Searching for Stabilization Amid a Volatile Market

U.S. stocks just posted their seventh consecutive down week. It’s the first time we’ve experienced a negative streak of that length since 2001. In doing so, the market closed near 52-week lows and sits 18.6% below the all-time high set earlier this year. With one more week like the last few, the S&P 500 will officially enter bear market territory for the second time in just 26 months.

With terms like ‘bear market’ and ‘recession’ getting thrown around, the debate between active and passive investing strategies will be back in the spotlight. Advocates of the passive approach will urge their followers to stay the course.

“Just be patient. The market always comes back”

or

“Don’t try to time the market.”

They’re right, to a degree. The U.S. stock market has always come back (though sometimes it takes a long time to do so, as I’ve talked about here and here). And thanks to behavioral flaws in the human psyche, people are notoriously bad at timing buys and sells. A passive strategy seeks to avoid such poor behavior by eliminating buys and sells altogether, and for many investors, it’s been a tremendous success. Ironically, advocates of the approach often use another behavioral flaw to ensure compliance: the fear of regret.

How many times have you heard about the damaging effects of missing a handful of the market’s best days? I can all but guarantee I’ll see the stat on some form of media this week, and it’s enough to make anyone fearful of selling at the wrong time.

“One dollar invested in the S&P 500 at its inception would be worth more than $200 today. If you missed the top 50 days, your $1 would have grown to only $4.40.”

The numbers are accurate, sure. But they’re a bit misleading. Though it seems counterintuitive, the best days tend to occur during bear markets. In other words, missing the best days shouldn’t necessarily be cause for concern – odds are that the gains will be reversed anyway.

Since the 1920s, stocks have spent about one quarter of their time in bear markets. Yet even though bear markets account for only 25% of all trading days, they’re home to 66% of the most volatile days. A 3.5% move in stocks is almost 6x more likely to occur during a bear market than in a bull.

And that’s true whether prices are moving up or down. It seems rather obvious that bear markets should be home to the worst days for investors, and they are: more than 70% of all 3.5% drops have occurred after stocks reached a bull market peak and before they hit a bear market bottom. But the same holds true for big up days in stocks: more than half of the market’s best days have taken place during extended downtrends, despite extended downtrends being a relatively rare occurrence.

So next time you hear about the long-term damage of missing the best days, take it with a grain of salt. Unless you have perfect timing – or more accurately, perfectly awful timing – you won’t be missing all of the best days without avoiding some of the worst ones, too. And missing both isn’t such a bad thing.

With all that said, we shouldn’t completely disregard the occurrence of large, positive returns. They’re a characteristic of bear markets, true, but they’re also a characteristic of major bottoms. The two weeks after bear market troughs have accounted for less than 1% of all historical trading days, yet they contain 13% of the market’s best days ever. Catching a falling knife is a dangerous proposition, but it’s lucrative if done successfully. So it pays to keep an eye out for signs of stabilization, even in a volatile market. Here are a few things to keep an eye on over the coming weeks.

Many pundits are blaming this market selloff on a Federal Reserve that’s tightening financial conditions to curb demand and cool inflation. Interest rates that rise too quickly tend to put pressure on risk assets, and Fed officials have been nudging borrowing costs higher all year through a combination of forward guidance and hikes on overnight lending rates. Over the past few weeks, though, Treasury rates have reached multi-year resistance levels and responded.

Ten-year yields failed to hold above 3%. That level was a major turning point on 2013 and 2018 as well.

The yield on 30-year government bonds was similarly rejected near 3.25%. That level was trouble from 2015-2018.

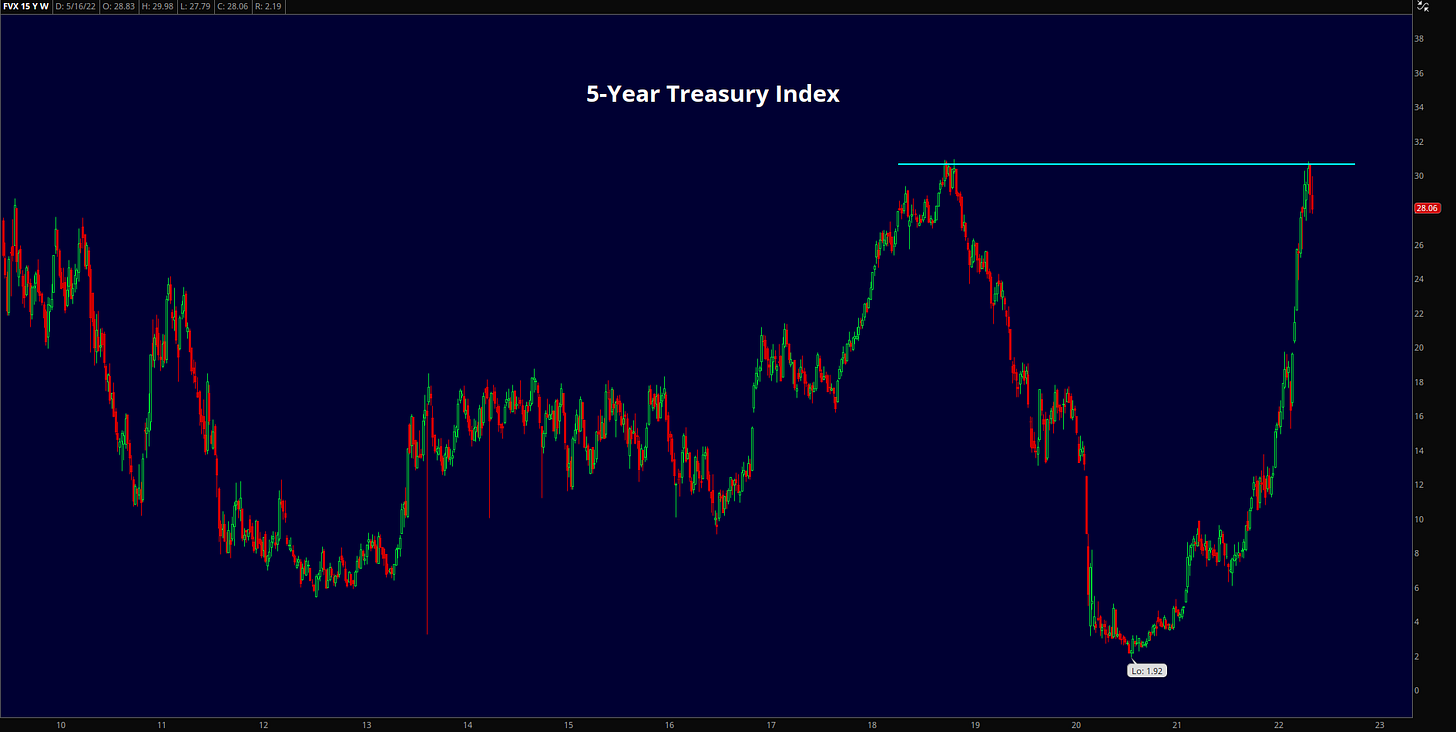

And even towards the shorter-end of the curve, we’re seeing yields stop at logical areas of resistance. The 5-year rate peaked at the same level it did in late 2018.

If you need fundamental justification for the recent hesitation in rates, take a look at the latest commentary from Fed officials. They’ve stopped raising the bar on tightening measures. They’ve already announced their plans for balance sheet rolloff. They’ve told us they plan to reach a ‘neutral’ level of interest rates by year-end. And they’ve pushed back against the idea of 75 basis point hikes. At least for now, the path ahead is clear and there’s nothing left to say. It just so happens they’ve moderated their collective tones at the same time most of the Treasury curve was running up against levels of historical significance.

Now, just because rates are responding to resistance doesn’t mean we’re in for a major reversal. It’s possible, sure, but it may not be necessary. Even a pause in rates could give equities a much needed reprieve.

We may be seeing that already in small cap stocks. The Russell 2000 has erased all of its gains from the last 4 years and is trying to form a base near the 2018 highs. And while large cap indexes were all setting new lows last week, the Russell 2000 bottomed on May 11.

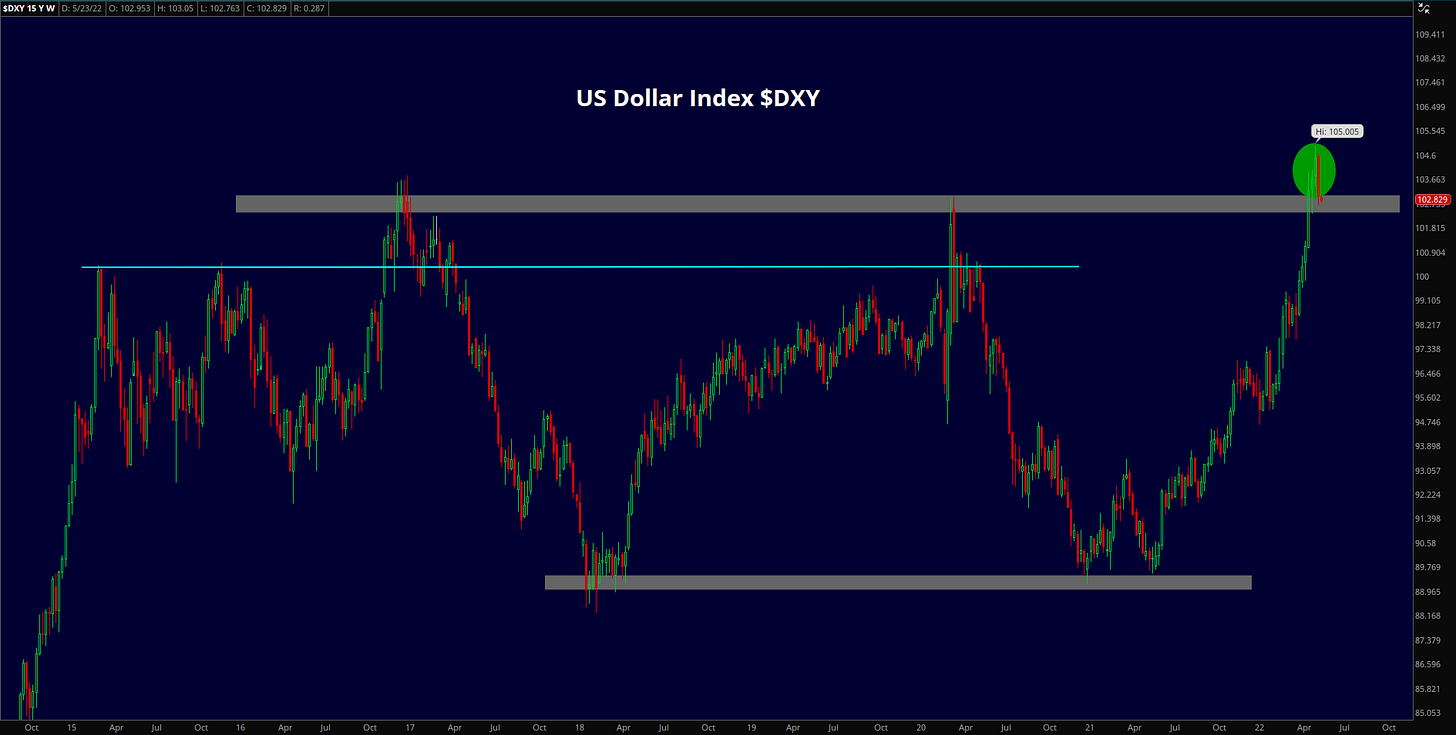

And finally, the US Dollar Index is on false breakout watch. The USD has been ripping higher all year, thanks to a variety of tailwinds, including higher domestic interest rates, better economic growth, and its safe-haven status amidst war in eastern Europe and COVID outbreaks in China. The rally pushed the DXY through resistance from the last decade and to the highest level in nearly 20 years. A reversal here could signal that supply chains are improving and global growth headwinds are diminishing. It would also reduce the exchange rate headwind to domestic earnings growth.

Maybe these few reversals are the start of something bigger. Maybe not. There’s only two things we can really be sure of: big gains and big losses are characteristics of downtrends, and volatility rules in a bear market.

The post Searching for Stabilization Amid a Volatile Market first appeared on Grindstone Intelligence.