The Monday Morning Grind - 4/8/2024

Stock prices dropped last week, led lower by the Dow Jones Industrial Average, which fell more than 2%. The Dow is the weakest of the large cap indexes this year, up only 3.2% compared to the S&P 500’s 9.1% year-to-date gain. Performance in the bond market has been even weaker:10-Year Treasury Note Futures are off 2.9% in 2024. The bright spot for investors has been commodities. Both crude oil and gold were up more than 4% last week, and both are up double digits for the year. For gold, last week’s close was the highest of all time.

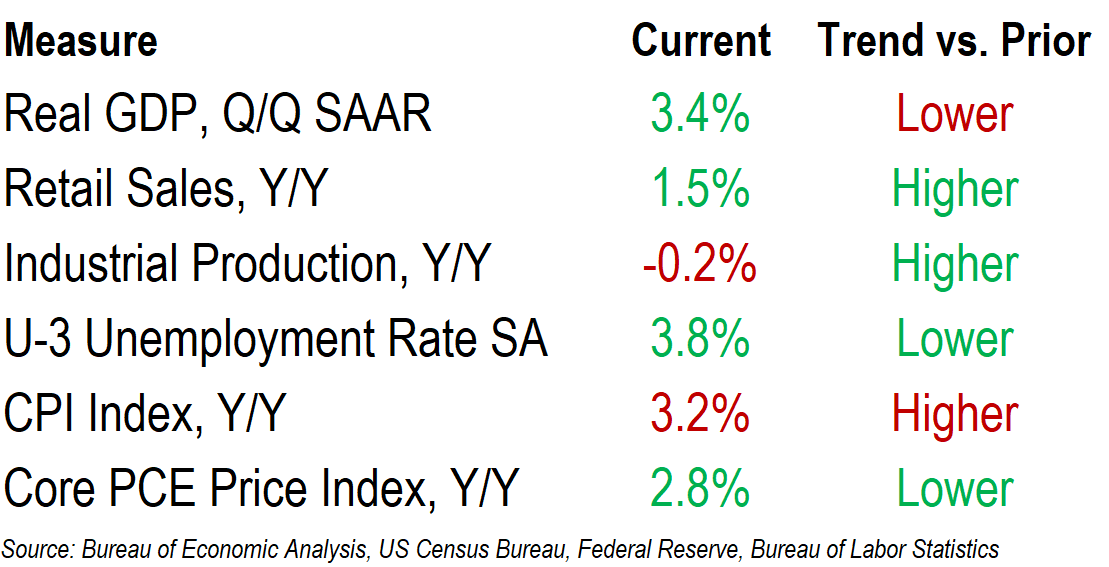

Macro Dashboard

The US economy proved to be more resilient than most economic forecasters thought possible in 2023, ending the year with GDP running at a healthy 3.4% annualized rate. Things are slowing down at the start of 2024. Retail sales growth decelerated from an annual rate of more than 5% in December to just 1.5% in February. Industrial production is in negative territory. The bright spot is the labor market. The unemployment rate dropped back to 3.8% in March, after the economy added 303,000 jobs. That’s the highest monthly add since January 2023.

A recession sometime in 2024 is possible as the effects of Federal Reserve policy actions come into full force, but looser policy is likely to come later this year, too, with inflation well off of last year’s peak. The year-over-year change in core PCE is down to 2.8%. Despite all the heat they’ve taken along the way, Jerome Powell & Co. are closer than ever to threading the needle on this soft landing.

In Case You Missed It: Last Week’s Insights

April Market Outlook

At the outset of every month, we take a top-down look at the US equity markets and ask ourselves: Do we want to own more stocks or fewer? Should we be erring toward buying or selling? That question sets the stage for everything else we're doing. If our big picture view says that stocks are trending higher, we're going to be focusing our attention on favo…

Financials Sector Outlook

The Financials sector is setting new all-time highs. It’s been more than two years since US equities began a bear market and 1 year since the collapse of Silicon Valley Bank sparked a panic that nearly upended the entire banking industry. Last March, everyone was scrambling to become experts on the accounting intricacies of held-to-maturity securities and the extent of unrealized losses on bank balance sheets. Even now, there are widespread concerns about the lasting impacts of the ongoing collapse in commercial real estate values.

Sector Ratings and Model Portfolio Update

It's still a risk-on environment, but leadership over the last month has shifted quite a bit. No longer is this a market where returns are dominated by a handful of mega cap growth names. The value-oriented areas of the market are helping to drive us higher, too.

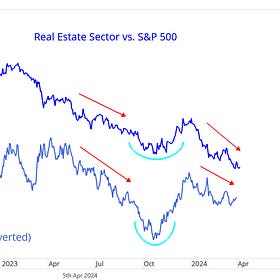

Real Estate Stocks Continue to Depress

It’s been a little more than two years since stocks kicked off the most extended bear market since the Great Financial Crisis. Today, 7 of the 11 S&P 500 sectors are higher than they were back at those January 2022 highs, and the index itself has been setting new highs for most of the last 3 months.

What’s Ahead

Here are the key data releases to keep an eye in the upcoming week: