The Morning Grind - 5/13/2024

Incoming inflation data

Sell in May and go away? Not so fast.

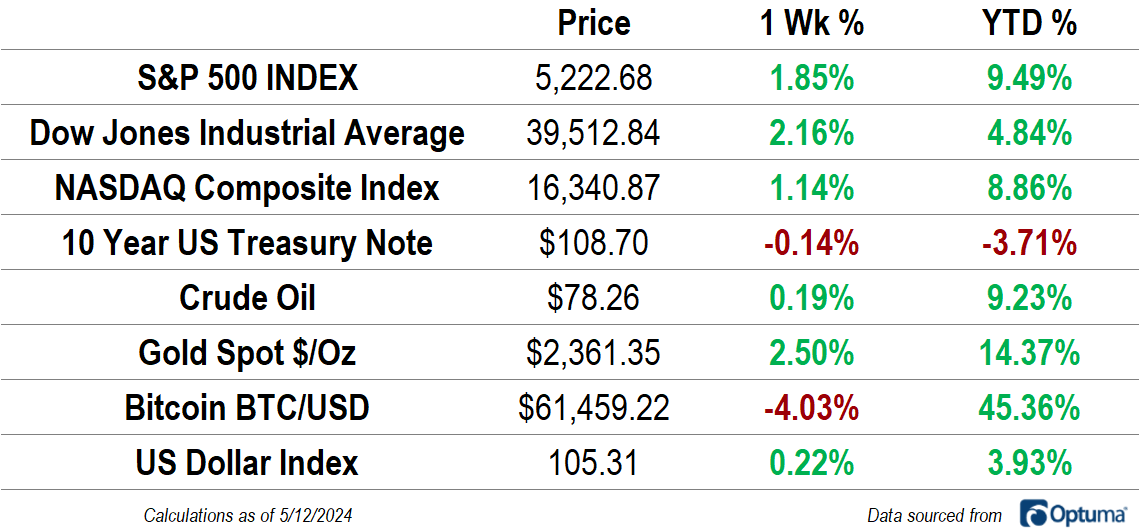

The S&P 500 rose 1.85% last week, bringing its year-to-date total back to nearly 10%. It’s the third straight week of gains for equities after prices experienced their first 5% decline since last October. Gold was even better, rising 2.5%.

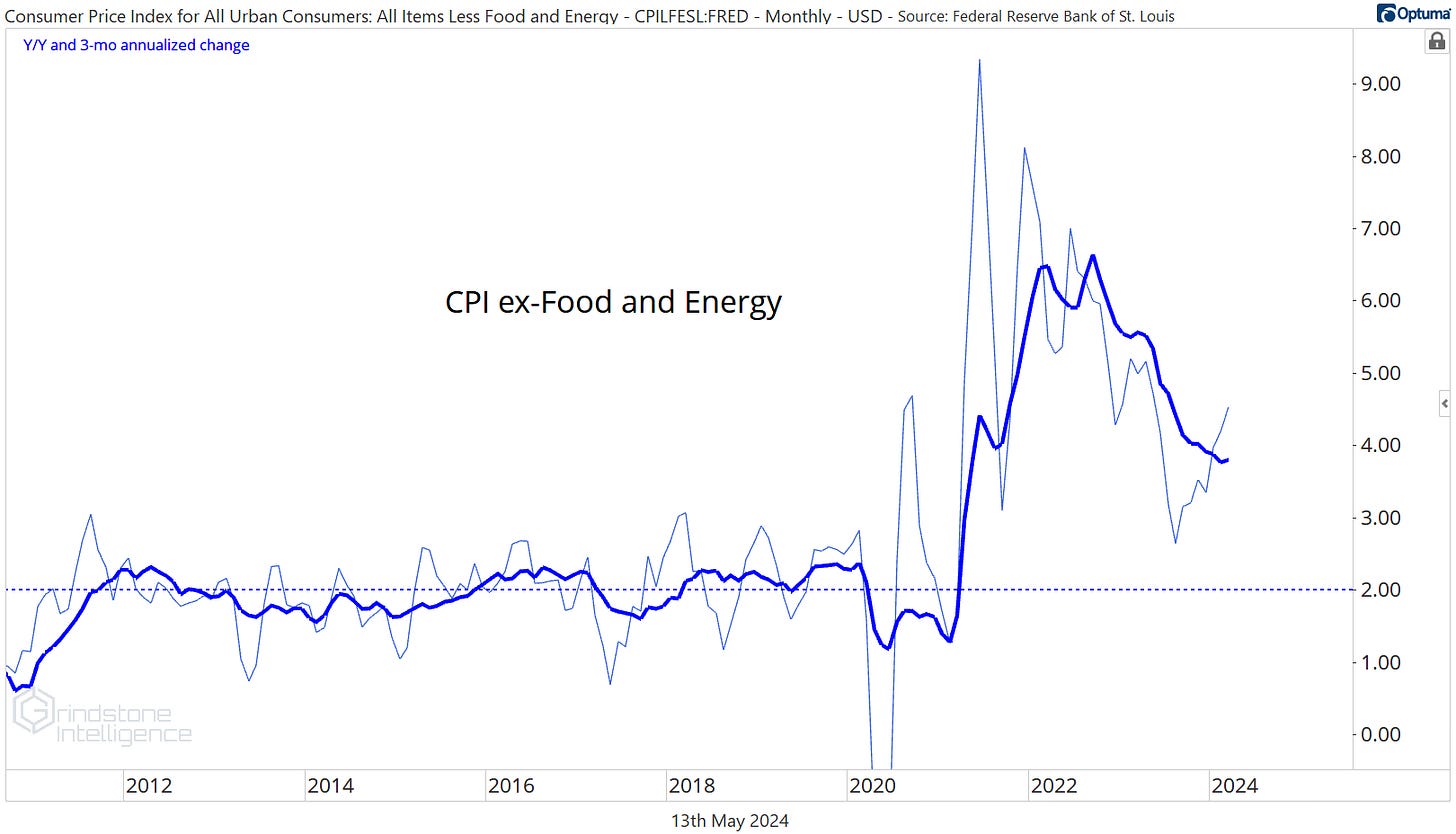

This week, all eyes will be on inflation data for April. First up is tomorrow’s Producer Price Index update, where consensus expectations call for a slight acceleration to 2.2% on the headline number. Wednesday’s CPI report will be even more important. Core inflation - the measure that excludes volatile measures like food and energy - accelerated in March after 11 consecutive months of declines. Forecasters are hoping expecting that inflation will resume its downward trend and dip to a multi-year low of 3.6% in April.

Relatively Speaking

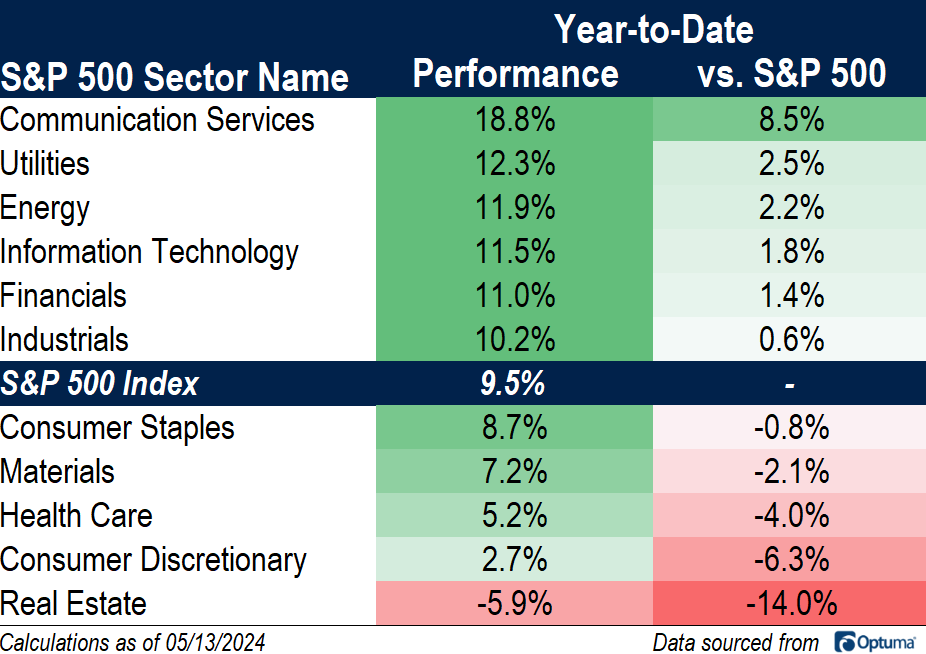

It may be a new year, but some things in 2024 look awfully familiar to 2023. The Communication Services and Information Technology sectors are both outperforming the S&P 500, with Communications the year-to-date leader, up nearly 19%. Participation in the bull market has broadened out, though. Last year, only the growth sectors did better than the benchmark index. This time around, 6 of the 11 sectors have outperformed. One thing that hasn’t changed? Real Estate is lagging. That sector is down almost 6%.

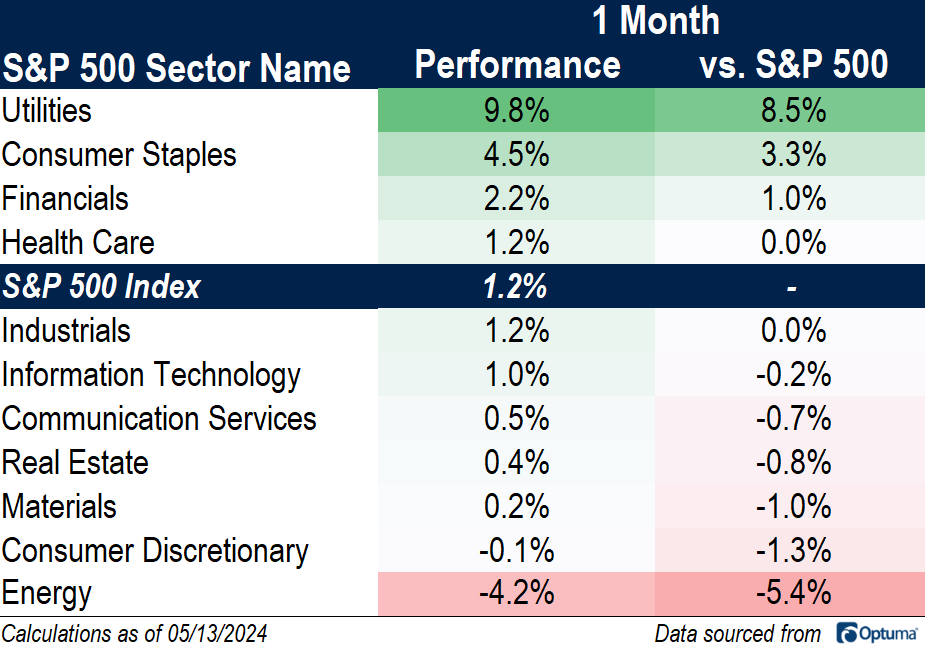

Risk-off areas of the market have dominated over the past month, as the Utilities jumped almost 10%, and the Consumer Staples rose 4.5%. Risk-off outperformance is often a reflection of a waning market, but it’s hard to make that argument right now - 9 of the 11 sectors were up over the period.

In Case You Missed It: Last Week’s Insights

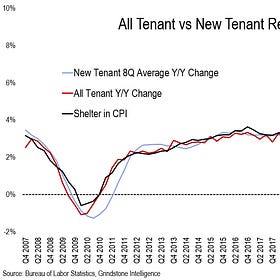

Housing Inflation is Too High

Inflation is still too high, and the cost of housing is largely to blame. The Federal Reserve decided to keep their interest rate target unchanged last week. Just 5 months ago, market participants were pricing in as many as seven 0.25% rate cuts in 2024. Today, that expectation has fallen to under 2.

Financials Sector Outlook

It’s been more than a year since the collapse of Silicon Valley Bank sparked a panic that nearly upended the entire banking industry. Last March, everyone was scrambling to become experts on the accounting intricacies of held-to-maturity securities and the extent of unrealized losses on bank balance sheets. Even now, there are widespread concerns about the lasting impacts of the ongoing collapse in commercial real estate values.

Which Gold Stocks Do We Want to Buy?

Gold has dropped 5% from the peak it set in the middle of last April, but we don’t think that’s the end of the rally. Zoom out for a minute and look at what gold prices have done over the last 30 years. Does this look like a big top to you? Or does it look like the early stages of a new uptrend?

Real Estate Sector Deep Dive

It’s been a little more than two years since stocks kicked off the most extended bear market since the Great Financial Crisis. Today, 9 of the 11 S&P 500 sectors are higher than they were back at those January 2022 highs, and so is the overall index.

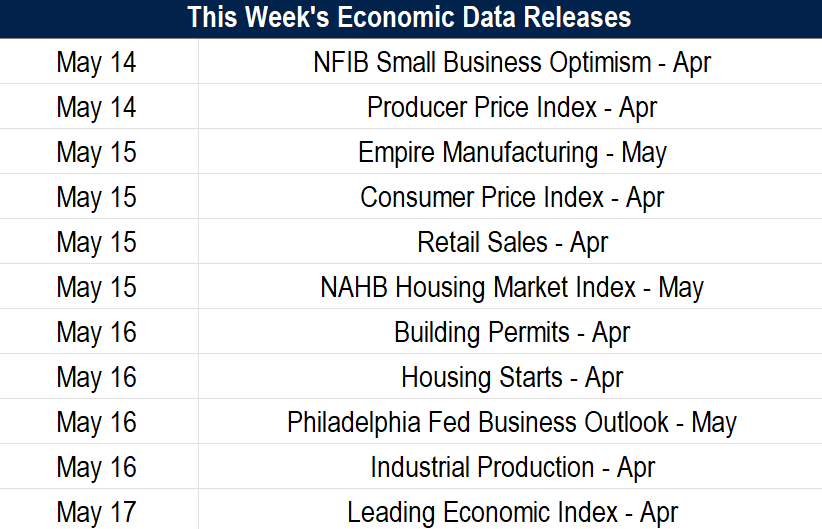

What's Ahead

Here are the key data releases and events to keep on eye on in the coming days.