Consumer Discretionary Deep Dive - 12/6/2023

Stay at home or travel abroad

Consumer Discretionary is one of just 3 sectors outperforming the S&P 500 this year, gaining 34% compared to the benchmark’s 19% YTD return. Only the Information Technology (+50%) and Communication Services (+45%) sectors have done better.

Those three sectors have something in common: they’re all home to mega cap growth stocks. For Consumer Discretionary, it’s Amazon and Tesla, which together comprise roughly 40% of the sector’s market cap. As we’ve discussed several times over the past few weeks, growth stocks are facing tough seasonal headwinds as we close out the year. Historically, growth has lagged value more consistently in December than any other month. The same goes for the Discretionary sector as a whole. The final month of the year has seen Discretionary lag by an average of 0.35% over the last 30-plus years.

Meanwhile, the Consumer Discretionary sector is stuck below stiff resistance at the summer 2022 highs. That fits in well with our belief that the next few weeks could be tough ones for the sector to gain ground.

Fortunately, the Consumer Discretionary sector is a diverse one below the surface, and that means there are some opportunities when we dig a little bit deeper. Check out the chart below, which shows the equally weighted group compared to the S&P 500 index. The ratio just rebounded off of last year’s lows.

Still, we need to be very selective.

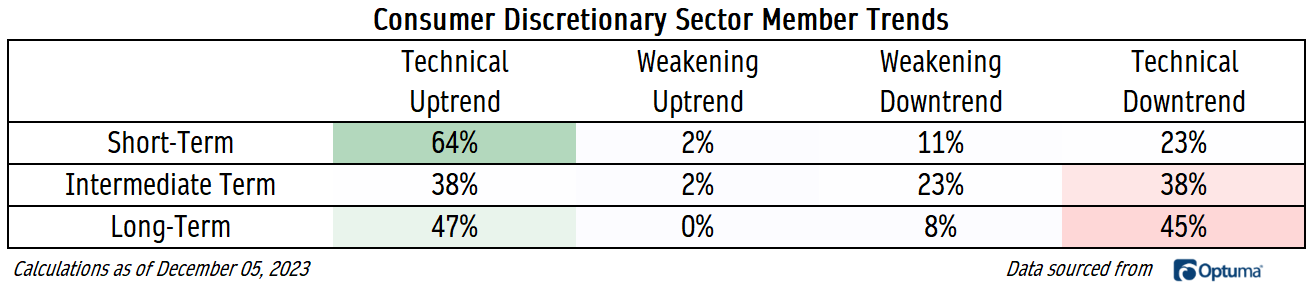

Just because the equally weighted sector is outperforming doesn’t mean that the majority of stocks are rising. In fact, there are nearly identical numbers of stocks in technical uptrends and downtrends. Forty-seven stocks are above rising long-term moving averages, and 45% are below falling ones. Thirty-eight percent of stocks are above rising intermediate-term moving average, and the exact same number are below falling ones. Only the short-term trends are decidedly bullish.

With the biggest and most important names facing seasonal headwinds and breadth sending mixed signals, a neutral approach is best for Consumer Discretionary in the month ahead.

Digging Deeper

The Autos industry, thanks to Tesla, has been far and away the best performer within the sector this year. But given that Autos peaked back in the summer, we’ve got our eye on Household Durables said. Here they are threatening to break out of a multi-year consolidation range.

It’s the homebuilders driving the move. Check out PulteGroup, which has risen 150% from last October’s lows and this week closed at all-time highs. We’re targeting $117 longer-term for PHM, which is the 261.8% retracement from the entire 2005-2011 decline.

What we love most about PHM is the relative strength. Here it is breaking out of a 15-year base against the S&P 500. If you think Pulte has gone too far, too fast, remember that it just went nowhere for more than a decade.

We also like DR Horton. For DHI, we’ve been targeting a long-term move to $170.

Leaders

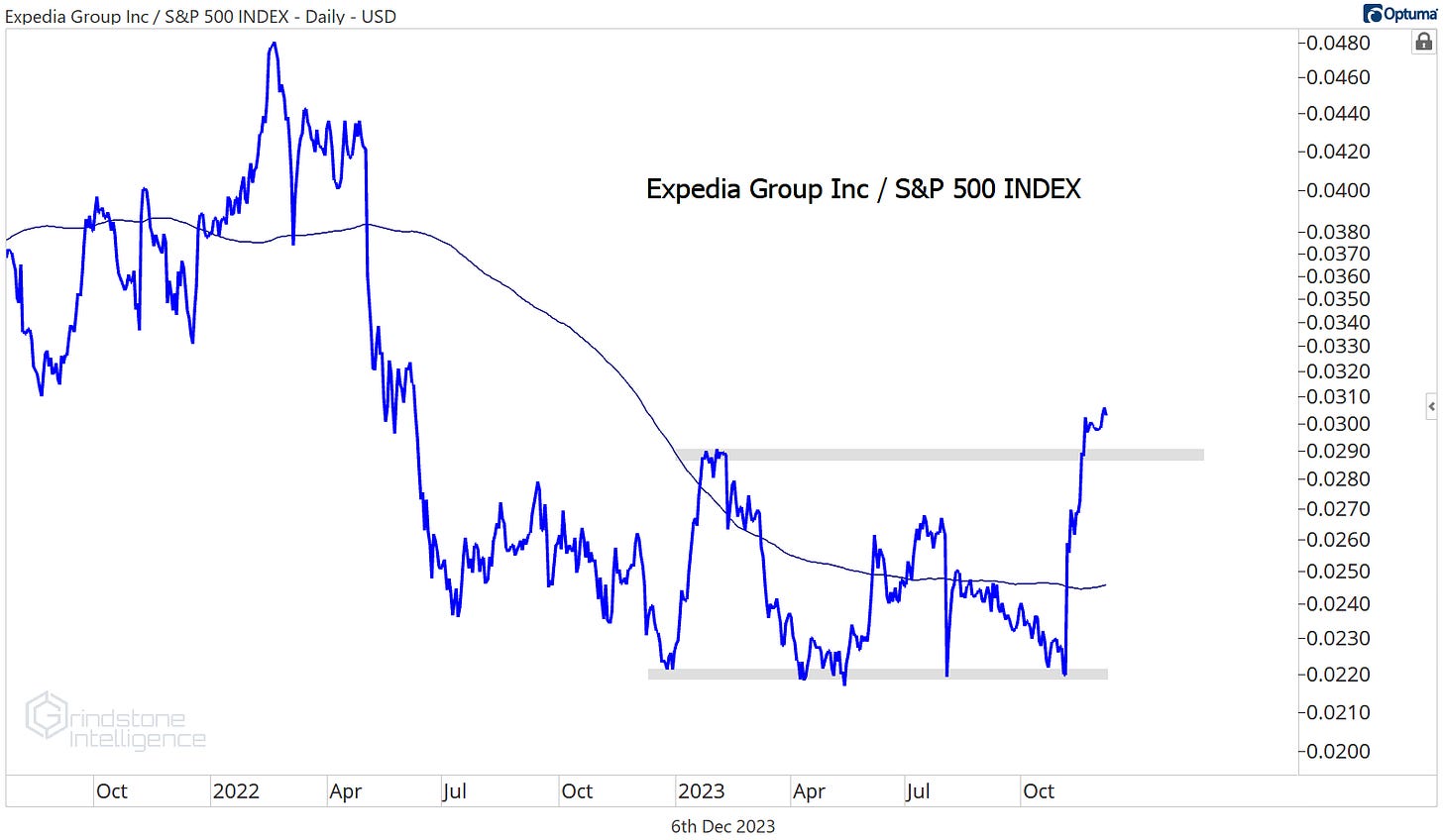

If staying at home with the homebuilders isn’t your style, perhaps it’s time to call a travel agent and travel abroad. Expedia rose 17% over the last 4 weeks and just broke out of an 18-month base.

It’s also showing relative strength by against the S&P 500.

Book a cruise while you’re at it. Royal Caribbean is breaking out to its highest level against the SPX since early 2020.

For RCL, we’re targeting the 161.8% retracement from last year’s decline which is at $138. But we only want to be long above $100.

Losers

Whirlpool is one of the sector’s worst performers this year, and it shows. The stock is a picture of relative weakness. Here it is compared to the S&P 500 and breaking below the COVID lows.

For tactical traders who like trading against the broader market trend, we can short WHR on rallies towards $125.

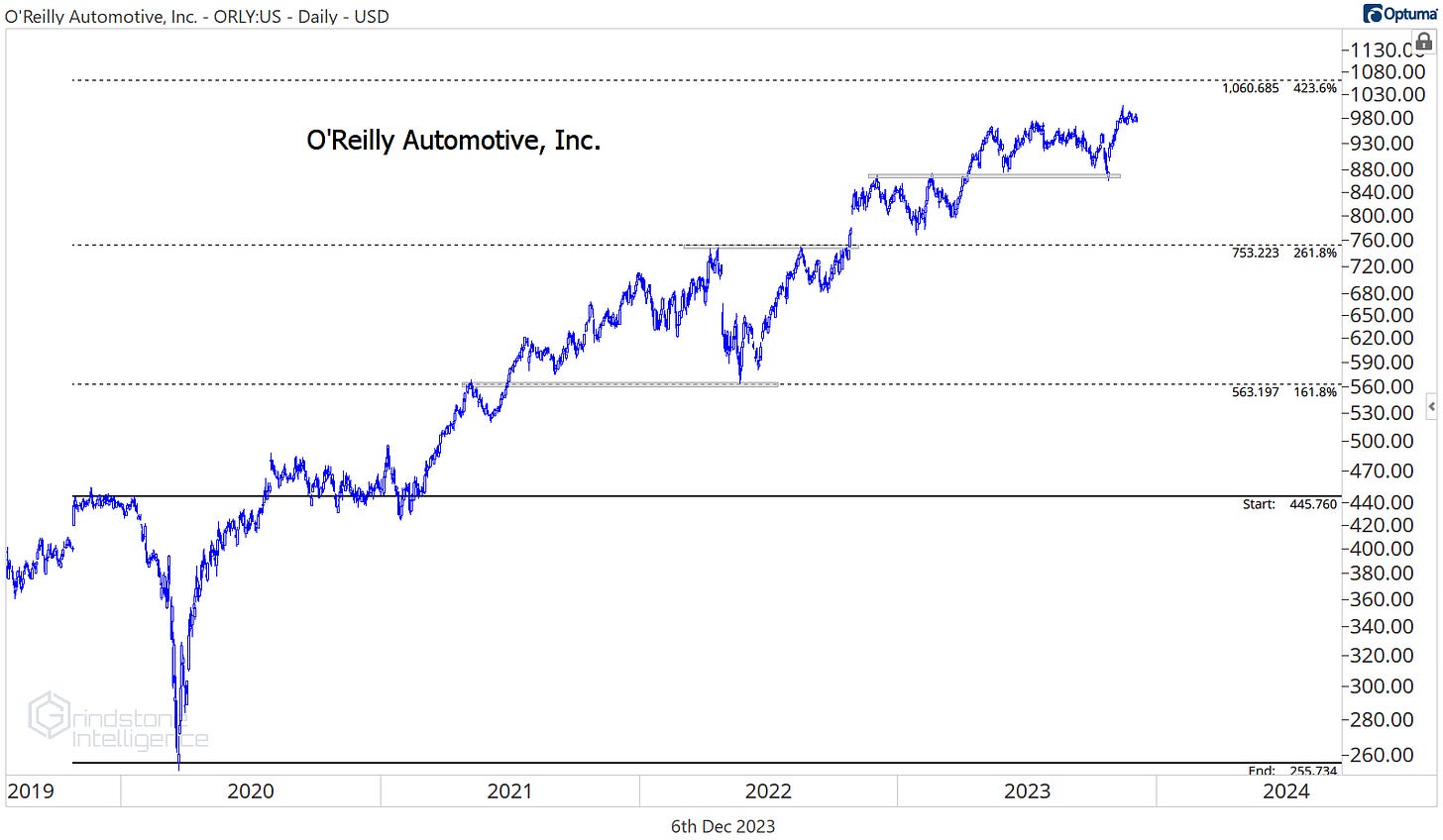

If WHR is a picture of weakness, O’Reilly has been a picture of strength. Check out the uptrend that’s been in place for the last 3.5 years, despite its lack of participation over the last 4 weeks.

There’s not a great risk-reward setup in ORLY right now, but the relative strength chart is one to keep an eye on. It’s gone nowhere vs. the S&P 500 over the last 12 months, as it digests a huge, 18-month run of outperformance that began in early 2021. This consolidation should resolve in the direction of that underlying uptrend.

Other Setups to Watch

Amazon has a great risk-reward setup in place from either the long or the short side. If you believe that seasonal headwinds for growth will drive prices lower, you can be short AMZN below $147. Otherwise, we like it long above that $147 level with a target back towards the highs near $190.

Going back to the travel theme, we still like Booking Holdings above $2700 with a target of $3650, which is the 261.8% retracement from the 2020 decline.

We want to be buying a breakout in Marriott above the summer highs at $212 with a target of $307.

And peer Hilton is already breaking out. We like it long above $160 with a target up at $230.

One we don’t particularly like is Ford. Autos as a whole have been a top performer this year, but that wasn’t driven by the old guard. Ford dropped to multi-year lows, and we don’t have any reason to approach it from the long side unless it’s back above $11.50. We’d much rather be shorting moves back towards that breakdown level.

That’s all for today. Until next time.