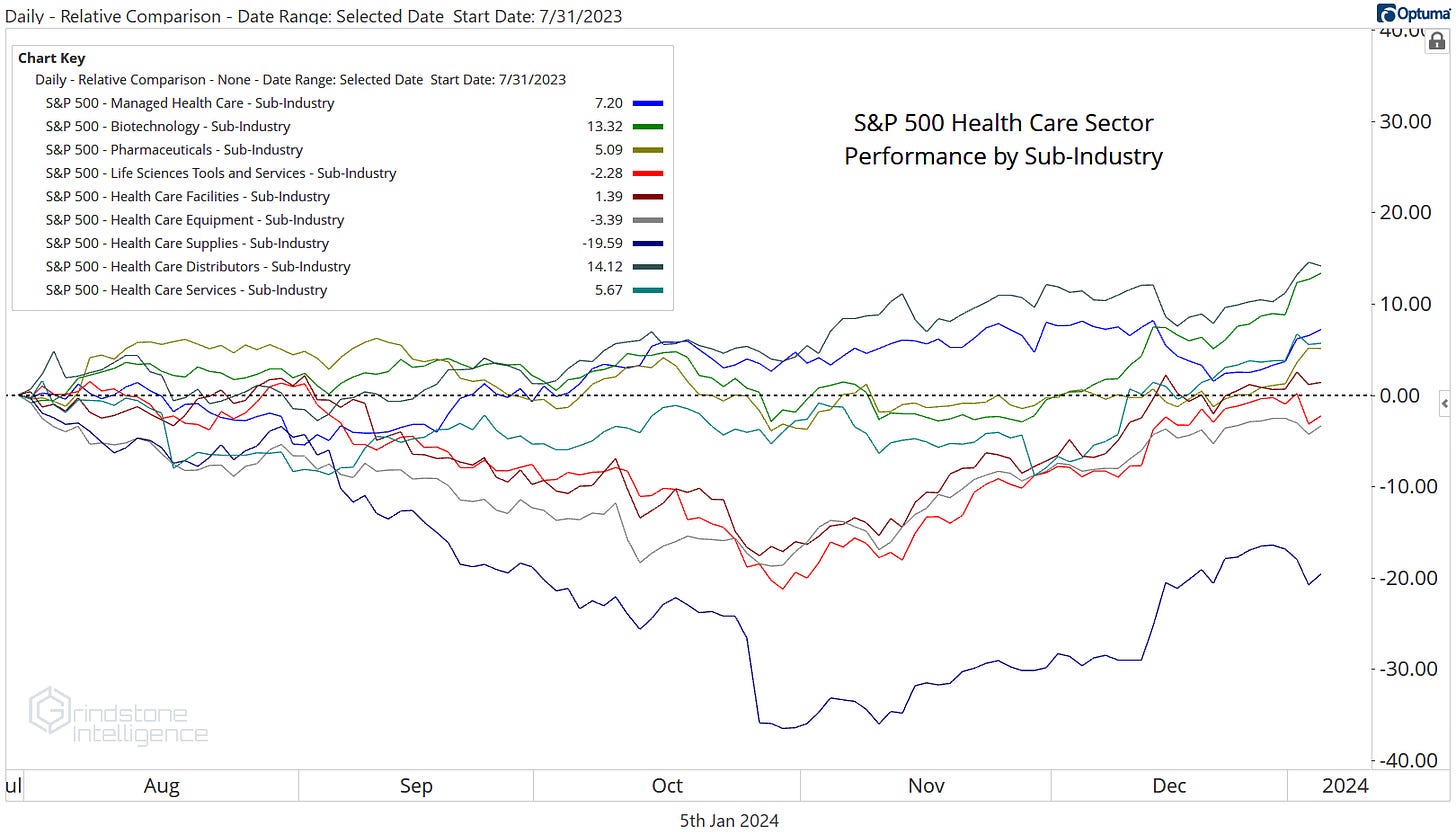

Since the S&P 500’s summer peak at the end of July, the Health Care Distributors have risen 14%, outperforming every other Health Care sub-industry. The strength is nothing new - they’ve been the best group over the last 5 years. What’s more impressive about the Distributors is how consistently they’ve risen. Since November 2020, they’ve spent all of 18 trading days below the 200-day moving average and never fallen more than 8.5% below the 50-day moving average.

Cardinal Health is the one we like most within the group right now. It just broke out of an 8-year base, and we’ve been targeting $125 for the stock.

What we like most is the relative strength. Compared to the overall S&P 500 index, CAH broke out of a 1-year cup and handle continuation pattern last fall, then successfully backtested the breakout in December. We see further outperformance ahead.

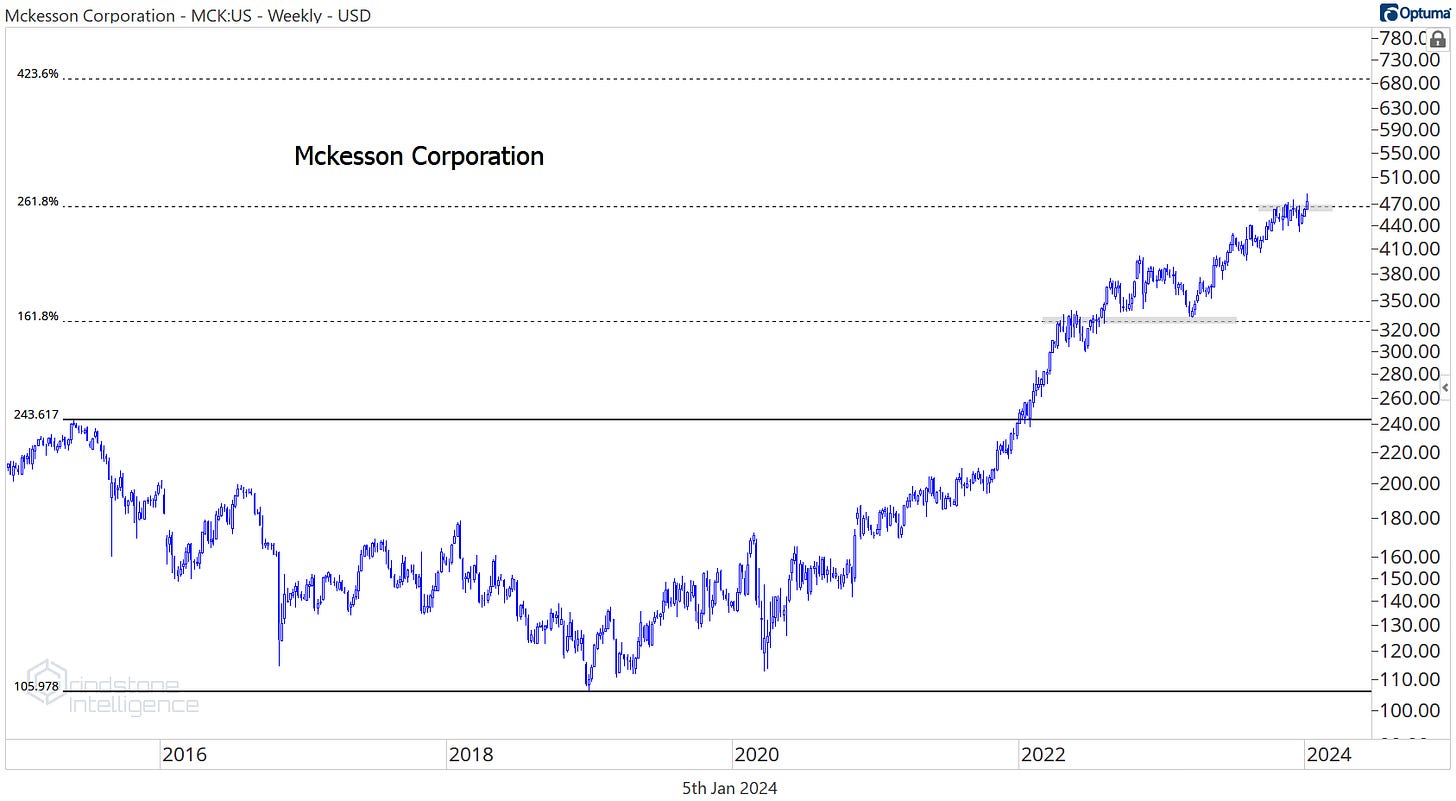

McKesson also looks good as it backtests a 10-year breakout relative to the rest of the Health Care sector.

We’re targeting $690 on MCK, but we only want to be long if it’s above $470.

Leaders

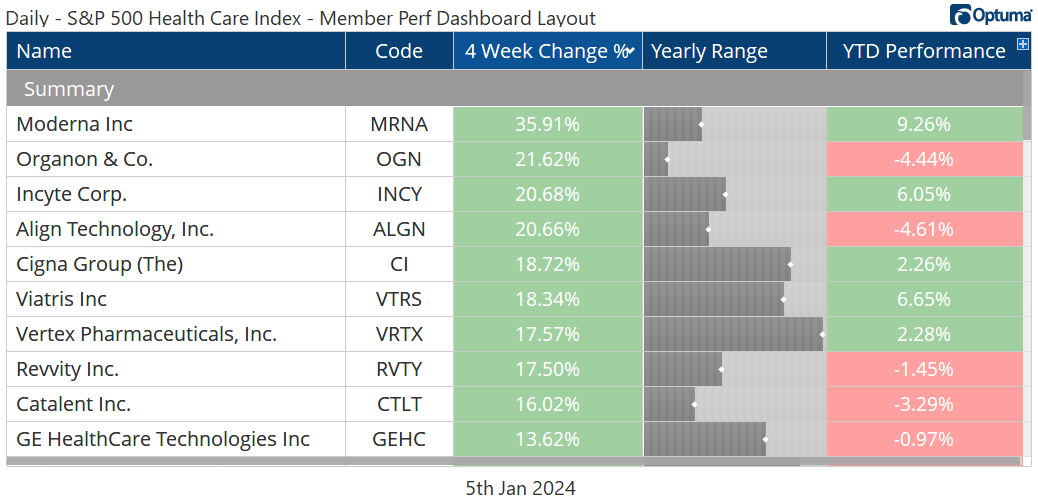

Moderna was the top-performing Health Care stock over the last 4 weeks, but we’re not yet convinced that this is the start of a new uptrend. The downtrend line from the 2021 peak is still intact, as is resistance at the 2022 lows. If MRNA is above $130, then we can start approaching this stock from the long side. Until then, we need to treat rallies as temporary, counter-trend moves.

The strength in Vertex Pharmaceuticals is a mirror image of Moderna’s weakness. VRTX bottomed in late 2021 near $180 and now trades over $400. Momentum has stayed in a bullish range by getting overbought on rallies and avoiding oversold territory on declines for more than 2 years now, and we think the rally has plenty of room to run. We want to be long Vertex with a target of $500, which is the 261.8% retracement from the 2020-2021 decline. We can place stops at $380.

Losers

Some of 2023’s best-performing Health Care stocks were among the worst over the last 4 weeks. We already discussed Cardinal Health and the Distributors. Another interesting group is Managed Care, which includes insurance names like Humana and Elevance. UnitedHealth is our favorite. Here it is testing the top end of the multi-year consolidation range at $550. We want to be buying a breakout in UNH with an initial target of $610 and a longer-term target above $700.

The relative strength in UNH is what we really like. Here it is compared to the rest of the sector:

A failed breakout in November put the uptrend on hold, but there’s nothing here to indicate that the failed move was anything more than a false start. The UNH/Health Care ratio is still above a rising 200-day moving average and above the top end of last summer’s consolidation range. The long-term trend here is higher.

Other stocks to watch:

Universal Health Services has gone nowhere for nearly a decade. From big bases come big resolutions.

We need to be a little careful with big, messy consolidations like this - sometimes the breakouts can be just as messy - but if UHS can get above $160 and stay there for a week or two, we like it long with a target of $225.

CVS is another that’s been pretty messy for the last 10 years, but we’re seeing more good than bad from the stock these days as it approaches new 52-week highs.

We also want to make sure this breakout in relative strength holds. CVS bottomed vs the rest of the sector in September and just set new 8-month relative highs. As long as the ratio stays above the summer-2023 peak, then we can be buying the stock on pullbacks toward $75 with a target of $90.

There’s nothing messy about Eli Lilly & Co. It’s been a picture of relative strength over the last 5 years. Check out this uptrend vs. the rest of the sector:

This 5-month consolidation should resolve in the direction of the underlying trend, which is up, and when it does, we want to be buying the breakout above $620 with a target of $830.

LabCorp just broke out to new 52-week highs, and there might not be a cleaner risk-reward setup in the sector. We only want to be long LH if it’s above $220, which is the 161.8% retracement from the 2020 selloff. Our target is the next key Fibonacci retracement level at $305.

That’s all for today. Until next time.