The Morning Grind

Valuations soaring

Stocks were most flat during the holiday-shortened trading week ahead of Easter. The S&P 500 rose 0.24%, the Dow Jones Industrial Average gained 0.07%, and the NASDAQ Composite fell 0.14%. There were big gains to be found elsewhere in the market, though, as Bitcoin climbed back above $70,000, crude oil had its best weekly close since November, and gold reached a record high.

We had a rare occurrence where key economic data was released on a day where US financial markets were closed. On Friday, the Bureau of Economic Analysis reported February numbers for the Federal Reserve’s preferred measure of inflation. The Personal Consumption Expenditures Price Index rose 2.5% year-over-year, and the core PCE deflator was 2.8%,, down slightly from an upwardly-revised 2.9% in January.

On am annual basis, it looks as though inflation is still trending steadily toward the Fed’s 2% target. Short-term measures are more concerning, though. On a 3-month annualized basis, core PCE has jumped to 3.5%, the highest in nearly a year.

Fed officials have said they need to see more progress on prices before lowering interest rates this year. But they’ll need to balance that goal against the risk of a weakening labor market. We’ll get a lot more data on jobs this week.

Earnings Expectations and Valuation

The 2022 bear market decline was not driven by a deterioration in corporate earnings. Though stock prices dropped well over 20% from their peak to trough, expected future earnings remained stubbornly high. That divergence pushed the S&P 500 forward price-to-earnings ratio from more than 22x (a level previously seen only during the late-1990s) to 15x (a level in-line with historical averages).

Almost 18 months after that bear market reached its lows, and valuations are right back to where they were. The S&P 500 forward p/e ratio is above 21x.

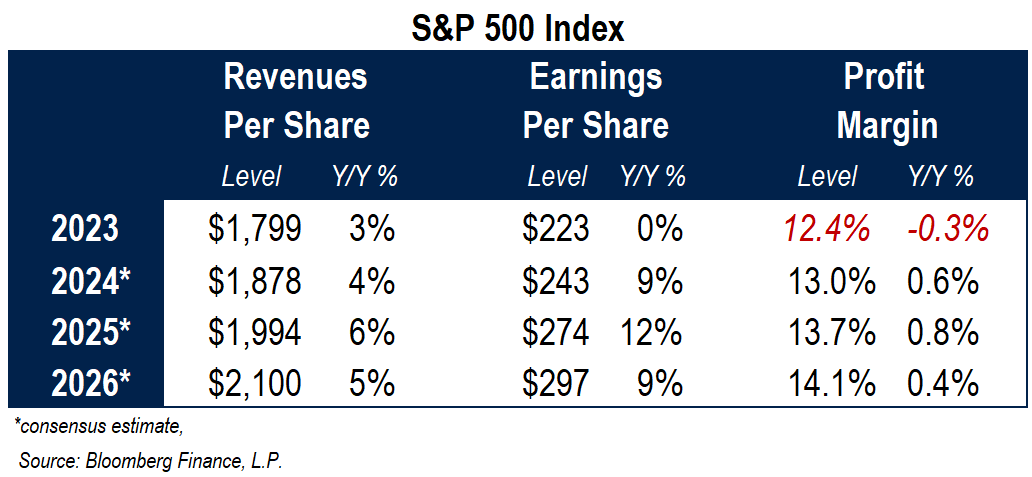

Fortunately, profits are expected to grow at an annualized pace of 10% over the next 3 years according to Bloomberg consensus estimates. That would help make current valuations easier to digest. There’s just one wrinkle. Expectations imply that S&P 500 profit margins will have to jump to the highest level in decades by 2025, and expand even more in 2026.

More from last week:

Consumer Staples: Sector Outlook

In bull markets, it’s the offensive areas of the market that lead. When prices are trending higher and the economy is booming, people don’t spend a bunch of time thinking about the risks. Who cares about the consistency and stability of selling toothpaste and diapers when there are new, fast-growing opportunities like artificial intelligence?

Materials Making a Comeback

It's still a risk-on environment, but leadership over the short-term has shifted quite a bit. No longer is this a market where returns are dominated by a handful of mega cap growth names. It’s the value-oriented areas of the market that are driving us higher.

Top Charts and Trade Ideas from the Industrials Sector

The strongest of bull markets don’t care about potential areas of resistance, bearish divergences, or the targets we set. That’s the type of environment we’re in today. A few short weeks ago, the S&P 500 Industrials sector was nearing the 161.8% retracement from the 2021-2022 decline, a perfectly logical place for sellers to step in given the strength of the rally we’d seen over the prior 4 months. Instead of finding resistance, the Industrials kept on chugging along.

What’s Ahead

Here’s the economic calendar for the week ahead