The Monday Morning Grind - 2/12/2024

The S&P 500 has risen for 14 of the last 15 weeks, closing at record weekly highs for each of the last 5. The index is already up 5.4% for the year, splitting the performance of the growth-focused NASDAQ Composite (+6.5%) and the value-oriented Dow Jones Industrial Average (+2.6%). A further testament to the risk-on attitude that’s driving markets, Bitcoin last week rose 14%, closing at its highest level since December 2021. That’s all happened in spite of rising interest rates and a stronger US Dollar index, which were major headwinds to stocks in 2022 and 2023.

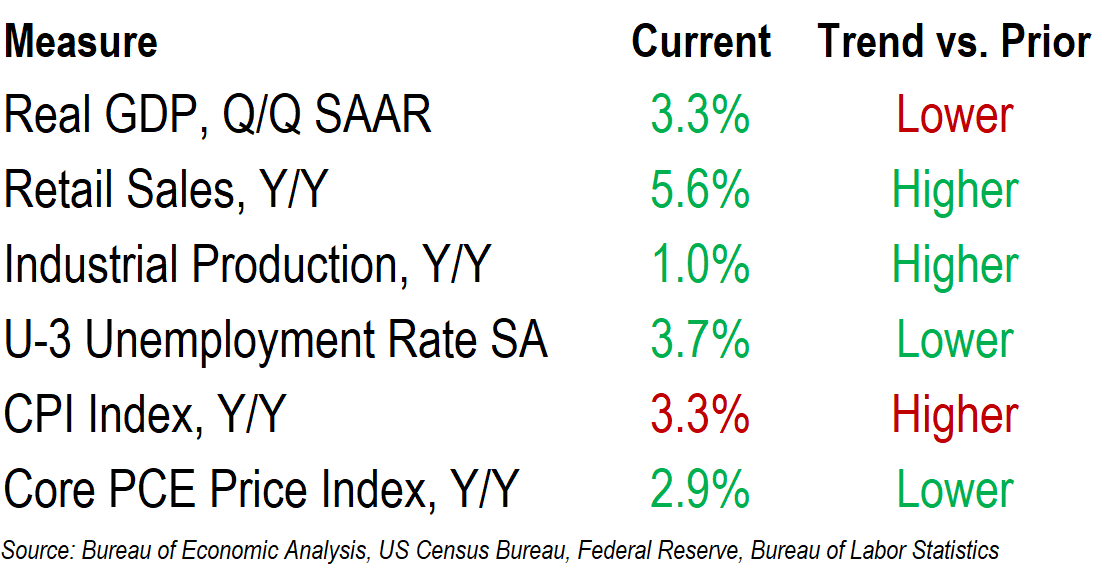

Macro Dashboard

The US economy proved to be more resilient than most economic forecasters thought possible in 2023, ending the year with GDP running at a healthy 3.3% annualized rate. A strong US consumer is to thank. Retail sales in December rose 5.6% year-over-year, even as excess savings from the pandemic dry up and student loan payments were resumed. This week, we’ll see how strong much appetite there was for spending in the final month of the holiday season, when December retail sales are reported. Spending has the backing of a strong labor market: unemployment fell back to 3.7% to end the year.

Recession in 2024 is possible as the effects of Federal Reserve policy actions come into full force, but looser policy is likely later this year with inflation well off of last year’s peak. The year-over-year change in core PCE fell below 3% for the time since March 2021. Despite all the heat they’ve taken along the way, Jerome Powell & Co. are closer than ever to threading the needle on this soft landing.

In Case You Missed It: Last Week’s Insights

Who's Number One?

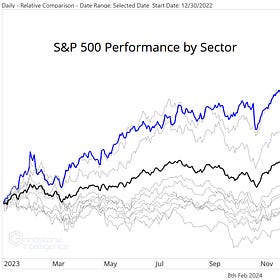

Ever since the end of 2022, growth stocks have dominated the investment landscape. And no group has been stronger than the Communication Services sector. It’s jumped 71%, more than doubling the return of the S&P 500 and outpacing even the ever-dominant Information Technology sector.

From the Ground Up

Back in 2005, Joel Greenblatt introduced his ‘Magic Formula for Investing’ with The Little Book That Beats the Market. The book details a methodical approach that helps investors find some of the cheapest, most well-operated companies and buy them each month for a one-year holding period.

Almost Time for a Tech Breather?

Tech is unstoppable. Just how unstoppable? Over the last 5 years, the Information Technology has risen more than 200%, 2x the return of the S&P 500 index. It goes even further than that, though. Tech’s dominance has been so extreme that every other sector has lagged the benchmark

A Risk Appetite Assessment

They say the stock market climbs a wall of worry. There sure is plenty to worry about - Twitter is all doom and gloom these days. Last week, New York Community Bank got cut in half, bringing back memories of the failures SVB and Signature Bank last March and sparking fears that weakness in commercial real estate will cascade through the banking industry.…

What’s Ahead

Here are the key data releases to keep an eye in the upcoming week: