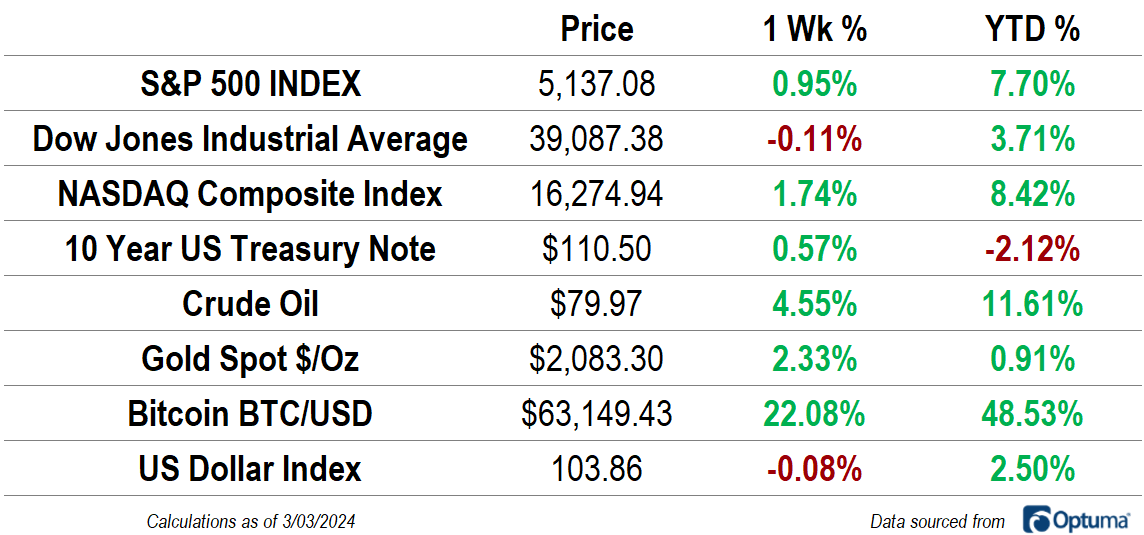

There was some concern heading into last week’s PCE report that progress on inflation had stalled, and that might force monetary policy officials to tighten their grip on the US economy. Those concerns proved to be without merit. The Fed’s preferred measure of inflation slowed to 2.4% in January, the lowest level in nearly 3 years. Equity prices jumped on the news, with the S&P 500 ending the week at record highs and up 7.7% for the year. Since bottoming in October 2023, the index has risen in 16 of the last 18 weeks. The NASDAQ Composite has been even stronger - it’s up 8.4% for the year.

The gains weren’t limited to stock prices, either. Bitcoin rose 22% to more than $60,000. Another week like the last would push it well past the all-time highs set back in November 2021. Crude oil surged too, gaining 4.5% to close at its highest level since last fall. And gold - which we keep hearing is obsolete in a world with digital assets - quietly gained 2.3% to close at an all-time high.

Earnings Expectations and Valuation

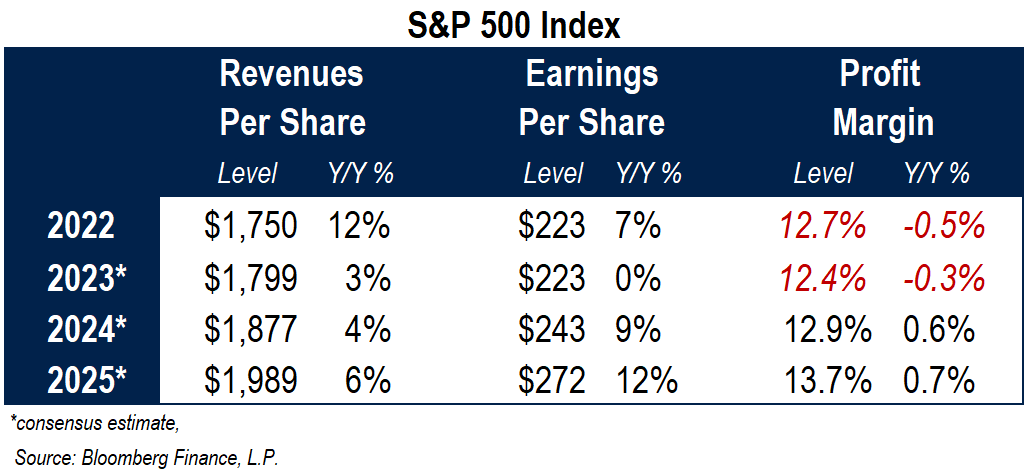

The 2022 bear market decline was not driven by a deterioration in corporate earnings. Though stock prices dropped well over 20% from their peak to trough, expected future earnings remained stubbornly high. That divergence pushed the S&P 500 forward price-to-earnings ratio from more than 22x (a level previously seen only during the late-1990s) to 15x (a level in-line with historical averages).

The bull market that reigned in 2023 and has continued into 2024 has been the opposite experience. Stock prices have risen 40% from their lows, but S&P 500 earnings haven’t kept up at all, taking valuations back up to 21x forward earnings estimates.

Fortunately, profits are expected to grow at an annualized pace of more than 10% over the next 2 years, according to Bloomberg consensus estimates. That would help make current valuations easier to digest. There’s just one wrinkle. Expectations imply that S&P 500 profit margins will have to jump to the highest level in decades by 2025.

More from last week:

Real Estate vs. Interest Rates

The Real Estate sector has been down in the dumps for most of the last two years. From the start of the 2022 bear market to today, Real Estate has fallen 20%. By comparison, the next worst sector is Utilities, down just 12% from its highs. And 5 sectors - Energy, Information Technology, Industrials, Health Care, and Communication Services - are all higher than they were back then.

Sector Ratings and Model Portfolio Update

First, a bit of housekeeping. I’ll cut to the chase. The price of a paid membership is going up. I had a big, long explanation written for you guys, but it all comes down to this: I’m putting a lot more time and effort into this stuff than I was when we launched, and you guys are getting a lot more content. The current price doesn’t reflect that.

New Highs Aren't Bearish

The Financials sector is knocking on the door of new all-time highs. It’s been more than two years since US equities began their bear market and nearly 1 year since the collapse of Silicon Valley Bank sparked a panic that nearly upended the entire banking industry. Last March, everyone was scrambling to become experts on the accounting intricacies of held-to-maturity securities and the extent of unrealized losses on bank balance sheets. Even now, there are widespread concerns about the lasting impacts of the ongoing collapse in commercial real estate values.

Catching Up on the Housing Market

Take a look at the best-performing S&P 500 sub-industries over the last year, and you won’t be surprised by who tops the list. The NVIDIA-led Semiconductors have surged by more than 100% since last February. You probably won’t be surprised to see Meta’s Interactive Media & Services sub-industry coming in at #2, either. That group has gained 90%.

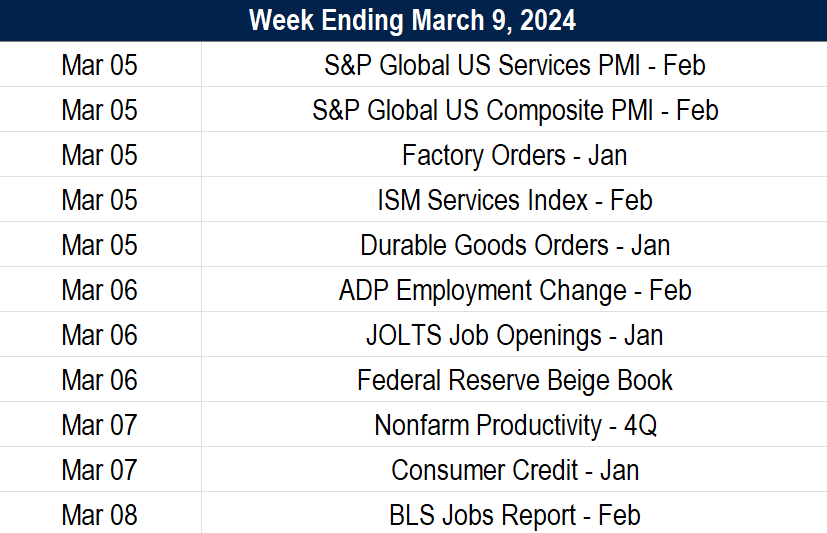

What’s Ahead

Here’s the economic calendar for the week ahead