The Monday Morning Grind - 3/11/2024

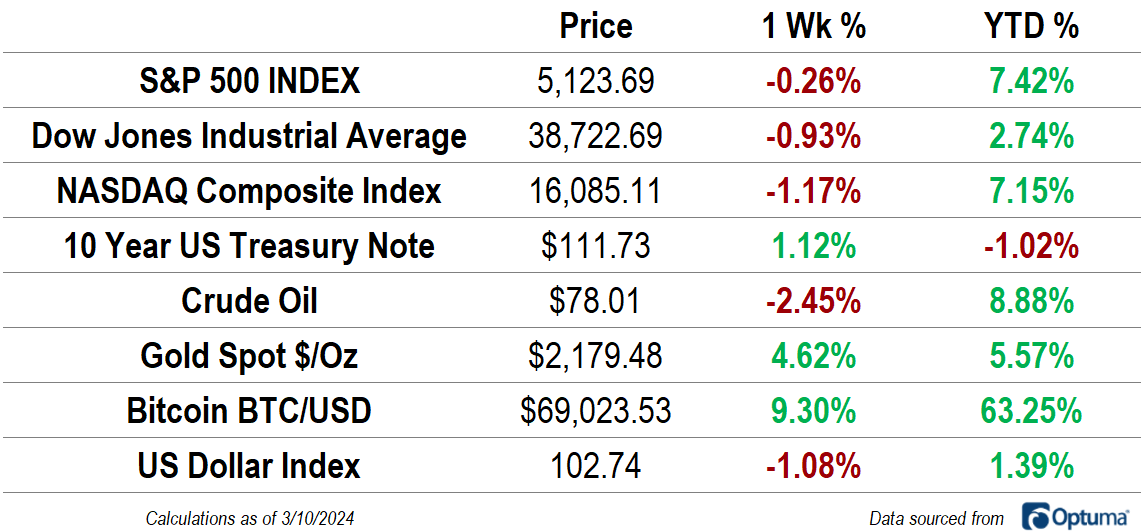

Since the October lows, the S&P 500 index has closed lower for the week just 3 times. Two of those 3 have come in the last 4 weeks. The rally has certainly slowed, but don’t let that distract from the strong start to the year. The S&P 500 and the NASDAQ are both up more than 7%, and the Dow Jones Industrial Average has gained 2.7%. The gains haven’t been limited to stocks, either. Bitcoin is following up on last year’s strong performance with a 63% year-to-date rally, while crude oil is up nearly 9%.

And gold just hit its highest price of all time.

For the last three and a half years, gold prices had been stuck below $2050, a level that is also the 261.8% retracement from the COVID selloff in March 2020. Between those pre-COVID highs at $1,680 and resistance at $2050, the yellow metal had bounced back and forth, digesting the gains from 2015 to 2020 and generally frustrating everyone that had been involved.

That resistance level is no more:

Macro Dashboard

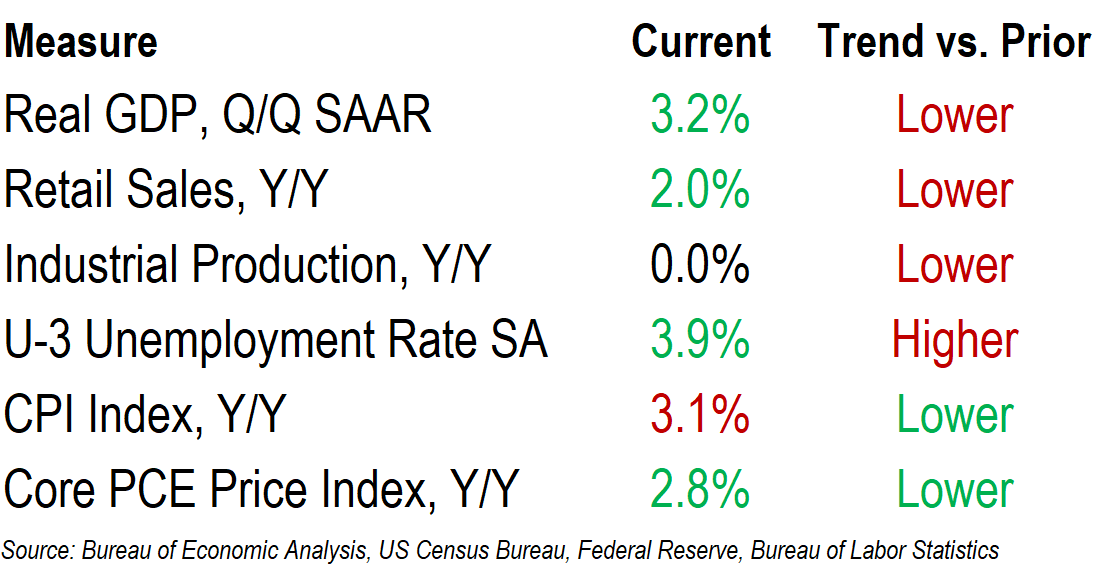

The US economy proved to be more resilient than most economic forecasters thought possible in 2023, ending the year with GDP running at a healthy 3.2% annualized rate. Things are slowing down at the start of 2024. Retail sales growth decelerated from an annual rate of more than 5% in December to just 2% in January. Industrial production is flat. And on Friday, the Bureau of Labor Statistics reported that unemployment rose to a multi-year high of 3.9% in February.

A recession sometime in 2024 is possible as the effects of Federal Reserve policy actions come into full force, but looser policy is likely to come later this year, too, with inflation well off of last year’s peak. The year-over-year change in core PCE is down to 2.8%. Despite all the heat they’ve taken along the way, Jerome Powell & Co. are closer than ever to threading the needle on this soft landing.

In Case You Missed It: Last Week’s Insights

March Market Outlook

At the outset of every month, we take a top-down look at the US equity markets and ask ourselves: Do we want to own more stocks or fewer? Should we be erring toward buying or selling? That question sets the stage for everything else we're doing. If our big picture view says that stocks are trending higher, we're going to be focusing our attention on favo…

Gold Hits New Highs

Bitcoin who? Gold just broke out to new all time highs. For the last three and a half years, gold prices were stuck below $2050, a level that is also the 261.8% retracement from the COVID selloff in March 2020. Between those pre-COVID highs at $1,680 and resistance at $2050, the yellow metal has bounced back and forth, digesting the gains from 2015 to 2020 and generally frustrating everyone that has been involved.

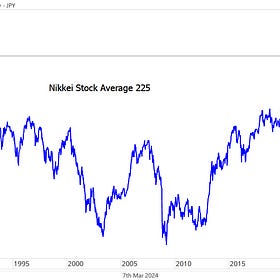

A Global Bull Market

It’s not just a handful of stocks. It’s not even just stocks in the United States. This is a global bull market. True, some parts of the market have failed to participate very much at all. But this bull market was never about just a few stocks. If it were, US growth stocks would stand alone atop the global leaderboard. Instead it’s a 58% gain for the CPTX Index in Poland that holds the banner. There’s no currency funny business driving that either. The returns below are all in USD terms.

Not a Risk-Off Rotation

We’re a little more than 2 months into the new year, but if you look at sector leadership, you might think we’re still stuck in 2023. Information Technology and Communication Services are each up double digits for the year, pacing the 8% year-to-date gain for the S&P 500 index.

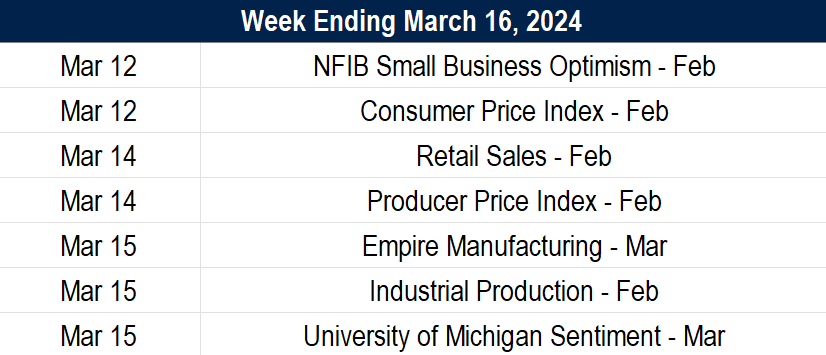

What’s Ahead

Here are the key data releases to keep an eye in the upcoming week: