The Morning Grind - 2/26/2024

Breadth still healthy

You can’t keep a good market down. Two weeks ago, a hotter-than-expected inflation print pushed the S&P 500 to a lower weekly close for just the second time since markets bottomed last October. This past week, stocks more than erased the decline, led by another blowout earnings report from AI leader NVIDIA. Further supporting the rally was a decline in the US Dollar Index - the first one of the year. The weaker Dollar also helped the gold prices, which rose 1.1%.

Market Internals

Breadth was a concern for most market watchers throughout 2023, as the rally in growth stocks obscured lackluster performances from value-oriented names during the spring and late-summer months. Index-level declines in August, September, and October had breadth as weak as it had been all year. A surge in prices to end the year laid any lingering concerns about participation to rest, and the strength has continued into 2024. 73% of S&P 500 members are above their 200-day moving average.

Long-term trends are healthiest in the Financials, Industrials, and Information Technology sectors, where more than 84% of constituents have moved above their long-term moving averages. Traditionally considered a risk-off area, the Utilities sector is the most weakly positioned. Just 37% of stocks in that group are in long-term technical uptrends.

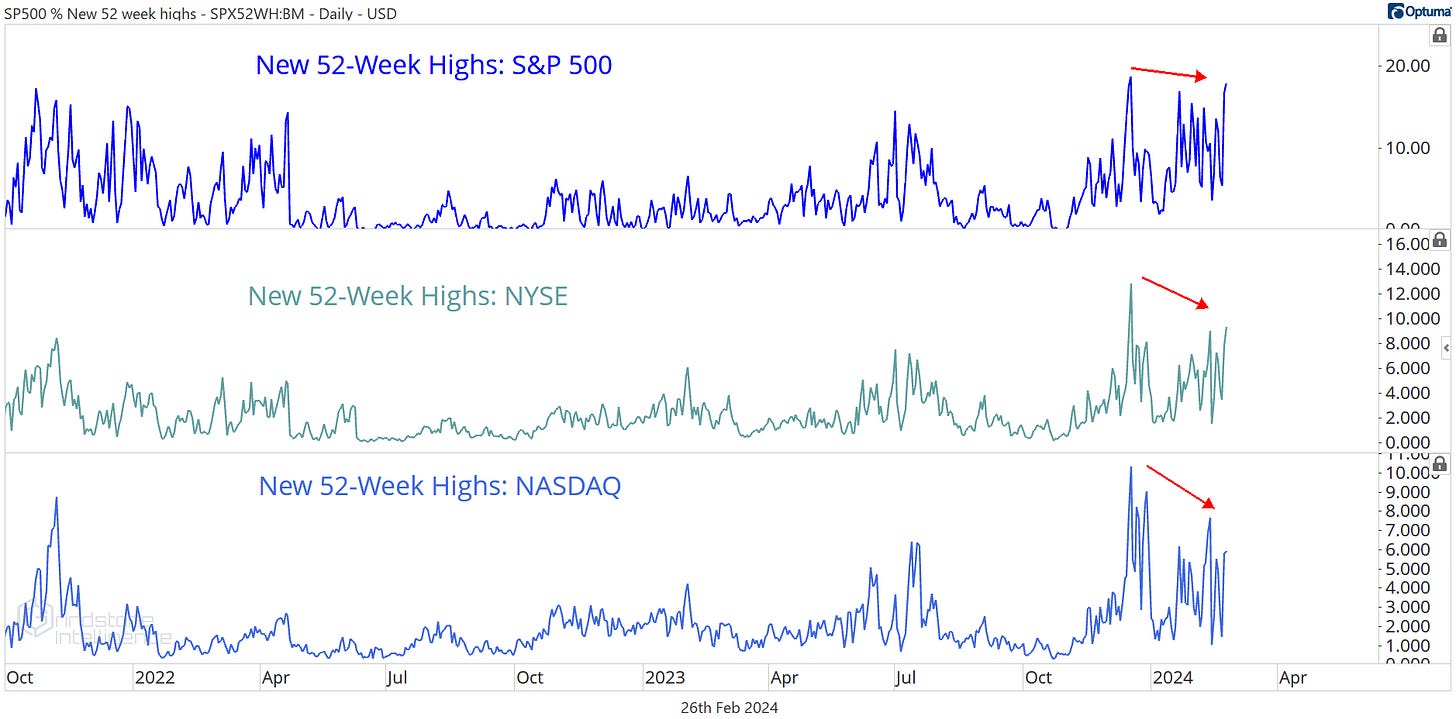

If there’s one thing the breadth bears can hold onto, it’s that the list of stocks setting new 52-week highs stopped going up more than 2 months ago - despite a steady stream of record highs at the index level.

But a lack of new new highs alone isn’t enough to derail a rally. In order to see true weakness below the surface, we’ll need to see an increase in the number of stocks setting new lows. Even on a shorter-term basis, we just aren’t seeing that. The list of stocks setting new 6-month lows has been subdued all year.

More from last week:

Energy Sector Deep Dive

Long-term resistance for the Energy sector has been too much to overcome. We’ve been dealing with the 2008 and 2014 highs for 18 months now, and while the bears haven’t taken outright control here, the bulls haven’t been able to gain any ground either. At some point, maybe we’ll get the long-awaited breakout. Or we might not. In any case, the risk is skewed to the downside as long as this resistance level remains intact.

Leaders and Losers: Industry Trends - 2/22/2024

We put a lot of emphasis on a top-down approach here at Grindstone. Yes, there’s tremendous value to be had in a bottom-up technical approach, too, which is why we sift through thousands of charts of individual stocks each month. When we’re just checking the charts of individual stocks, though, we can miss out on big themes in the market – especially if we aren’t in tune with the fundamental factors that drive each of those individual stocks.

Bull Market on Hold

Last week we pointed out a sharp bearish momentum divergence and a failed breakout in the Consumer Discretionary sector. Our point wasn’t to say we needed to flip the script and turn bearish while the market was near new all-time highs, but to acknowledge that real damage to the trend had occurred.

Happy Presidents' Day

Good morning everyone. The market is closed today in honor of Presidents’ Day, which means I’m not going to sit and stare at a screen all day. If the weather holds up, I’ll be working on my golf game instead. And trust me, it needs A LOT of work. While I’m searching the woods for hooked drives and digging my way out of sand traps, here’s one of my favori…

What's Ahead

Here's what to watch in the week ahead: