The Morning Grind - 4/15/2024

Discontinued Disinflation?

The S&P 500 Index fell 1.5% last week, knocking its year-to-date gain down to 7.4%. The Dow Jones Industrial Average was worse, falling 2.4% and erasing nearly all of its gains for 2024. For the Dow, it’s been the worst 2-week stretch since before the bear market bottom back in October 2022.

Blame a resurgence in interest rates and a strengthening US Dollar for the stock price declines. During 2022, rates and the Dollar were the only things that mattered. Each time rates hit a new high or the USD rallied, equities dropped to new lows. Last week, the US Dollar Index broke above a key resistance level to hit new 5 month highs.

The price action in financial markets isn’t the only thing that harkens to 2022. So do prices in the economy. On Wednesday, the Consumer Price Index surprised to the upside once again, coming in 3.5% higher than a year ago, and up 4.6% on a 3-month annualized basis. Rather than continuing to drift lower, inflation has failed to make much progress over the last year, instead stabilizing above the Federal Reserve’s 2% target.

Discontinued disinflation has everyone wondering whether the monetary policymakers will indeed be able to lower interest rates later this year. Stay tuned.

Relatively Speaking

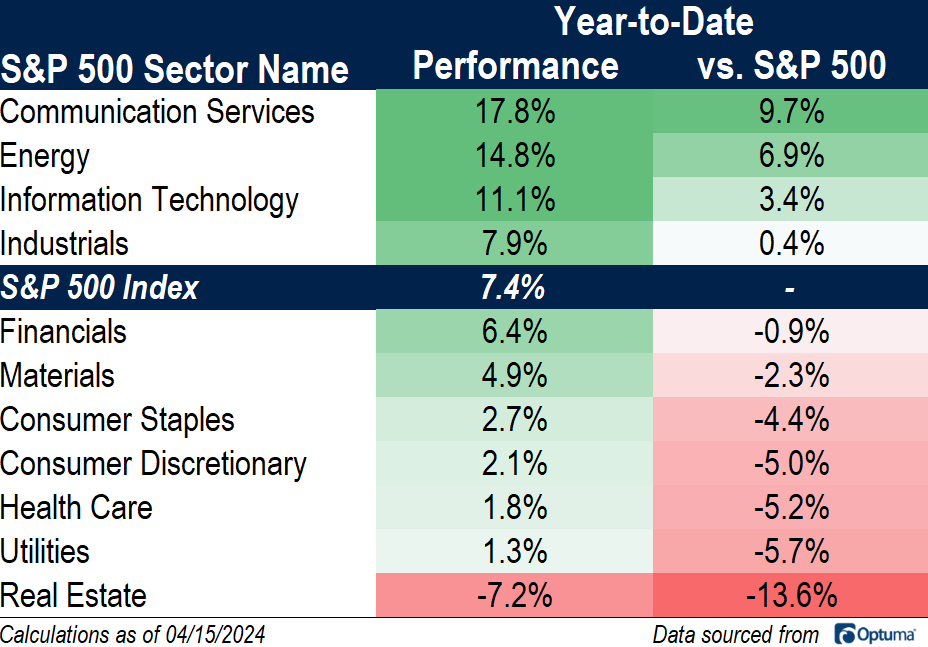

It may be a new year, but some things in 2024 look awfully familiar to 2023. The Communication Services and Information Technology sectors are both outperforming the S&P 500, with Communications the year-to-date leader, up nearly 18%. Participation in the bull market has broadened out, though. Last year, only the growth sectors did better than the benchmark index. This time around, Energy investors are being rewarded, too, as are those who own stocks in the Industrials sector. One thing that hasn’t changed? Risk-off sectors are lagging. The Real Estate sector is down 7%, while the Utilities are virtually flat.

Almost all of Real Estate’s weakness has come over the past 4 weeks, thanks to the resurgence in interest rates. Health Care has been nearly as bad, dropping more than 5% over that period. The year-to-date winners - Communication Services and Energy - are the two that have been able to buck the weakness of the broader market over the past month. The S&P 500 has dropped 1%, but Energy stocks have risen 9%, and the Communications sector jumped 5.5%.

In Case You Missed It: Last Week’s Insights

What's Ahead

Here are the key data releases and events to keep on eye on in the coming days.