The Morning Grind - 4/22/2024

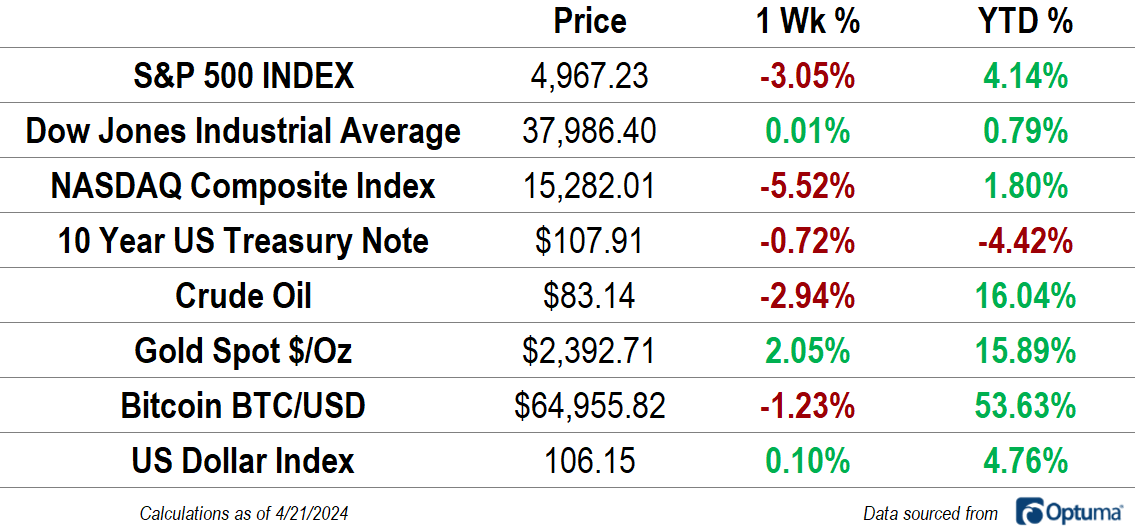

The NASDAQ Composite gave up nearly all of its year-to-date gains and the S&P 500 erased almost half of its own as both indexes fell for the third straight week. The Dow Jones Industrial Average briefly dipped into negative territory for 2024, but rallied back on Friday to (barely) end the week in the green. For the S&P 500, the three week selloff is the largest since December 2022, shortly after the bear market bottom.

The bond market hasn’t been any better: 10-year Treasury note futures have hit the lowest level since November after falling 2.5% in April. Gold, however, continues it be a bright spot. Gold prices have risen 8 of the last 9 weeks and reached another record high on Friday.

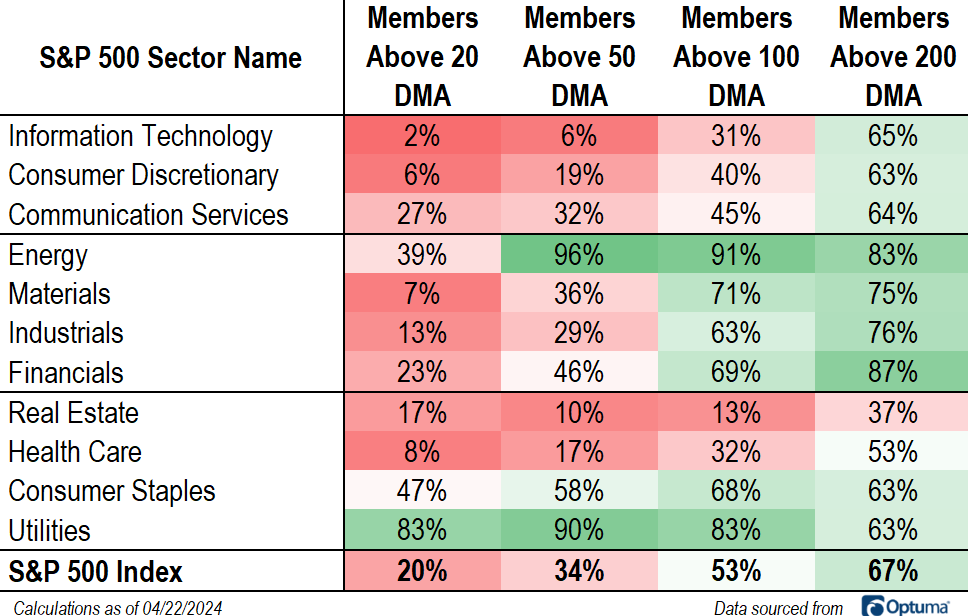

Market Internals

Short-term trends have reversed sharply lower over the month of April. Just 20% of S&P 500 stocks are above their 20-day moving average, and one-third are above their 50-day. The weakness is widespread. Just one sector - Utilities - can say that more than half of its constituents are in a short-term uptrend.

For now, that short-term weakness has yet to do significant damage to the longer-term structure of the market. Two-thirds of stocks in the index are still above their 200-day moving average, and only one sector (Real Estate) has fewer than half of its members in a long-term uptrend. Breadth is strongest in the value-oriented, risk-on sectors: Financials, Energy, Industrials, and Materials.

More from last week:

What's Ahead

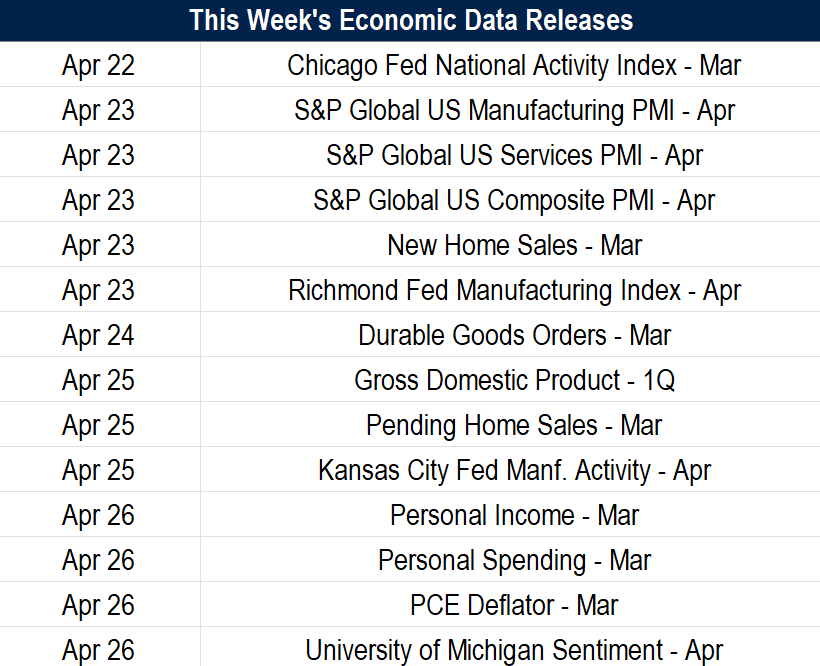

Here's what to watch in the week ahead: